Forensic accounting, that precise art and sober science that combines cold numbers with warm stories of institutions and companies, is more than just a means of tracking money and profits; it is the beating heart that pumps transparency and credibility into the veins of the global economy. In today’s fast-paced world of intertwined business operations and increasing financial complexities, accounting plays a crucial role in safeguarding investors’ rights, ensuring the integrity of financial reports, and uncovering any illegal practices. So, we brought you this article in which we will delve into legal accounting, exploring its importance, mechanisms, and latest developments that make it one of the basic pillars of building confidence in the financial markets. So follow along.

What is forensic accounting?

It represents a specialised branch of accounting that focuses on legal compliance and detecting any legal violations within companies and institutions. While the ancient tradition of accounting is concerned with recording and analysing financial accounts, forensic accounting goes beyond this scope to include the legal and regulatory obligations that companies must adhere to.

What does forensic accounting offer?

It provides reliable reports that help companies comply with local and international laws and regulations, and this includes carefully analyzing accounting records and financial statements to detect potential violations, such as fraud, embezzlement, or any other type of illegal activity.

Example

Forensic accounting techniques examine financial transactions to ensure validity and compliance with accounting and legal standards. It is also concerned with verifying compliance with taxes and other financial reports required of companies by regulatory authorities.

What are the basic principles of forensic accounting?

Forensic accounting includes several basic principles aimed at achieving transparency and accuracy in financial reports, and among these are the following:

Cost calculation principle

We record the cost based on its actual value at the time of occurrence, disregarding potential economic changes like inflation. Therefore, this means that the costs are recorded as they are without adjusting them to reflect future economic conditions, enhancing the financial statements’ objectivity and accuracy.

Separation principle

This principle requires that the company’s activities be completely independent of the personal activities of its owners, as the company is a legal entity separate from individuals. It is worth noting that this independence is necessary to ensure that personal funds do not overlap with company funds, contributing to the clarity and accuracy of financial statements.

The principle of immediate recording of revenues

This principle is based on recording revenues as soon as the sale process occurs or the service is provided, regardless of the timing of the receipt of cash. Therefore, this principle aims to achieve consistency between revenues and expenses in the same financial period. This provides an accurate picture of the company’s performance.

The principle of eternity

The company is viewed as a continuing legal entity that is not affected by the death or changes of its owners. The financial statements reflect this principle through the preparation of continuous periodic reports. This helps provide an accurate picture of long-term financial performance.

Principles of full reporting

This principle requires the company to disclose all the challenges and problems it faces and provide a clear and comprehensive view of its financial position. Thus, this includes all material information that may affect the decisions of users of the financial statements, which enhances transparency and credibility.

The principle of currency unification

This principle requires that all financial data be recorded in a specific currency, often the US dollar and all financial transactions carried out in other currencies be converted into dollars to ensure consistency and accuracy of financial records and facilitate the comparison process.

The principle of difference of rulings

This principle recognises that accounting judgments may change based on the financial impact of errors. If the errors are immaterial, the chartered accountant may overlook them while taking corrective action if the errors significantly impact the company. Thus, this aims to balance accuracy and efficiency in accounting work.

What are the tasks of forensic accounting?

After we learned about forensic accounting, we must mention the chartered accountant, who has sufficient experience and knowledge to apply accounting and auditing standards accurately and in compliance with financial laws and regulations.

It is relied upon to provide accurate and transparent financial reports that help companies make informed decisions. Let us learn about the most important tasks and functions of the chartered accountant, which are as follows:

Financial reviews

Financial auditing is one of the primary tasks of a chartered accountant, as he examines and reviews all the company’s financial records and transactions to ensure their accuracy and compliance with generally accepted accounting principles (GAAP). It is worth noting that this includes verifying the accuracy of the numbers, detecting any errors or manipulation, and ensuring that the financial reports reflect the company’s true financial position.

Taxes

The chartered accountant plays a pivotal role in the field of taxes. He is responsible for preparing and submitting tax returns in accordance with applicable laws and regulations. This requires a deep understanding of tax laws and continuous updates. In addition, the chartered accountant advises companies on how to plan and save taxes legally.

Internal and external audit

The chartered accountant performs internal and external audits. The internal audit aims to evaluate the effectiveness of the company’s internal control and compliance with internal policies and procedures. In contrast, the external audit includes a comprehensive review of the financial statements and verification of their accuracy by an independent party. This enhances confidence in the financial reports provided to investors and other stakeholders.

Financial consulting

A chartered accountant provides financial advisory services to companies that help them make important strategic decisions. These services include analyzing financial performance, providing recommendations to improve operational efficiency and profitability, and preparing budgets and financial forecasts.

Compliance and regulation

The chartered accountant ensures the company complies with all financial and regulatory laws and regulations. This includes verifying compliance with accounting standards, tax laws, and other regulatory requirements. It is worth noting that this role aims to avoid legal penalties and maintain the company’s reputation.

Risk Management

The chartered accountant identifies and evaluates the financial risks that the company may face and develops strategies to manage and reduce them. These risks include financial fraud, price fluctuation, and changes in economic and tax policies.

The importance and role of the chartered accountant

The chartered accountant is an indispensable strategic partner for companies, as his duties go beyond merely preparing financial accounts to provide added value related to legal compliance and business development. Several main points highlight the importance and role of the chartered accountant, which are as follows:

Legal compliance

The chartered accountant ensures that the company remains fully aware of the legal regulations and updates affecting its activity sector. Through this knowledge, the company can avoid legal penalties and operate within a correct legal framework.

It is worth noting that the accountant’s role is not limited to documentation but extends to providing suggestions for the necessary changes that help the company adapt to the new laws proactively.

Choose the most appropriate legal status.

When starting a new project, business owners face many legal options that can be confusing. Still, a chartered accountant can advise on the most appropriate legal status for the startup, which helps meet the expectations of all parties involved.

This correct choice can significantly impact the company’s costs, tax liabilities, organisational structure, and, thus, its long-term success.

Strategic support in decision-making

During the company’s life cycle, many situations arise that require critical decisions, from establishing the company to making amendments to the articles of association, such as increasing capital. Here, the chartered accountant provides the necessary support at all these stages.

Thanks to his experience, business owners can rely on him to make informed decisions based on carefully analysing the company’s financial and legal situation.

Improving financial and operational performance

In addition to the legal aspect, the chartered accountant plays a role in improving the financial and operational performance of the company by providing accurate financial reports and informed cash forecasts. The company can plan effectively for the future, and the accountant can advise on managing costs and improving operational efficiency.

How do you become a certified public accountant in Saudi Arabia?

To become a chartered accountant, you need to follow sequential steps and have dedication to work. Here is how to reach this prestigious title:

Academic education

The path begins with obtaining a bachelor’s degree in accounting or similar recognised disciplines, and it is worth noting that this degree must be from an institution that offers an accredited program that covers the necessary accounting curricula.

Practical Training

After obtaining a bachelor’s degree, you must work as an accountant for no less than three years under the supervision of certified accountants. Do not forget that this period will help you gain the necessary practical experience.

Preparing for the test

Before taking the final exam to obtain the Certified Public Accountant (CPA) certification, you must study intensively and prepare well for the exam. This exam is the cornerstone for achieving your goal.

Obtain the certificate.

After you successfully pass the test and obtain a score of no less than 75, the official CPA certificate is granted to you, and it is worth noting that this certificate qualifies you to practice the profession of chartered accounting independently or in advanced financial work environments.

Annual renewal

Maintaining the certificate requires renewing it annually by attending ongoing training courses and learning about the latest information and practices in the accounting field.

Obligations of the chartered accountant

The accountant’s obligations require the chartered accountant to adhere to a set of laws and professional ethics that determine the course of his work and confirm the quality of the services he provides, which can be summarised as follows:

Follow a specialised training course.

He must first follow an eight-year specialised training course, register with the Association of Chartered Accountants, and complete his oath within six months of registration.

It must also train specialised work teams with appropriate services and use external service providers when needed to enhance its internal expertise.

Commitment to professional implementation standards

The accountant also adheres to professional implementation standards, including professionalism and due care when carrying out various tasks. He must also respect the specified deadlines and inform his client immediately if he cannot adhere to them.

He must create implementation files for all assigned work to ensure smooth monitoring and transfer of work when needed.

Providing the necessary information to customers

As a consultant, the accountant must provide the necessary information to his clients regarding the tax, legal, social, and environmental obligations related to their business. He must also inform the client of the economic or reputational risks that may arise from his decisions and stress the importance of respecting laws and professional guidance.

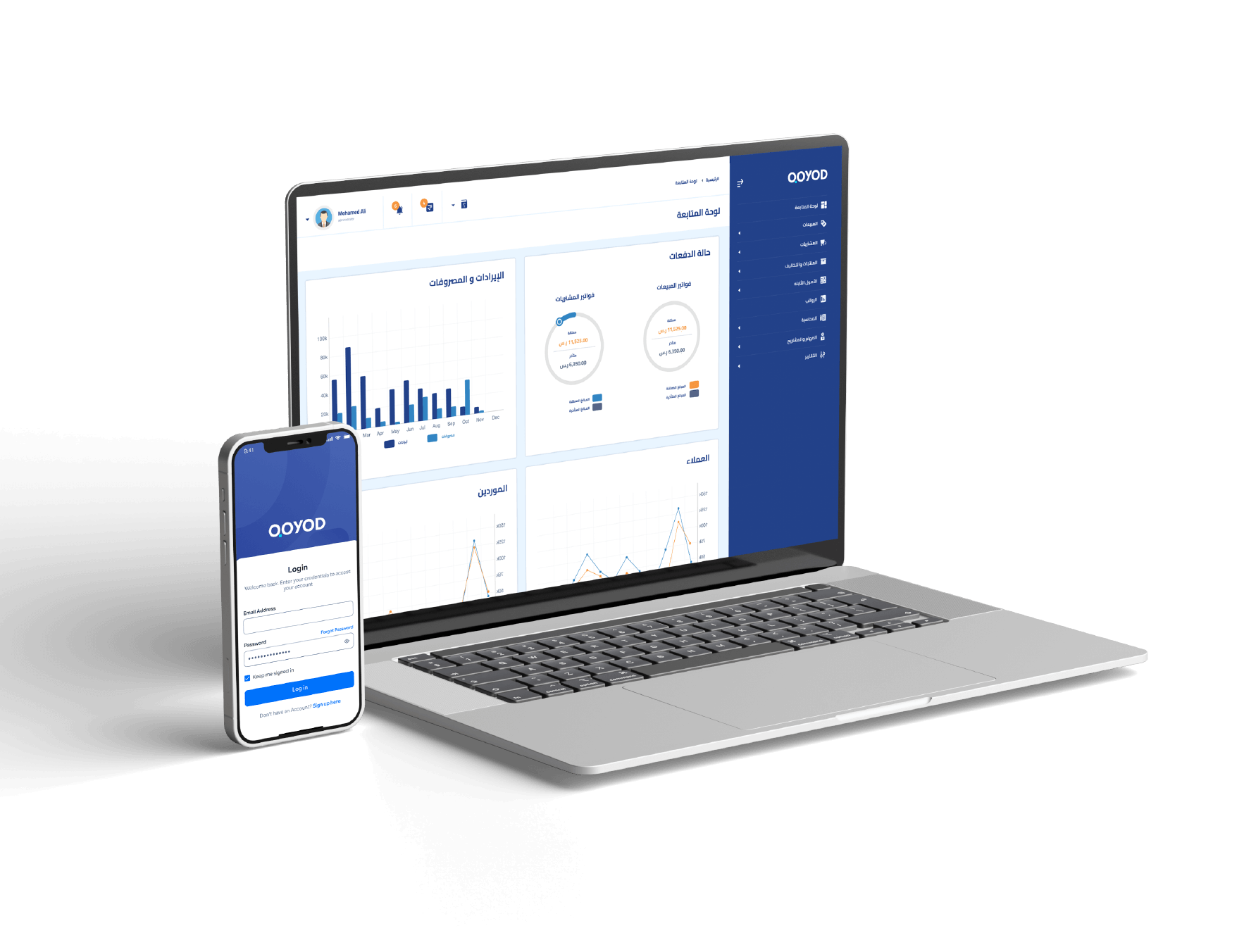

How can Qoyod make forensic accounting easier?

Forensic accounting represents a vital part of companies’ financial work, as it is essential to ensuring legal compliance and achieving the best financial management. It is worth noting that the Qoyod accounting website supports the principles of forensic accounting with great accuracy, in addition to the following:

Apply forensic accounting principles.

Qoyod software offers an integrated solution that facilitates forensic accounting operations by carefully applying applicable accounting standards and legislation. This precise method, therefore, ensures that companies adhere to laws and instructions. This reduces legal risks and improves its position before regulatory authorities.

Combating accounting manipulation and fraud

Through a strong control and auditing system, Qoyod works to prevent and detect any accounting manipulation or fraud, whether by accountants or any other employee. This protects the company from financial losses and preserves its reputation and legal position.

Managing legal consulting offices efficiently

For companies that provide legal accounting consultations, Qoyod provides an easy and effective interface for managing client relationships. The program organizes consultations and facilitates the provision of advisory services with the highest levels of quality and reliability, which enhances cooperation between companies and their clients in a sustainable manner.

Conclusion

Forensic accounting represents the cornerstone of protecting the economy and strengthening confidence in businesses and institutions. It is worth noting that the role of the chartered accountant goes beyond simply recording numbers to influencing strategic decisions that determine the future of companies. With the rapid developments in legislation and technology, forensic accounting has become more important than ever, playing a pivotal role in detecting fraud and ensuring transparency and integrity. Therefore, we must value this profession and be aware of its value in building a sound and sustainable economic environment, as well as a future full of challenges and opportunities for chartered accountants to formulate new and innovative ways to support institutions and economies worldwide.

It is worth noting that the Qoyod program makes forensic accounting easier than ever before with the enormous capabilities it offers. It also offers all its clients electronic invoice systems, point-of-sale systems, warehouses, customers, etc., which makes it the best accounting program in the Kingdom of Saudi Arabia.

After learning what forensic accounting is, try Qoyod now for free for 14 days. It is an accounting program that achieves the best possible results for you.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!