E-invoicing is a core component of Saudi Arabia’s ongoing digital transformation, designed to improve tax compliance and boost transparency in business activities. The companies are required to enhance their accounting systems to comply with the standards set by the Zakat, Tax, and Customs Authority (ZATCA), including the use of digital signatures and the direct integration of e-invoices with ZATCA.

What is E-Invoicing?

E-invoicing is an advanced system designed to replace traditional paper invoices with structured electronic formats that allow seamless processing and sharing between sellers and buyers. This system is a key step in the digital transformation of business management, enhancing the efficiency of financial transactions and minimizing the risk of tampering or loss of invoices.

E-invoicing involves the electronic recording and secure storage of all business transactions, facilitating easy access in the future. Each e-invoice must include essential details, such as the seller’s tax identification number, commercial registration, and transaction date, ensuring compliance with legal standards.

Understanding the Difference Between Phase One and Phase Two with Qoyod

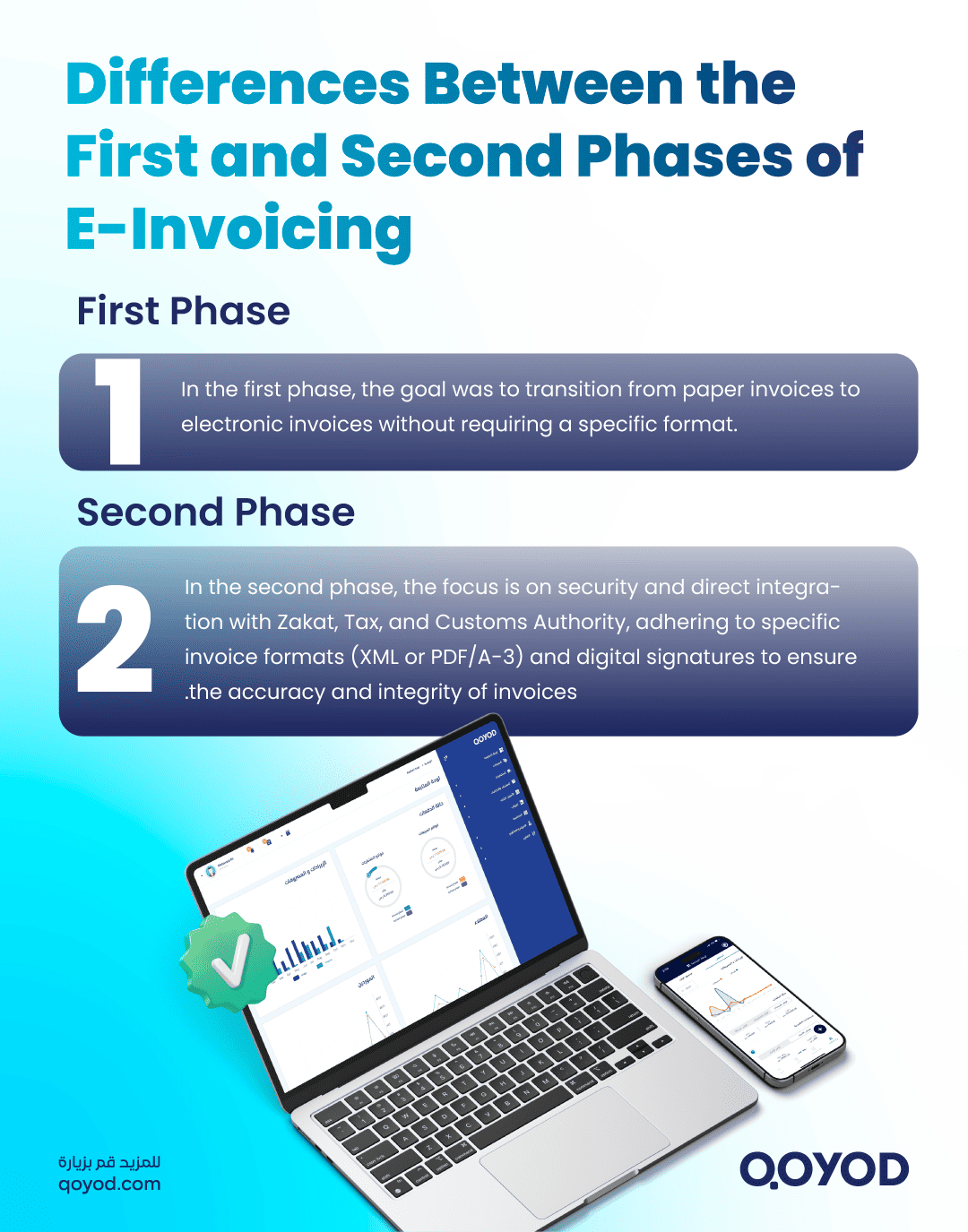

Phase One of e-invoicing was centered on shifting from paper invoices to electronic versions, where companies were required to issue e-invoices without stringent format specifications or mandatory direct integration with ZATCA. This phase aimed to prepare companies for digital invoicing practices and ensure electronic storage of invoices.

Phase Two, which was gradually implemented starting in January 2023, introduces higher standards of security and integration with ZATCA. Companies must now use accounting systems capable of digitally signing invoices and ensuring that all invoices are directly integrated with ZATCA. Additionally, this phase requires invoices to be issued in specific formats (XML or PDF/A-3) to guarantee data integrity and reliability.

| The Difference Between Phase One and Phase Two of E-Invoicing

Phase One 1. The primary objective in Phase One was to transition from paper invoices to electronic versions, without mandating a specific format. Phase Two 2. Phase Two emphasizes enhanced security and direct integration with ZATCA, requiring invoices to adhere to a specified format (XML or PDF/A-3) and include a digital signature to ensure both validity and integrity of invoices. |

The Role of E-Invoicing in Strengthening Tax Compliance

E-invoicing is essential for enhancing tax compliance, as it ensures precise and complete documentation of all business transactions. This system mitigates human errors inherent in manual invoicing, thereby deterring tax evasion and fraudulent activities. Integration with the ZATCA enables companies to have their invoices automatically recorded and reviewed, boosting transparency and minimizing the risk of financial data manipulation.

| The Benefits of E-Invoicing for Strengthening Tax Compliance

E-invoicing enhances tax compliance by ensuring precise and comprehensive recording of all transactions. Through direct integration with ZATCA, it guarantees the accuracy of invoices, minimizes the risk of tax evasion, and promotes transparency in business transaction management, thereby building trust between companies and their customers. |

Phase Two E-Invoicing Requirements

For full compliance with Phase Two of e-invoicing, companies are required to adhere to strict rules set by ZATCA, which include:

- Digital Signature: Invoices must carry a digital signature to ensure their validity and integrity, preventing any alterations post-issuance.

- Direct Integration with ZATCA: All invoices must be directly integrated with ZATCA to enable accurate tracking of tax transactions.

- Specified Electronic Formats Compliance: Invoices should be issued in either XML or PDF/A-3 format to facilitate seamless processing and verification.

- Inclusion of Essential Data: This includes the seller’s tax ID, commercial registration, and address to ensure data clarity and reliability.

Enhancing Efficiency in Financial Processes

E-invoicing enhances the efficiency of financial processes by minimizing the need for manual invoice processing. Through an integrated electronic system, companies can swiftly issue invoices and monitor payments and revenue in real-time. Additionally, the digital platform enables companies to produce accurate, timely financial reports, supporting improved financial planning and informed decision-making.

Minimizing Errors and Enhancing Data Accuracy

With advanced accounting systems like “Qoyod,” companies can significantly reduce the human errors associated with manual invoicing. The system automates data entry and applies digital signatures to invoices, ensuring high data accuracy and reducing the need for manual checks. This efficiency saves time and effort in financial management, enabling companies to focus more effectively on their business objectives.

E-Invoicing’s Role in Combatting the Shadow Economy

A key objective of e-invoicing implementation is to combat the shadow economy and prevent tax evasion. The digital system provides precise tracking of all financial transactions, minimizing the risk of manipulation or revenue concealment. By integrating invoices with ZATCA, it becomes increasingly difficult for companies to issue incorrect invoices or avoid tax obligations, thereby promoting economic transparency and supporting government revenue growth.

Enhancing Customer Experience

E-invoicing not only optimizes internal company processes but also improves the customer experience. Customers can receive their invoices conveniently via email or SMS, allowing them to review and maintain invoices without the worry of loss. This builds customer trust and enhances satisfaction with the services provided.

Environmental Sustainability

By adopting e-invoicing, companies reduce their dependence on paper and printing, bolstering environmental sustainability initiatives. This digital system decreases the use of natural resources and cuts carbon emissions linked to paper production and transport. Moreover, it allows for electronic data storage instead of physical invoices, reducing the need for large storage spaces and helping to preserve the environment.

Phase Two Additional Requirements

- Invoices must be issued in specific formats, such as XML or PDF/A-3.

- Invoices should be stored in formats that meet ZATCA standards.

- Invoices must be approved by ZATCA before being shared with customers, as invoices cannot be sent to customers until they are approved.

Qoyod: An All-in-One Solution for Phase Two

The “Qoyod” system is a comprehensive solution supporting Phase Two e-invoicing compliance. Featuring user-friendly interface and alignment with legal standards, it is an ideal choice for companies aiming to streamline their financial processes and achieve full compliance. The software’s intuitive interface allows users to seamlessly issue, store, and submit invoices to ZATCA.

| Additional Requirements for Tax Invoices Across Both Phases: | |

| Additional Requirements for the Simplified Tax Invoice Across Both Phases:

Phase One:

Phase Two:

|

|

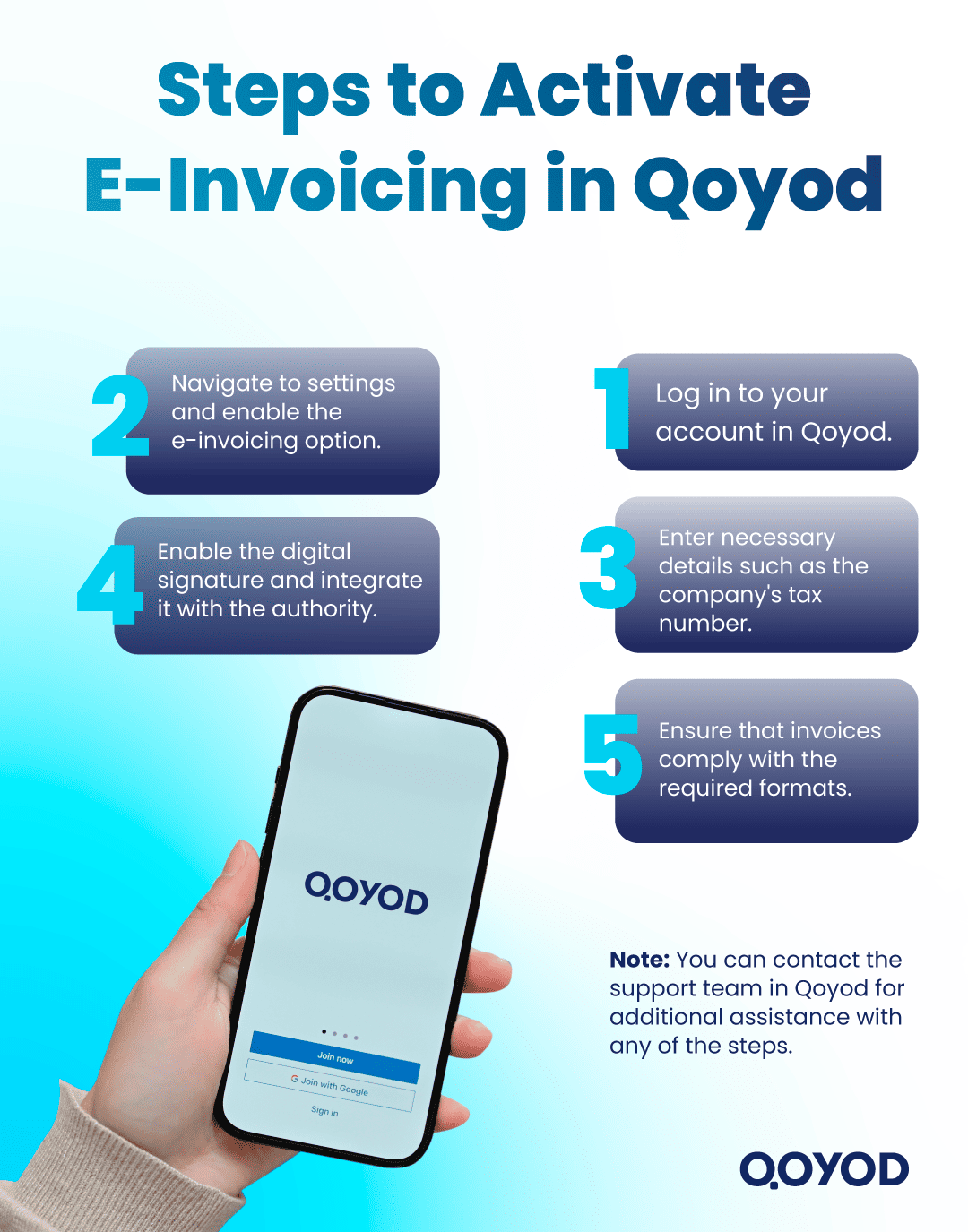

Activating E-Invoicing in Qoyod Software

To activate e-invoicing in “Qoyod” system, users need only navigate to the software settings and activate the e-invoicing option according to the regulations set by ZATCA. Once activated, companies can seamlessly issue e-invoices that fully comply with Phase Two requirements.

Steps for Activating E-Invoicing in Qoyod:1. Log in to your Qoyod account. 2. Navigate to the settings and enable the e-invoicing option. 3. Enter necessary information, including the company’s tax ID number. 4. Enable digital signatures and integrate your account with ZATCA. 5. Verify that invoices meet the required format specifications. Note: For further assistance with any step, feel free to contact the Qoyod support team. |

Phase Two of E-Invoicing and Its Impact on Businesses

Phase Two of e-invoicing in Saudi Arabia marks a substantial step forward in the digital transformation of financial transactions, aligning with the Kingdom’s Vision 2030 to modernize its financial and business infrastructure. This phase introduces new standards aimed at strengthening tax compliance and enhancing transparency in managing e-invoices, thereby fostering greater trust in the tax system and reducing tax evasion. In this article, we examine how e-invoicing supports companies in streamlining financial processes and how systems like Qoyod can simplify compliance with Phase Two requirements.

Impact of Phase Two E-Invoicing on Businesses Using Qoyod

An e-invoice is a digital equivalent of the traditional invoice that was previously issued manually or through software not integrated with a government system. It serves as an electronic document to record financial transactions between a seller and buyer, issued, received, and stored in digital format. E-invoicing streamlines invoice management, accelerates accounting processes, and ensures seamless documentation in line with legal requirements.

The primary objective of e-invoicing implementation is to reduce invoice manipulation and enhance tax compliance for companies across the Kingdom, ensuring effective documentation of financial transactions while preventing the concealment of financial data from government authorities.

Example:

United Furniture Stores operates five locations within the Kingdom with more than 20 cashiers. Each cashier generates a simplified e-invoice for each sale, complete with a QR code on each invoice. All simplified e-invoices are electronically transmitted to the central storage server and the company’s financial management system. These invoices are archived in system records per VAT law and its implementing regulations.

During Phase Two, United Company must submit all issued invoices in XML format to ZATCA’s portal within 24 hours of issuance, in accordance with the phased compliance requirements for integrating e-invoicing systems with ZATCA’s portal for the targeted taxpayer categories.

Strengthening Tax Compliance

A core objective of e-invoicing is to strengthen tax compliance. The e-invoicing system aids companies in avoiding manual errors associated with traditional invoicing, thereby minimizing the risk of data manipulation or financial information concealment. By directly integrating with ZATCA, companies can ensure that all invoices are systematically registered and verified, enhancing tax compliance and fostering greater transparency within the business sector.

Qoyod Software’s Role in Ensuring Phase Two Compliance

“Qoyod” is a premier accounting solution that enables companies to meet the requirements of Phase Two e-invoicing seamlessly. With its user-friendly interface and integration capabilities, Qoyod is particularly suited for small and medium-sized enterprises (SMEs) aiming to streamline financial processes. Qoyod not only guarantees full legal compliance but also offers a robust set of features that empower companies to manage their invoicing with efficiency and security.

- User-Friendly Interface:

Qoyod’s intuitive interface simplifies e-invoice issuance and storage

- Legal Compliance:

Fully aligned with Phase Two requirements, Qoyod supports digital signatures and direct integration with ZATCA.

- Security:

Equipped with advanced encryption, Qoyod secures invoice data.

- Integration:

Qoyod integrates smoothly with other essential business systems, such as inventory and customer relationship management, enhancing operational efficiency.

Enabling E-Invoicing in Qoyod

Activating e-invoicing in Qoyod is straightforward. Users simply navigate to the settings menu and enable the e-invoicing option, fully aligned with the regulations set by ZATCA. Once activated, companies can issue e-invoices that meet all Phase Two requirements smoothly and with ease.

The Role of QR Codes in E-Invoicing

The QR code is a critical feature of Phase Two e-invoicing, designed to enhance data precision and accelerate verification processes. Formed by a unique pattern of black and white squares, the QR code enables the validation of invoices when scanned through specialized applications, such as those provided by ZATCA. In Phase Two, additional data, including encrypted signatures, are embedded to secure invoice authenticity. The QR code acts as a safeguard for invoice data, helping to prevent any post-issuance tampering.

| The QR Code’s Role in E-Invoicing

The QR code is an essential tool for real-time data reading and invoice authentication. With Phase Two implementation, it is now mandatory on all tax invoices, incorporating extra elements such as a digital signature and cryptographic stamp to guarantee data integrity and safeguard against tampering. |

The QR Code’s Role in E-Invoicing

Initially required only for simplified tax invoices in Phase One, the QR code is now mandatory across all tax invoices in Phase Two. This QR code provides real-time verification of financial information and prevents unauthorized invoice modifications. Encrypted within the QR code are key details such as the supplier’s name, tax registration number, invoice timestamp, and total VAT.

Additional Requirements in Phase Two

Phase Two of e-invoicing introduces more elements within the QR code to, including:

- Cryptographic Stamp: Verifies the authenticity of the invoice.

- Public Encryption Key: Ensures data accuracy by enabling decryption and validation.

- Hash Function: Protects against stored data alteration, reinforcing the reliability of invoices in line with government standards.

These added layers of security increase the integrity of e-invoices, deter fraud, and foster greater trust between companies and their customers.

How to Read the QR Code in E-Invoicing

The QR code cannot be scanned with a standard camera app. To properly read the data, an application approved by ZATCA must be used. Upon scanning, the invoice is instantly verified, streamlining the system and helping to minimize tax evasion.

In conclusion, the QR code in e-invoicing marks a major step forward in enhancing invoice management while improving transparency and security in financial transactions.

Steps to Activate Phase Two of E-Invoicing in Qoyod

- Log into Your Account: Visit the Qoyod website and log in using your credentials.

- Navigate to Invoice Settings: Once logged in, find the “Settings” or “General Settings” section in the main menu.

- Select E-Invoicing: Look for the “E-Invoicing” or “Activate E-Invoicing” option within the settings menu.

- Activate Phase Two: You will see an option to activate Phase Two of e-invoicing. Click this option; you may need to provide additional details such as your tax identification number or company information.

- Confirm Activation: After entering the required information, carefully review the data and click the “Activate” or “Save” button to finalize the process.

| Settings -> General Settings | |||||

| General Settings | Printing Settings | Quotation Settings | Sales Invoice Settings | Purchase Order Settings | Purchase Invoice Settings |

| Receipt Settings | Credit Note Settings | Debit Note Settings | Product Settings | ||

| Sales Invoice Settings

Remarks |

|||||

Contents of the Tax Invoice in Phase Two

Phase Two of e-invoicing mandates that invoices include a set of key details, whether it is a simplified tax invoice or a standard tax invoice.

Contents of the Simplified Tax Invoice:

- Invoice Title: “Simplified Tax Invoice.”

- Date and Time of Invoice Issuance.

- Unique Serial Number.

- Seller and Buyer Information.

- QR Code.

- Store Address.

- VAT Registration Number.

- Price of Each Product Including VAT.

- Total Invoice Amount Including VAT.

| Sample Simplified Tax Invoice (Typically Issued Between a Business and a Consumer)

To avoid violating e-invoicing requirements, ensure that all simplified tax invoices include the required e-invoice elements. |

Contents of the Standard Tax Invoice:

- Invoice Title: “Tax Invoice”

- Invoice Issue Date and Time

- Unique Serial Number

- Seller and Buyer Information

- QR Code

- Commercial Registration Number or Alternate Identifier of the Seller

- Total Invoice Amount (excluding VAT)

- Total Invoice Amount (including VAT)

| Sample Tax Invoice (Typically Issued Between a Business and a Business)

To avoid violating e-invoicing requirements, ensure that all tax invoices include the required e-invoice elements. |

Note: During Phase Two, it is mandatory to include the reason for issuing credit notes (such as product returns) on both standard and simplified tax invoices.

Additional Tips:

- Conduct a Practical Test: Once activated, issue a test e-invoice to confirm that the system is functioning properly.

By following these steps, you can seamlessly and efficiently activate Phase Two of e-invoicing within Qoyod.

Implementation Stages for Phase Two of E-Invoicing Integration for Companies:

| Name of the Wave | VAT Turnover | Effective date |

| 1st Wave | Above S.R. 3 billion (2021) | January 1 – June 30, 2023 |

| 2nd Wave | Above S.R. 500 million (2021) | July 1 – December 31, 2023 |

| 3rd Wave | Above S.R. 250 million (2021 or 2022) | October 1, 2023 – January 31, 2024 |

| 4th Wave | Above S.R. 150 million (2021 or 2022) | November 1, 2023 – February 29, 2024 |

| 5th Wave | Above S.R. 100 million (2021 or 2022) | December 1, 2023 – March 31, 2024 |

| 6th Wave | Above S.R. 70 million (2021 or 2022) | January 1 – April 30, 2024 |

| 7th Wave | Above S.R. 50 million (2021 or 2022) | February 1 – May 31, 2024 |

| 8th Wave | Above S.R. 40 million (2021 or 2022) | March 1 – June 30, 2024 |

| 9th Wave | Above S.R. 30 million (2021 or 2022) | June 1 – September 30, 2024 |

| 10th Wave | Above S.R. 25 million (2022 or 2023) | October 1 – December 31, 2024 |

| 11th Wave | Above S.R. 15 million (2022 or 2023) | November 1, 2024 – January 31, 2025 |

| 12th Wave | Above S.R. 10 million (2022 or 2023) | December 1, 2024 – February 28, 2025 |

| 13th Wave | Above S.R. 7 million (2022 or 2023) | January 1 – March 31, 2025 |

| 14th Wave | Above S.R. 5 million (2022 or 2023) | February 1 – April 30, 2025 |

| 15th Wave | Above S.R. 4 million (2022 or 2023) | March 1 – May 31, 2025 |

| 16th Wave | Above S.R. 3 million (2022 or 2023) | April 1 – June 30, 2025 |

| 1st Wave | 2nd Wave | 3rd Wave | 4th Wave |

| Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: |

| S.R. 3 billion | S.R. 500 million | S.R. 250 million | S.R. 150 million |

| 2021 | 2021 | 2021 or 2022 | 2021 or 2022 |

| Effective Date: January 1 – June 30, 2023 |

Effective Date: July 1 – December 31, 2023 |

Effective Date: October 1, 2023 – January 31, 2024 |

Effective Date: November 1, 2023 – February 29, 2024 |

| 5st Wave | 6st Wave | 7st Wave | 8st Wave |

| Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: |

| S.R. 100 million | S.R. 70 million | S.R. 50 million | S.R. 40 million |

| 2021 or 2022 | 2021 or 2022 | 2021 or 2022 | 2021 or 2022 |

| Effective Date: December 1, 2023 – March 31, 2024 |

Effective Date: January 1 – April 30, 2024 |

Effective Date: February 1 – May 31, 2024 |

Effective Date: March 1 – June 30, 2024 |

| 9st Wave | 10st Wave | 11st Wave | 12st Wave |

| Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: |

| S.R. 30 million | S.R. 25 million | S.R. 15 million | S.R. 10 million |

| 2021 or 2022 | 2022 or 2023 | 2022 or 2023 | 2022 or 2023 |

| Effective Date: June 1 – September 30, 2024 |

Effective Date: October 1 – December 31, 2024 |

Effective Date: November 1, 2024 – January 31, 2025 |

Effective Date: December 1, 2024 – February 28, 2025 |

| 13st Wave | 14st Wave | 15st Wave | 16st Wave |

| Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: | Taxpayers whose annual VAT turnover exceeds: |

| S.R. 7 million | S.R. 5 million | S.R. 4 million | S.R. 3 million |

| 2022 or 2023 | 2022 or 2023 | 2022 or 2023 | 2022 or 2023 |

| Effective Date: January 1 – March 31, 2025 |

Effective Date: February 1 – April 30, 2025 |

Effective Date: March 1 – May 31, 2025 |

Effective Date: April 1 – June 30, 2025 |

Steps for Issuing Phase Two E-Invoices in Qoyod

- Log in to Your Account:

Go to the Qoyod website and log in using your credentials.

- Navigate to the Invoices Section:

After logging in, access the “Invoices” or “Sales” section from the main menu.

- Create a New Invoice:

Select “Create New Invoice” or “Issue Invoice” to begin creating your invoice.

- Input Invoice Details:

- Invoice Date: Enter the current date.

- Customer Information: Provide the customer’s name, tax ID number, and address.

- Product/Service Details: Add details of the products or services rendered, including quantity, price, and any applicable taxes.

- Review the Information:

Ensure that all data, including amounts and tax details, are correct.

- Issue the Invoice:

Once verified, select “Issue” or “Save” to generate the e-invoice.

- Apply an Electronic Signature:

If an electronic signature is required, sign the invoice to confirm its legal validity.

- Send the Invoice:

The invoice can be sent directly to the customer by email through the system or downloaded as a PDF for manual distribution.

- Save the Invoice:

Save a copy of the invoice in the system for easy access and future reference.

Additional Tips

- Keep the System Updated:

Regularly update Qoyod to the latest version to ensure compatibility with legal and regulatory requirements.

- Utilize Training Resources:

For new users, take advantage of the tutorials and documentation available on the Qoyod website.

- Seek Technical Support When Needed:

If you face any challenges, contact Qoyod’s technical support team for prompt and effective assistance.

By adhering to these steps, you can efficiently issue e-invoices via Qoyod .

https://www.youtube.com/watch?v=Rar6gePuFd0

The Role of Qoyod in Phase Two of E-Invoicing

Qoyod is instrumental in supporting Phase Two of e-invoicing by offering software solutions that align with ZATCA requirements. This system simplifies the process of integration with ZATCA systems, ensuring that invoices are issued in full compliance with established standards, minimizing human errors, and safeguarding data.

Qoyod stands out as a premier solution for Phase Two e-invoicing, thanks to its comprehensive features designed to meet the specific requirements of this phase. It is the optimal choice for companies and individuals aiming for full compliance with minimal complexity.

Why Choose Qoyod for Phase Two E-Invoicing?

Qoyod’s compliance with ZATCA’s standards in Saudi Arabia makes it a top choice, ensuring smooth and direct integration with the portal. Its support for digital signatures and invoice encryption guarantees that all invoices are valid, secure, and tamper-proof, bolstering trust and integrity in business transactions.

The software is also highly compatible with other accounting systems, simplifying financial operations from invoice generation to financial reporting. With support for required formats such as XML and PDF/A-3, Qoyod enables companies to issue invoices quickly and accurately. Furthermore, it provides adaptable solutions for various needs, including simplified and standard tax invoices, and facilitates the tracking of discounts and outstanding amounts.

Qoyod offers robust tax management capabilities, including the ability to verify the tax registration status of each customer, ensuring companies remain compliant without manual intervention. It integrates smoothly with the ZATCA’s portals, allowing invoices to be submitted directly for verification and approval, reducing errors and improving processing time.

A standout feature of Qoyod is its ability to automatically generate tax invoices and related notifications, saving users valuable time and effort. Additionally, the system enables companies to easily track the status of invoices, with each invoice’s status automatically updated after approval by ZATCA.

Issuing Reports and Tax Declarations via Qoyod

Qoyod enables companies to leverage advanced tools and reports to analyze financial performance and ensure continuous compliance with e-invoicing regulations. With an intuitive and user-friendly interface, companies of all sizes can quickly adopt the software without needing extensive technical expertise, making it a perfect fit for small, medium, and large enterprises alike.

Furthermore, Qoyod offers tailored customer support to address any issues that may arise during the integration process or when implementing Phase Two e-invoicing requirements. This comprehensive support service ensures uninterrupted business operations and aids in overcoming any potential technical challenges.

In summary, Qoyod delivers a seamless and professional experience that ensures full compliance with Phase Two of the e-invoicing requirements, while enhancing operational efficiency and reducing costs related to invoice management. By choosing Qoyod, companies adopt a complete, secure solution that simplifies and streamlines all aspects of e-invoicing, making it the top choice for Phase Two compliance.

Frequently Asked Questions with Qoyod Regarding Phase Two E-Invoicing

Can taxable persons continue using the same e-invoicing solution from Phase One?

Yes, you can continue using the same invoicing system from Phase One. However, the system must be updated to comply with the requirements of Phase Two to ensure full compliance. The Qoyod program provides the necessary updates from ZATCA, requiring only activation on your part—no further modifications needed.

Is it necessary to adhere to the requirements of Phase One until Phase Two becomes mandatory?

Yes, taxable persons must continue to follow the requirements of Phase One until Phase Two is implemented. However, businesses can choose to start complying with Phase Two voluntarily before the established deadline.

What if a taxable person has not been notified about the implementation of Phase Two?

If ZATCA has not issued a notification, there is no obligation to implement Phase Two. Nevertheless, it is recommended to prepare for and comply with the Phase Two requirements using the Qoyod program in anticipation of its final implementation.

What is the required language for invoices with ZATCA?

Invoices must be issued in Arabic, while the technical elements of the XML format are in English. However, the invoice data (which will be displayed once the XML format is rendered) must be in Arabic, although other languages can also appear on the invoice.

In some cases, the invoice may enter an approval process that could take up to two weeks after it is created. So, what is the appropriate invoice issuance date to use?

The invoice issuance date should be the date on which the final tax invoice is created. If internal approvals are required, consider the invoice final only after receiving all necessary internal approvals. Once approved, the final invoice should be submitted to ZATCA. It’s important to note that tax invoices must be issued within 15 days of the month following the supply date. However, for simplified tax invoices, taxable persons must report them to ZATCA within 24 hours of creation.

When does ZATCA issue the QR code series for tax invoices (B2B)?

ZATCA generates the QR code series for tax invoices (B2B) upon approval, accompanied by the its official seal. Taxaple persons are expected to generate the QR code using the series provided by ZATCA.

Conclusion

Phase Two of e-invoicing marks a significant step towards enhancing financial efficiency and tax compliance in Saudi Arabia. By adhering to these requirements and utilizing advanced software like “Qoyod,” companies can streamline their financial processes and boost transparency. Whether managing a small or medium-sized enterprise, transitioning to e-invoicing will substantially improve your business operations and help achieve your financial objectives.