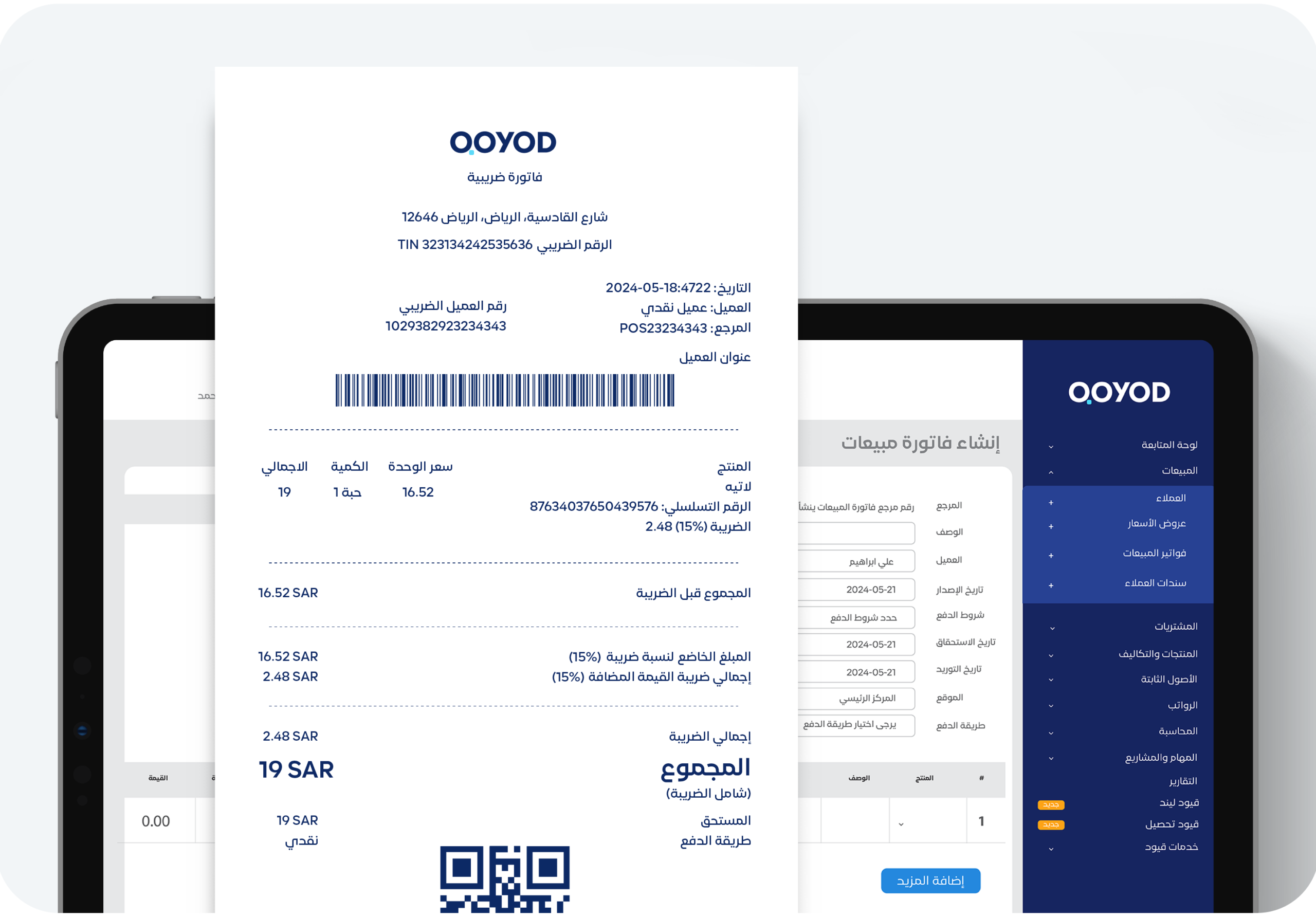

Issue e-invoices that comply with the requirements of Zakat, Tax and Customs Authority. You can also customize invoices to include any important additional data.

Get accurate sales reports by integrating POS with Qoyod software where data is automatically updated in Qoyod software, ensuring information is accurate and up-to-date.

Connect Qoyod software with your bank to automatically reconcile invoices and track payments. Also you can integrate Qoyod with different programs, tools, and apps to work seamlessly with.

Any companies violating the requirements of the Zakat, Tax and Customs Authority may be exposed to financial fines if they do not implement or comply with the Authority’s requirements.

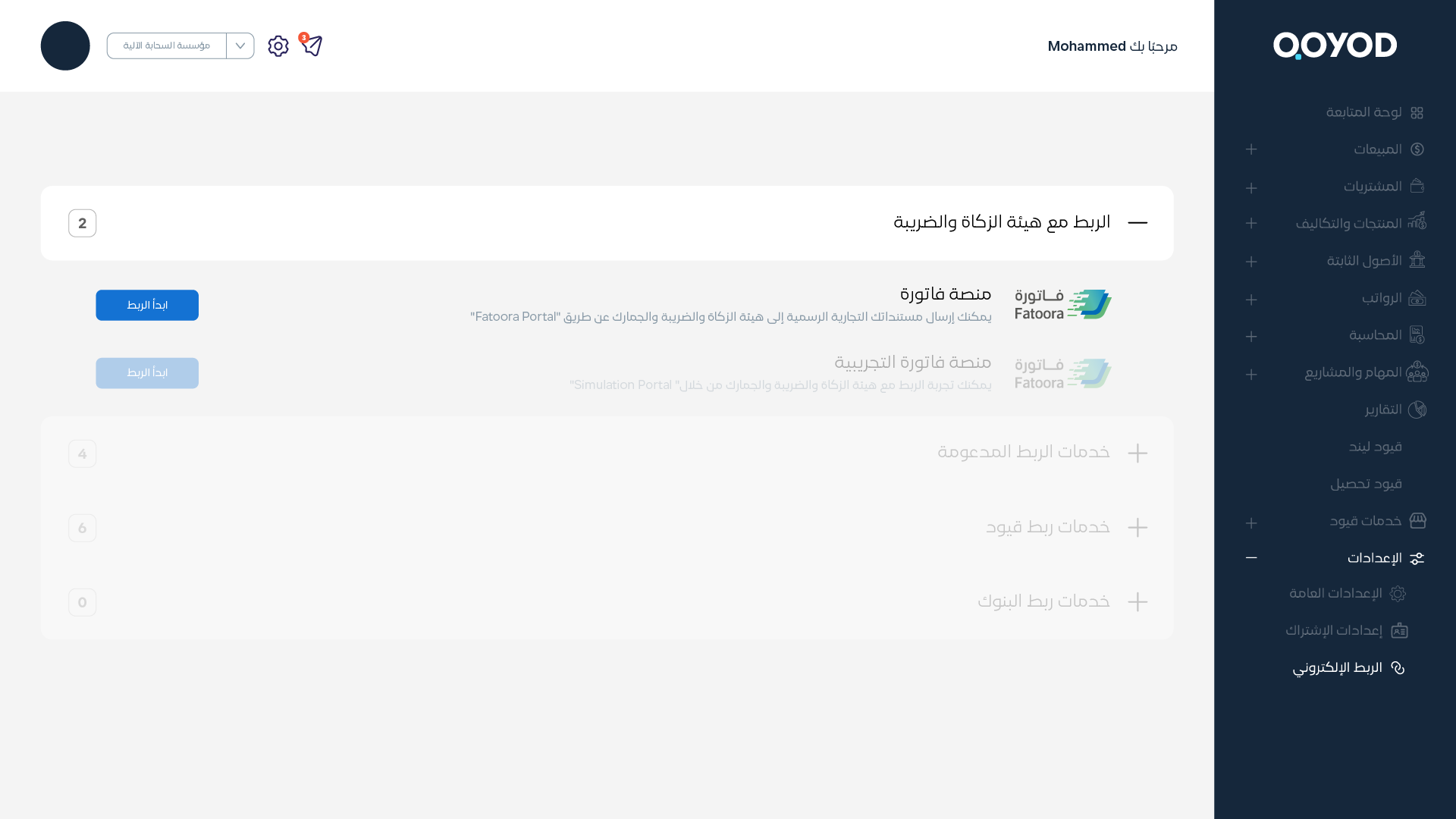

اربط مؤسستك أو مشروعك بمنظومة الفاتورة الإلكترونية التابعة لهيئة الزكاة والضريبة والجمارك بكل سهولة مع قيود

Learn more e-invoicing and tax regulations from our informative blogs.

Invoice title – Store name – Invoice serial number – Invoice issue date – VAT registration number – QR code.

Seller name – Seller’s VAT registration number – Time and date of the invoice – Total VAT – Total invoice (including VAT)

Non Compliance with the Authority’s requirements – Using an e-invoicing system not compatible with the ZATCA’s requirements – Deleting e-invoices – Issuing e-invoices through a system that has not been configured and linked with ZATCA Authority.

Invoices must be issued in Arabic as a mandatory requirement, and may include English additionally.