In the business world, microenterprises play a vital role in promoting the economy and creating jobs. Micro-enterprise financing is a critical support for the economy, contributing to the empowerment of entrepreneurs and stimulating economic growth. It also provides the necessary funds and resources needed by individuals to start and expand their businesses, thus contributing to the creation of new opportunities and sustainable development.

In this article, we will learn about the most important benefits of the Qoyod program for financing small businesses and the most important information related to it.

Benefits of using the Qoyod program to finance small businesses

Using the Qoyod program to finance small businesses provides many benefits, including:

Saving time and effort

The Qoyod program for financing small businesses provides many advantages that contribute to saving time and effort, and these advantages include:

- Organizing financial records: The program allows you to organize financial records accurately, reducing the need for manual data entry.

- Financial data analysis: The program provides advanced financial data analysis tools, which help to understand financial performance better and more quickly.

- Preparing automatic reports: The program prepares automatic financial reports, which reduces manual effort and facilitates the process of keeping track of numbers.

- Easy access to data: You can quickly access project data and financial reports with the push of a button, without the need for long searching.

- Improved data accuracy: reduces the chances of human error in data entry, which increases the accuracy of financial records.

Overall, Qoyod offers advanced technology to efficiently manage financial aspects, saving time and effort that can be directed to developing and improving other processes in the project.

Providing accurate organization of financial records

- Classification of accounts: The program allows accounts to be classified in an organized manner according to different financial categories, which makes it easier to organize and deal with data.

- Transaction management: The program can accurately record all financial transactions, making it easier to track income and expenses and ensure their accuracy.

- Financial reports: The program provides the ability to automatically create detailed financial reports, which helps in reviewing the data and ensuring its accuracy.

- Adjust settings: Users can adjust the software settings according to their own requirements, allowing financial record operations to be customized more precisely.

- Access Control: The program can assign access permissions to users, which limits unauthorized access and ensures data confidentiality and accuracy.

Using these tools and features, Qoyod can achieve accurate organization of financial records, making it easier to manage finances effectively and confidently.

Providing a comprehensive view of the project's financial performance

The Qoyod program provides a comprehensive view of the project’s financial performance through:

- Financial reports: The program provides detailed financial reports that include income, expenses, profits, and losses, enabling users to accurately analyze project performance.

- Budget: The software can create a project budget and track expenses and revenues in detail, which helps evaluate financial performance and determine future trends.

- KPIs: Users can create and track KPIs such as profitability ratio, liquidity, and late payments, which helps in understanding the overall financial status of the project.

- Actual versus planned analysis: The software allows the actual performance of the project to be compared with the pre-defined financial plan, which helps to identify gaps and take corrective actions when necessary.

- Financial Forecasts: The software can create future financial forecasts based on current data and past trends, which helps plan growth and make better investment decisions.

Using these tools, Qoyod can provide a comprehensive and integrated view of a project's financial performance, helping to make strategic decisions based on reliable and accurate data.

Enhancing transparency and credibility before investors and banking entities

The Qoyod program enhances the transparency and credibility of the project’s financial performance for investors and bankers by providing:

- Transparent financial reports: The program allows the creation of accurate and comprehensive financial reports that reflect the project’s performance in a clear and transparent manner, enabling investors and banking entities to easily understand the project’s financial status.

- Regularly updated data: The program updates financial data regularly and accurately, making it easier to follow the latest financial developments and financial analyses of the project.

- Accurate tracking of transactions: The software allows all financial transactions to be accurately recorded and tracked, including income, expenses, repayments, and investments, ensuring the accuracy and reliability of financial data.

- Comprehensive analytical reports: The program allows the creation of comprehensive analytical reports that highlight the entire project performance, including financial ratios, key trends, and strategic analyses.

- Compliance with accounting standards: Qoyod is compatible with international and local accounting standards, which enhances the credibility of financial statements and increases confidence among investors and banking entities.

Using these tools, Qoyod can enhance transparency and credibility for investors and bankers, facilitating the investment and financing process for small businesses and contributing to their future success.

Providing accurate and detailed financial reports and analyses

Qoyod provides accurate and detailed financial reports and analyzes them in several ways:

- Automatically generate reports: Qoyod can automatically generate financial reports based on entered data, maintaining data accuracy and reducing human input errors.

- Advanced financial analyses: The program provides advanced analytical tools that help comprehensively analyze project performance, including financial ratios, key trends, and strategic analyses.

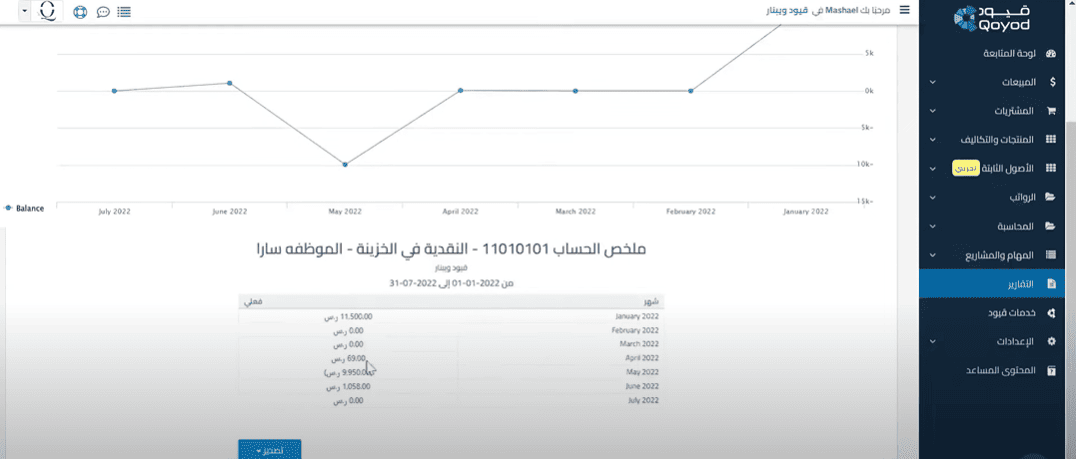

- Displaying visual data: The program allows financial data to be presented in a visual and easy-to-understand manner, which helps investors and banking entities better understand project performance and make decisions.

- Customizing reports: Users can customize reports according to their specific needs, allowing them to show important and salient aspects of the project more prominently.

- Compatibility with accounting standards: Qoyod software is compatible with international and local accounting standards, which increases the credibility of reports and makes them ready to be presented to investors and banking entities.

In these ways, Qoyod contributes to providing accurate and detailed financial reports and analyses, which increases the chances of attracting and investing in the project and enhances its future success.

Seamless integration for small business financing

Qoyod provides seamless integration for small business financing through:

- Connecting financial accounts: The program connects financial data directly from bank accounts and electronic payment platforms, which facilitates the process of accurately tracking cash flows and financial transactions.

- Integration with electronic payment platforms: The program allows integration with various electronic payment platforms, which facilitates the process of effectively recording and monitoring payments and cash receipts.

- Easily generate financial reports: Qoyod can generate comprehensive and accurate financial reports based on entered financial data, providing a comprehensive view of the project’s financial performance and helping to make informed decisions.

- Integration with financing platforms: The program provides integration with electronic financing platforms such as banks and financial companies, which facilitates the process of obtaining financing and managing it effectively.

- Compliance with financial reporting standards: Qoyod ensures compliance with international financial reporting standards, which increases the credibility of financial reports and makes them acceptable to banks and investors.

In these ways, Qoyod provides seamless integration of small business financing, helping to manage finances efficiently and achieve financial goals successfully.

Compliance with legal requirements for small business financing

Qoyod provides compliance with legal requirements for small business financing by:

- Compliance with Financial Regulations: Qoyod is compatible with national and international financial regulations and standards, such as International Accounting Standards (IFRS) and local tax and financial regulations.

- Legal Financial Reporting: Qoyod software can generate the required financial reports in compliance with local legal requirements, ensuring that financial statements are submitted correctly and on time.

- Documentation of transactions: The program documents all financial transactions accurately and reliably, which contributes to compliance with audit and tax audit requirements.

- Data Protection and Privacy: Qoyod provides advanced security features that protect customers' financial and personal data and ensure compliance with data protection and privacy laws.

- Legal Updates: The Qoyod technical support team follows up on legal updates and implements them into the program, ensuring continued compliance with the latest financial legislation and regulations.

In these ways, Qoyod helps ensure compliance with legal requirements for small business financing, improving confidence in financial statements, and reducing the risk of legal violations and penalties.

The importance of using the Qoyod program to finance small businesses

Using the Qoyod program to finance small businesses can bring many benefits to your company, the most important of which are the following:

- Providing financing for your facility: by providing solutions for your facility that take into account the challenges and possibilities of small and medium-sized companies.

- Providing sustainable development for your business: Obtaining financing and directing it towards expanding operations and innovation will move your SME forward.

- Clear criteria for application: easy access to all information and a clear view of application requirements.

- Providing flexible payment plans: Many of our partners offer payment terms that understand the challenges facing SMEs.

- Providing networking opportunities: Expand your network by connecting with SMEs and financiers.

- Financing solutions that suit you: Our partners see the challenges and sensitive needs of SMEs, so they offer financing plans that can be customized according to the actual need.

Conclusion

If you want a program to finance small businesses, the Qoyod program is undoubtedly the best, as it plays a prominent role in financing small businesses by providing integrated accounting solutions that help organize financial records accurately, provide accurate financial reports, and provide comprehensive analyses of financial performance.

The Qoyod program for financing small businesses also helps in providing compliance with legal and tax requirements and providing distinguished technical support to customers. Through all of these features, the Qoyod platform enhances transparency and credibility and contributes to attracting investments and achieving the success of small businesses.

After learning what the best program is for financing small businesses, try Qoyod now for free for 14 days and make it your partner in innovation and success. It is your opportunity to stand out and excel; don't miss it!

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don't miss out, join us today!

.png?width=206&height=208&name=Mask%20group%20(1).png)