- Solutions

- Qoyod Tahseel

Qoyod Tahseel

New service to accelerate your payment collection process.

- Qoyod Lend

Qoyod Lend

New service to help you your business grow with flexible funding solutions.

- Qoyod Tahseel

- Integrations

- Sectors

- Retail sector

Retail sector

Integrated solutions to tackle Retail sector challenges.

- Manufacturing

Manufacturing Sector

Integrated solutions to tackle Manufacturing Sector challenges.

- Food & Beverages

Food & Beverages Sector

Integrated solutions to tackle Food & Beverages Sector challenges.

- Legal Sector

Legal Sector

Integrated solutions to tackle Legal Sector challenges.

- Rental Sector

Rental Sector

Integrated solutions to tackle Rental Sector challenges.

- Travel & Tourism

Travel & Tourism Sector

Integrated solutions to tackle Travel & Tourism Sector challenges.

- Education Sector

Education Sector

Integrated solutions to tackle Education Sector challenges.

- Services Sector

Services Sector

Integrated solutions to tackle Services Sector challenges.

- Real Estate & Contracting

Construction and Real-estate

Integrated solutions to tackle Construction and Real-estate challenges.

- Operation & Maintenance

Operation & Maintenance Sector

Integrated solutions to tackle Operation & Maintenance Sector challenges.

- Technology Sector

Technology Sector

Integrated solutions to tackle Technology Sector challenges.

- Retail sector

- Pricing

- Resources

- Vat Calculator

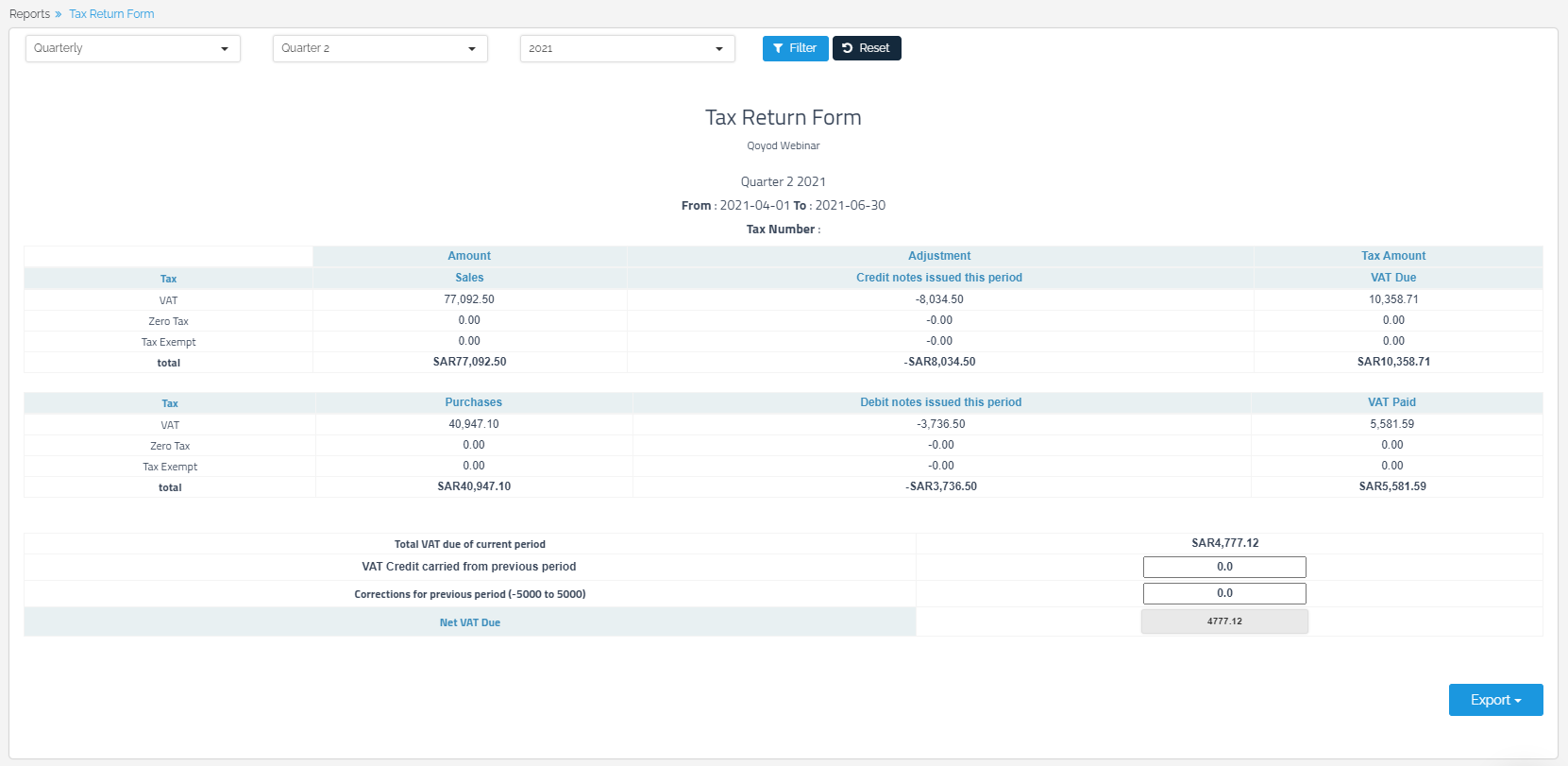

TAX Calculator

Accurately and effortlessly calculate your tax with Qoyod’s advanced TAX Calculator, helping you stay compliant with the Saudi ZATCA requirements.

- Blog

Qoyod Blog

Explore rich articles and topics on accounting and business management to enhance your skills and stay up-to-date with industry trends.

- Newsletter

Monthly Newsletter

Subscribe to our monthly newsletter for the latest news, updates, and valuable tips delivered straight to your inbox.

- Affiliate Program

Affiliate Program

This program allows anyone to earn money by promoting Qoyod solutions.

- Vat Calculator