Employees

Employees

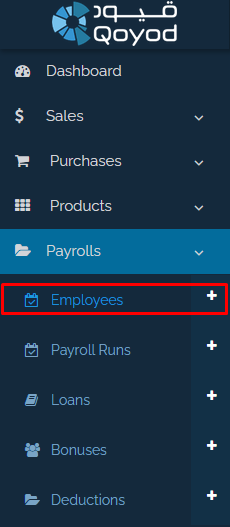

From the drop-down list, select “Payrolls” – “Employees”

By clicking on “Employees” from the main list, you will be automatically directed to the “Employees” page. At the top of the page, there are 7 options: “New employee”, “Terminated”, “Archived”, “Employee Documents”, “Employee Payments”, “Schedules”, “Insurances”, as shown below:

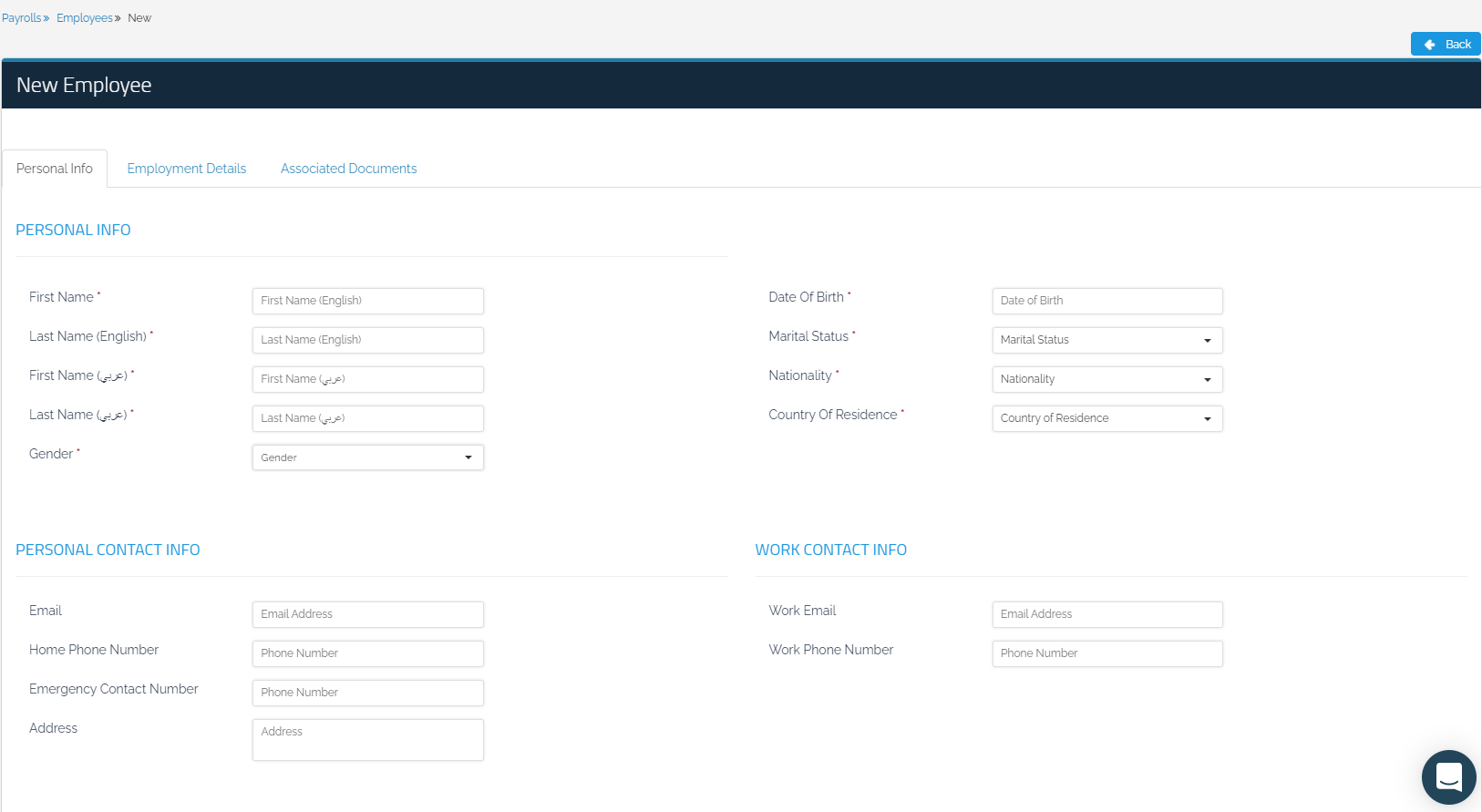

How to add a new employee:

First tab: Personal Info

Fill out the information of the new employee in detail:

Determine the employee’s first name, last name (in Arabic and English), gender, date of birth, and country of residence as shown below:

Second tab: Employment Details

In this tab, fill in the following details:

Employee ID in the organization (the employee’s job number)

The date the employee “Joined On”

Employment Type:

Select “Direct Cost” for the employees whose salaries are dependent on the continuity of work and the increase and decrease in production. It is considered a direct cost to the organization, such as the production factor. However, for the employees whose salaries are not affected by the continuity of work or the decrease and increase in productivity, such as accountants and public administration, select “Overhead Cost”.

Department

Job Title

Manager

“Level of Education” and “Description Of Education”.

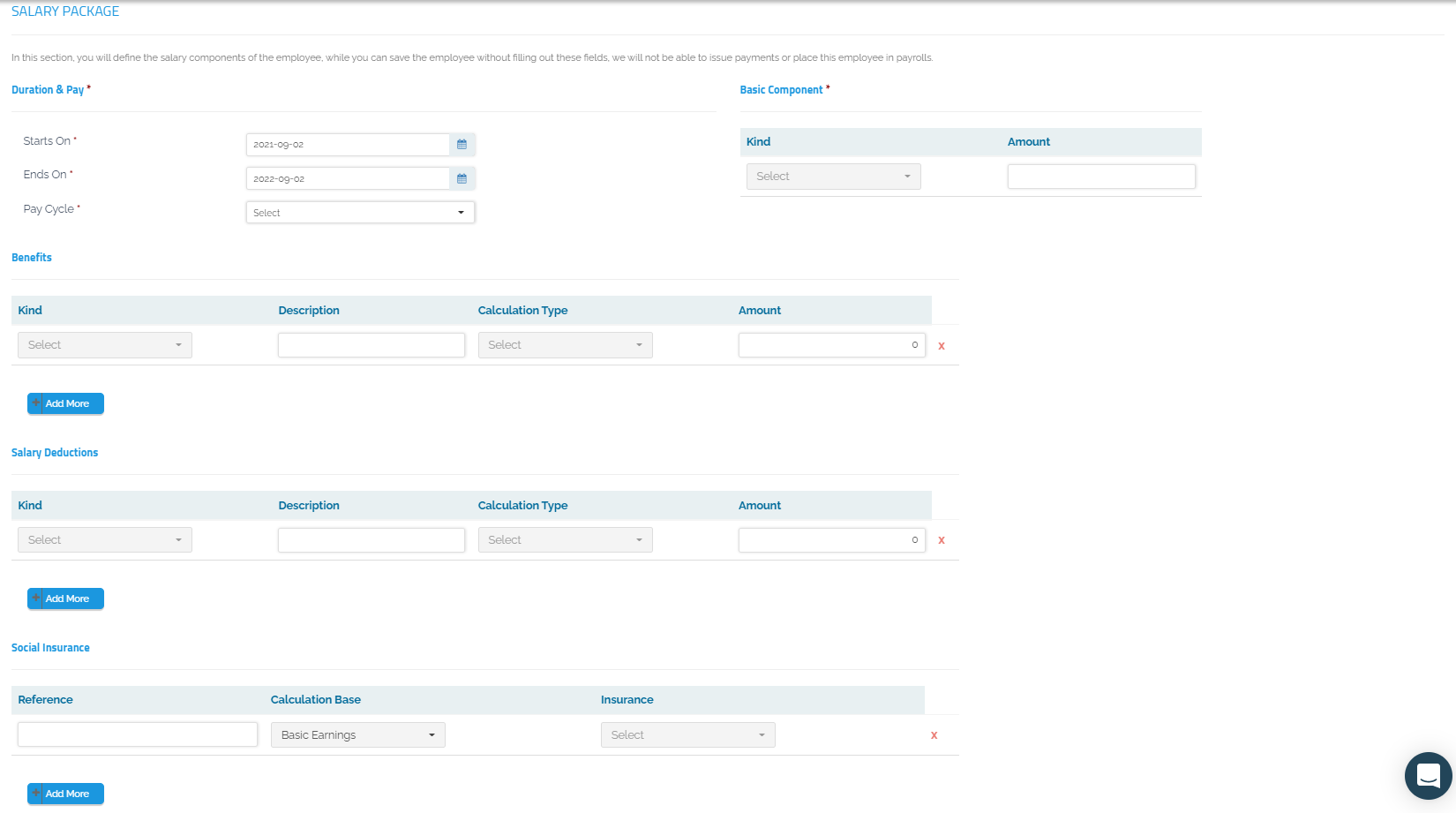

In addition, you need to fill in the “Salary Package” details:

In this section, you will define the salary components of the employee, while you can save the employee without filling out these fields, you will not be able to issue payments or place this employee on payrolls. Then, specify the following:

Duration and Pay:

The employee’s start date, which is the date of the first salary, and the end date of the contract, which is the date of the last salary.

Pay Cycle:

It is the payment made on a daily, weekly, or monthly basis.

Basic Component:

Determine the type of salary as an “Hourly Wage” or a “Monthly Salary”

Benefits:

Specify the benefits either as “Fixed Monthly Amount” or as a “Percent Of Basic”.

Salary Deductions:

You can add periodic discounts to the employee, such as “Fund Contribution” or “Other”.

Social Insurance:

Determine the employee’s social insurance type when the payrolls feature is activated. Otherwise, you can add other types of insurances to link them to the employee which will be mentioned later.

The page will appear as follows:

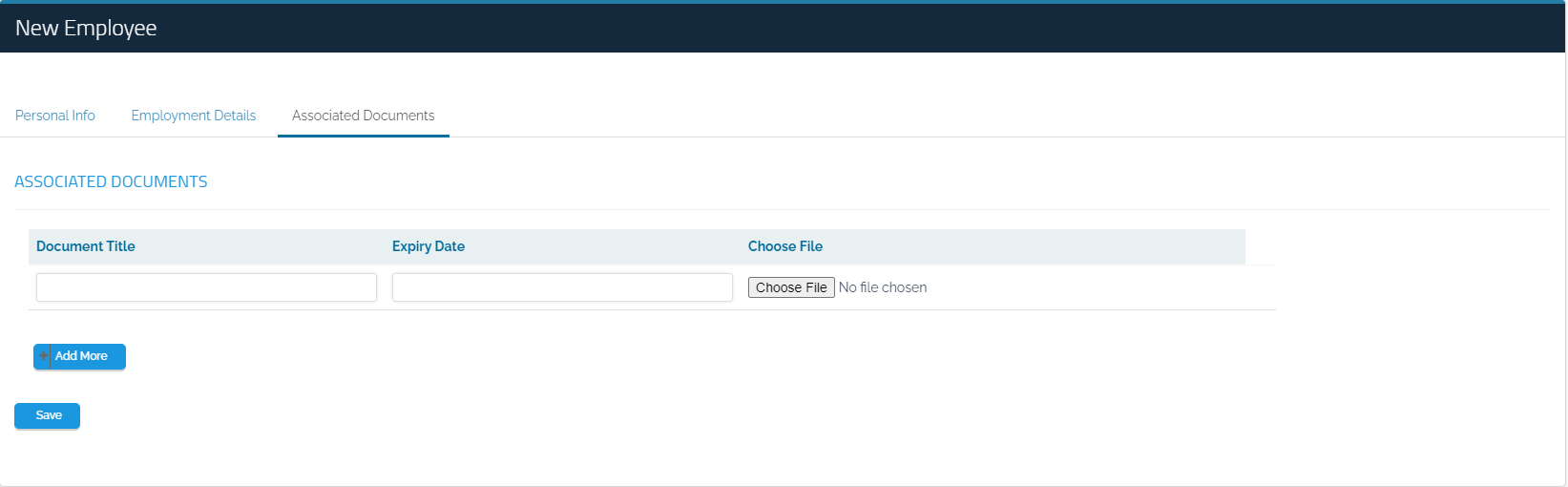

Third tab: Employee documents

It is a tab to upload any documents or addresses related to the employee, as shown below:

Terminated:

It indicates the employees whose services are terminated in the organization.

Archived:

It shows the employees whose work period has expired, and whose transactions have been archived.

Employee documents:

It shows the names of the employees and their attached files and the last date of their working period.

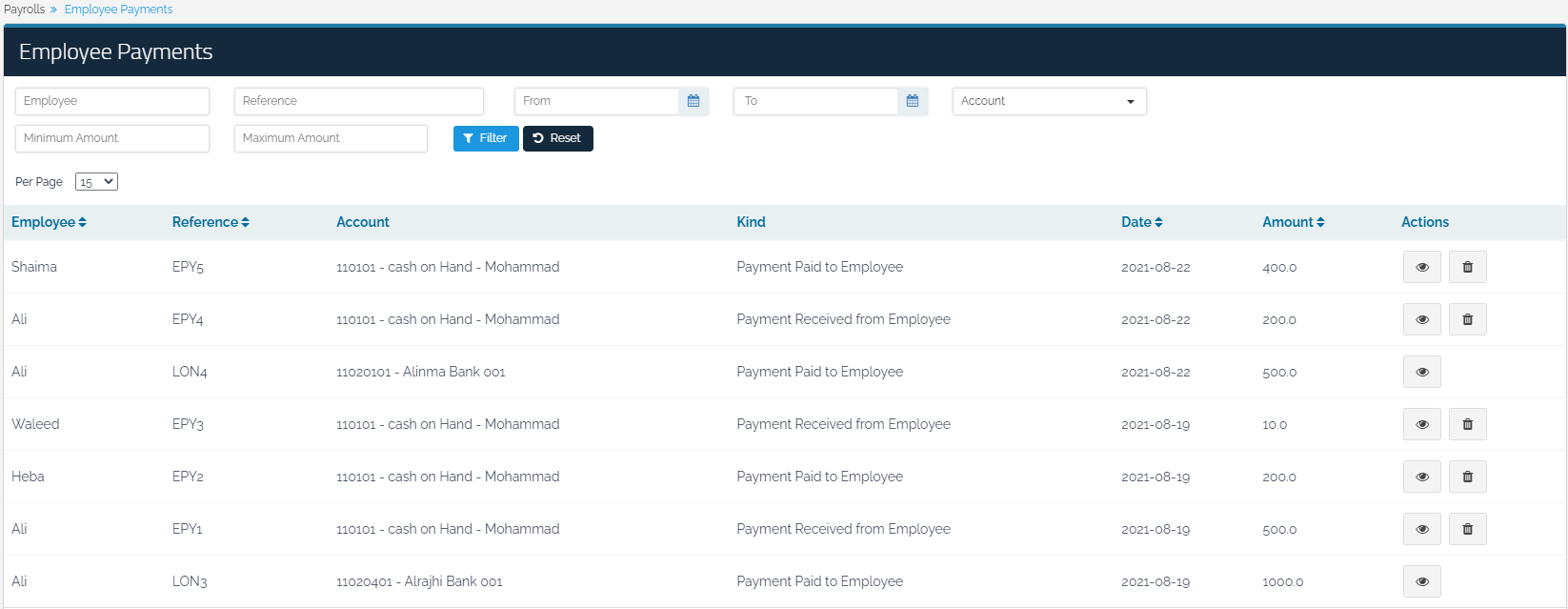

Employee Payments:

It represents all the employee’s pay-slips when paying the salary, taking a loan or allowance, etc.

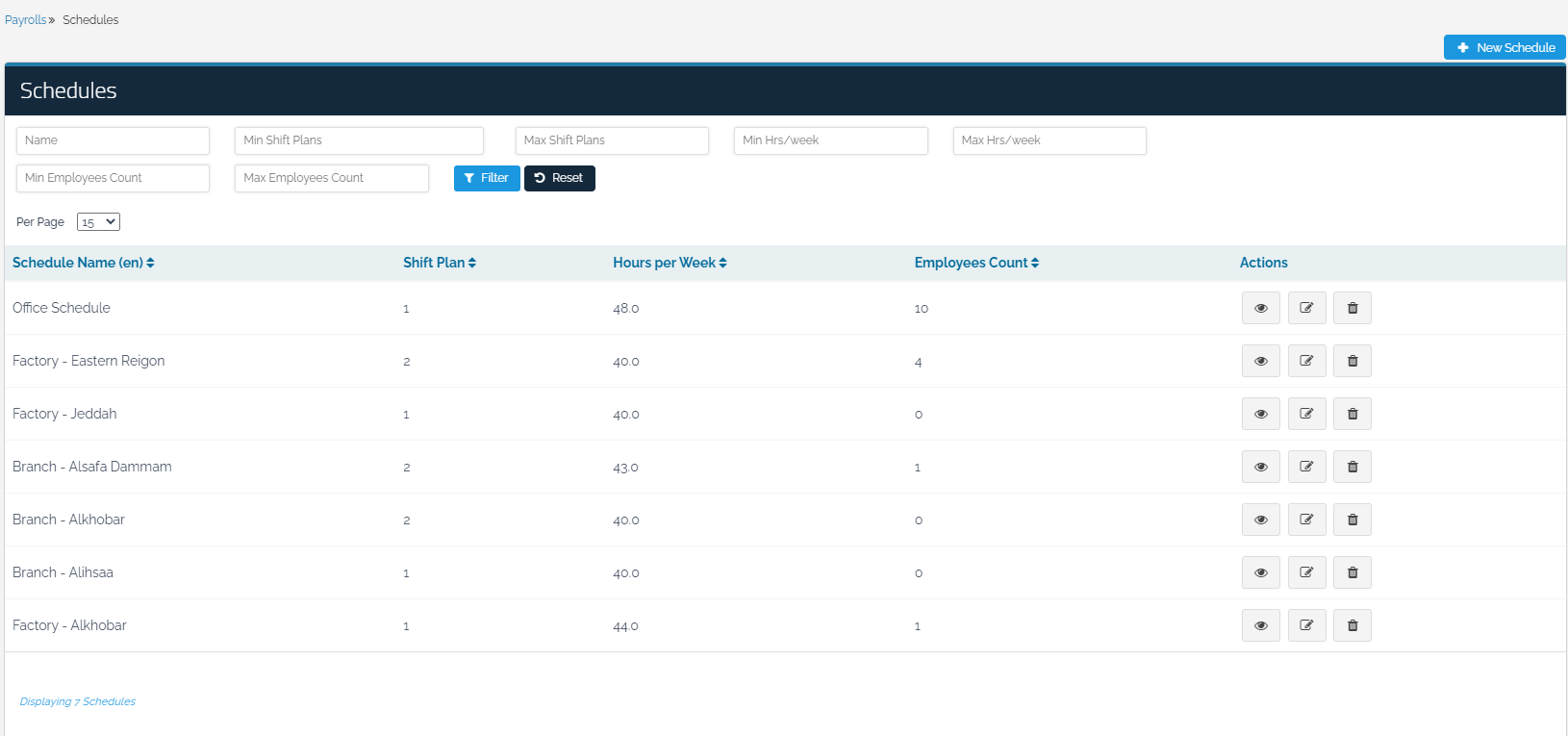

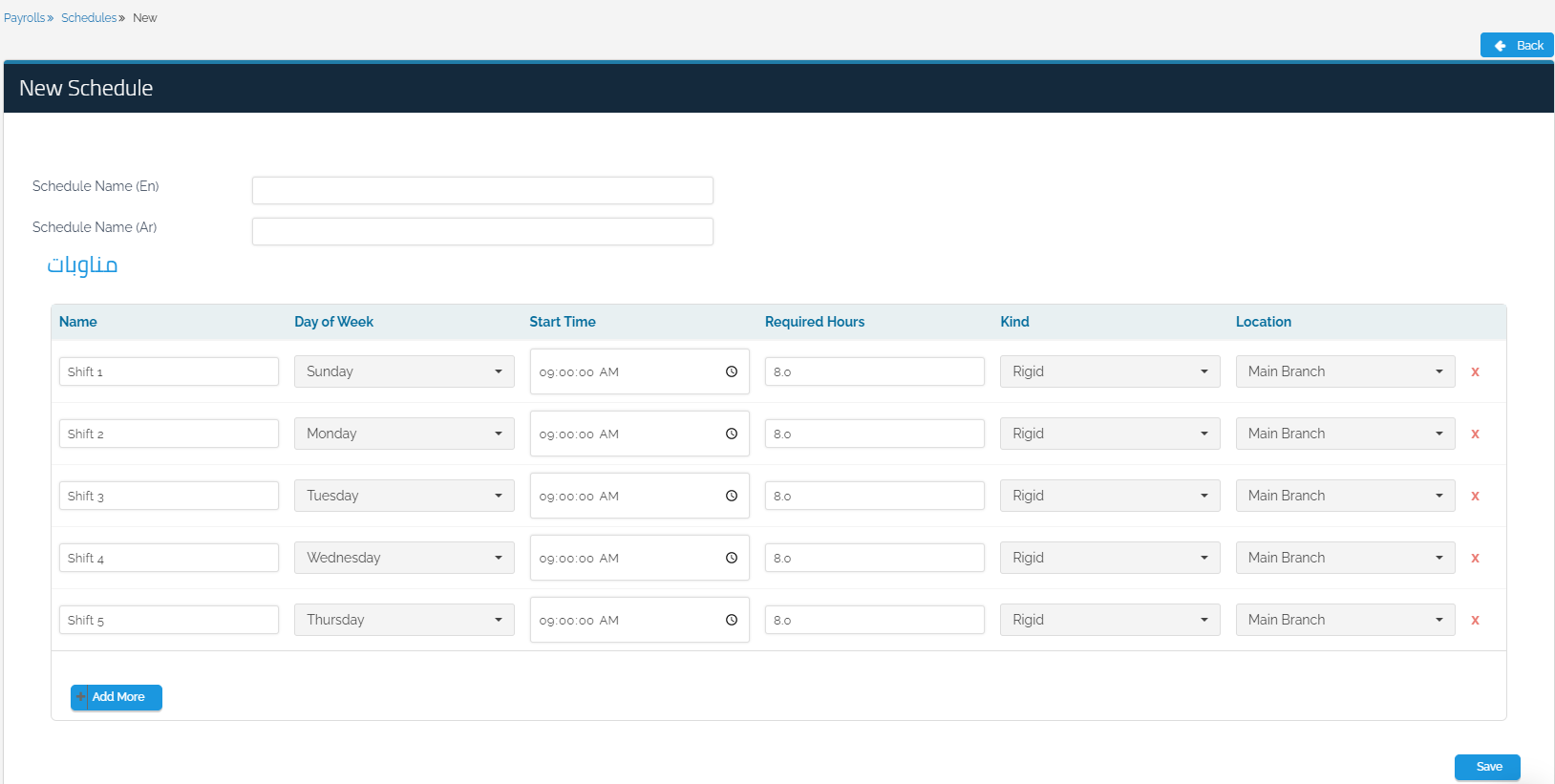

Schedules:

The schedule shows the working hours according to each organization. Therefore, if office work is selected, it shows the number of employees in the office and the shift days as well as the number of weekly working hours. You can also add a new schedule, and classify/add employees according to each approved schedule.

For more information about schedules, click here.

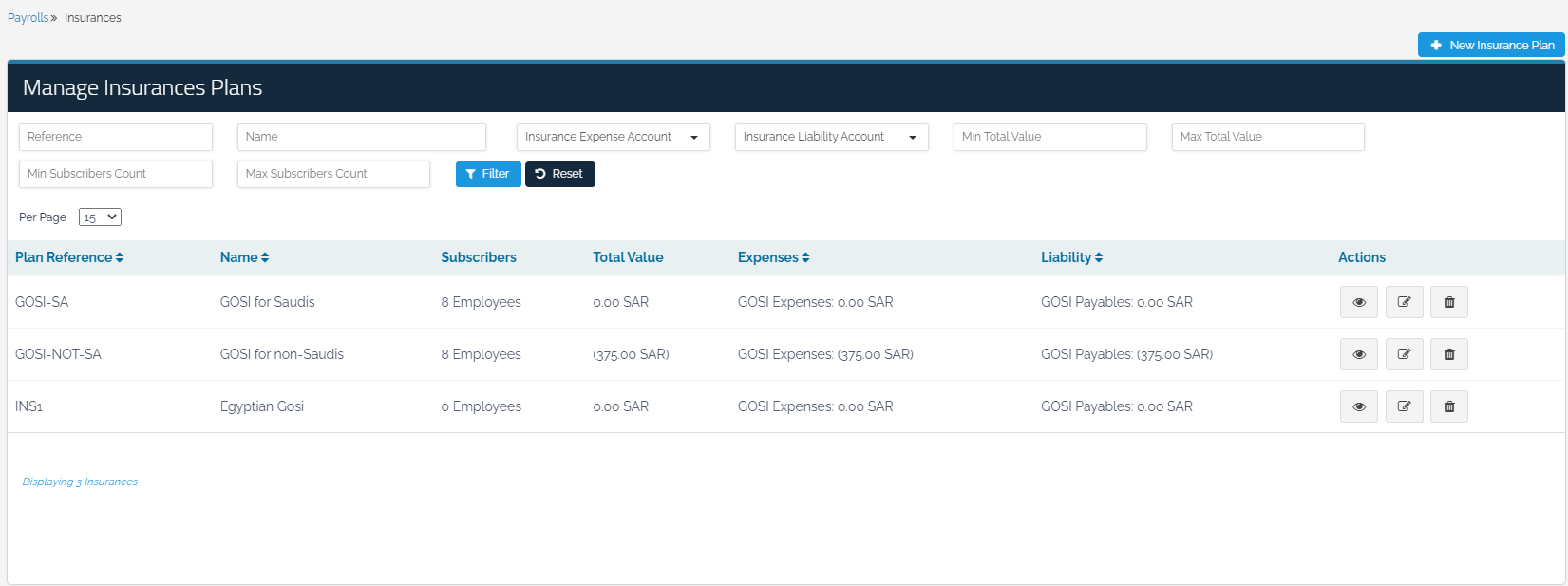

Insurances:

You can define the insurance plan upon adding a new employee by adding a “New Insurance Plan” and entering the name of the plan (Arabic and English), and then determining the “Employee Share” and the “Company Share”. The employee’s share is from his salary, and the accounts of the social insurance liabilities and expenses should be determined.