Every organization has multiple resources that help it achieve its goals and objectives. Individuals are working in the company depending on their efforts and experience. Just as there are devices, tools, and equipment without which the work cannot be completed, there is also a property or building where people gather to do the required work and use that equipment to accomplish it. All those resources that the company depends on to achieve its goals and accomplish its work are known as capital, which is a key element that the company cannot do without, and if it loses it, it will not be able to continue working. It is used to complete daily tasks, achieve operational plans, develop projects, and create new projects and areas of work. It has many characteristics that distinguish it. In our article today, we explain the definition of capital and the reasons for its importance. We also present to you some of the characteristics that help you preserve it and avoid wasting it on what is not useful.

What is capital?

Capital is defined as everything that gives value to the organization, whether it is financial or material property, thanks to its use in the organization's work. It is also defined as the wealth that the organization or individual owns and uses to develop and expand the business. It can also be used for investment and developed through that. It is the most important resource of the organization and has an important role in all its work, which helps it continue to work and achieve its goals.

When the capital for setting a budget for the organization is defined, the capital here will only include the cash money available in the organization, but this does not mean that the organization’s liquid funds are the same as its capital because they are just a part of it.

Definition of capital market

The concept of the capital market differs from the definition of capital, as it is a description of the market in which stocks and bonds of companies are traded. These companies make their shares available for trading in order to obtain sufficient capital to invest in new projects that help them develop their business and achieve their goals.

The importance of capital

Capital cannot be dispensed with in any organization. Rather, institutions dissolve and expire if they lose their capital, due to its great importance, which is represented in the following:

Strengthening the economic aspect

The work of any organization or its projects cannot be conducted except through the use of capital. All operational plans include a portion of the resources that move within the organization. It is offered to obtain returns and profits that cover what was provided and exceed it at a rate known as the profit margin, which is what enables the organization to continue and achieve its goals.

Establishing stability in the organization

As long as the institution's financial assets and capital are safe and well managed, its business will also continue, and with the increase of its capital, its chances of success and development of its resources increase, which provides it with financial security and enables it to develop growing plans that help in its continuous development. It also gives it the strength and ability to make quick development decisions.

Increase job opportunities in the organization.

With the presence of appropriate capital in the organization, it will be able to create new job opportunities for individuals in it when opening new departments or larger branches or even adding new areas of work. Here, the institution becomes a stronger entity and more capable of providing benefit to the community in which it exists, and the amount of this power is linked to the value of the capital it owns.

Enhance productivity

As long as capital, cash flow, equipment, machinery, and assets are available in the required manner, the institution produces and operates with high efficiency and productivity. It needs prudent management of those funds and operational plans that help it achieve its goals while monitoring the progress of the business to develop and expand the projects.

Providing the materials required for production

The organization will not suffer from any shortage related to raw materials when it has capital, because there is a percentage of it that is used to provide raw materials, equipment, or any mechanism necessary for manufacturing and producing production in the required manner, and therefore there is a part of the capital that can be used to provide and maintain another part. These materials are also mainly required to improve the organization’s position in the market and increase its chances of achieving its goals.

Types of capital

Capital does not come in just one form but is classified into several different types, divided into main classifications, each of which has sub-classifications. Among the types of capital are the following:

Debt Capital

It is all the money or equipment that the institution obtains through borrowing, regardless of the different sources to which it lends the money. The institution only has to have a credit reputation and a credit record that proves its commitment to repaying debts in order to be able to obtain loans that help it achieve profits and develop investments.

Additional Paid-In Capital

It is also known as additional capital, and it is specific to institutions that are offered for trading on the stock exchange. It appears when you start purchasing the company’s shares and is added to a special account for its properties. The value of this type of capital varies according to the value and number of shares sold.

Working Capital

It means the amount of difference between the organization's assets and its liabilities, and it is a measure in some companies because of this, as it measures the amount of cash flow in the organization. Through it, it is determined whether the company can fulfill its obligations within one financial year or not, and it can be calculated through two equations that are as follows:

|

Current assets and current liabilities Accounts Receivable + Inventory + Accounts Payable |

Equity Capital

It is a type of capital that does not require repayment. It is a financial investment that comes from contributions or sales proceeds. Equity capital can also be the result of the company’s trading on the stock exchange and the sale of its various types of shares.

Trading Capital

It is a part of the capital known in the business field as financing, and it is allocated to securities trading and is used to finance other institutions that provide commercial deals on a regular basis, which helps to develop it and improve the trading movement of securities.

Capital components

Capital consists of three components, which are as follows:

Human component

It is represented by the individuals working in the organization who give it their effort and expertise to develop its business and improve its chances of success in the business community, and it is an essential and indispensable element of capital.

Intellectual component

It means the plans, operations, and organizational processes established for the organization to chart a path that it must follow if it is to reach a specific goal within a specific period.

Social component

It refers to the relationship of the institution as an entity with the surrounding community, whether they are its clients, other companies cooperating with it, or allies with whom it is able to exchange benefits and launch initiatives that contribute to the opening of new projects and attracting investments from multiple sources.

Capital characteristics

Several characteristics distinguish capital, which are as follows:

- Capital is purely human work. It, in all its forms, comes from the product of human labor. Humans are the ones who build buildings, manufacture equipment, trade securities, buy shares, and take other actions that contribute to the formation and development of capital.

- Continuous consumption of capital leads to a decrease in its value.

- The company's capital is considered a negative production factor because it must be operated in order to obtain results. It alone is not capable of production but must be accompanied by many activities in order to benefit from it.

- Capital is subject to destruction and depreciation if it is not used wisely and managed properly. It needs continuous renewal by adding returns on a periodic basis, and if it is not renewed properly, it will disappear completely, causing the company to go bankrupt.

- Capital is characterized by its variable value, as it is subject to increase and decrease.

- It is considered part of the inventory. Although part of it is within the company's business, there are other parts that serve as inventory used for specific purposes.

Capital functions

These functions are the entities in which capital is used, and there are many roles that are performed in the company depending on capital, including:

- Providing raw materials that help production and carry out the work as expected.

- Bringing the necessary equipment and devices for work makes the production process continuous, which helps achieve the organization’s goals.

- Giving workers the appropriate return so that they can spend on themselves and their families in a way that suits their circumstances, and it also cares about providing the appropriate environment for them to work comfortably in the company.

- Renewing job opportunities and creating new opportunities for the company’s employees has a good impact on the company and the employees as well.

- Providing the cars and carriers the company needs to carry products or workers from one branch to another, from the factory to merchants, or otherwise.

What is an equity investment?

Investment is a term that refers to an amount of money given to another company as a type of loan for the purpose of financing it, with an agreement to recover the value paid for the loan within a specific period. The aim of this is to give the other company some assistance in achieving its practical goals.

Capital investment may come in another form, which is purchasing assets that provide the investing company with a long-term acquisition, which provides both companies with the required benefit, as the first benefits from those assets and the other benefits from the financing it obtained thanks to that process.

Advantages of investing in capital

When your company invests in capital, you benefit from a number of advantages, which are as follows:

- Reaching economic cooperation between the institution and the surrounding community, because investment is in areas that allow the community to benefit.

- Renewing job opportunities and creating new opportunities by expanding the projects that the company was able to obtain through investments.

- Improving the user experience and increasing the efficiency of products thanks to competition between companies, which benefits all parties, ultimately leads to a consumer who is satisfied with the services provided to him and has a number of options available to him.

How to add a capital entry in the Qoyod system

The accounting entry for capital is recording the process of receiving money or any part of the company's capital in the form of in-kind or cash, or delivering it to other parties. This must be recorded in the Qoyod accounting system to preserve the rights of the various parties. The steps for creating a capital addition entry in the system are as follows:

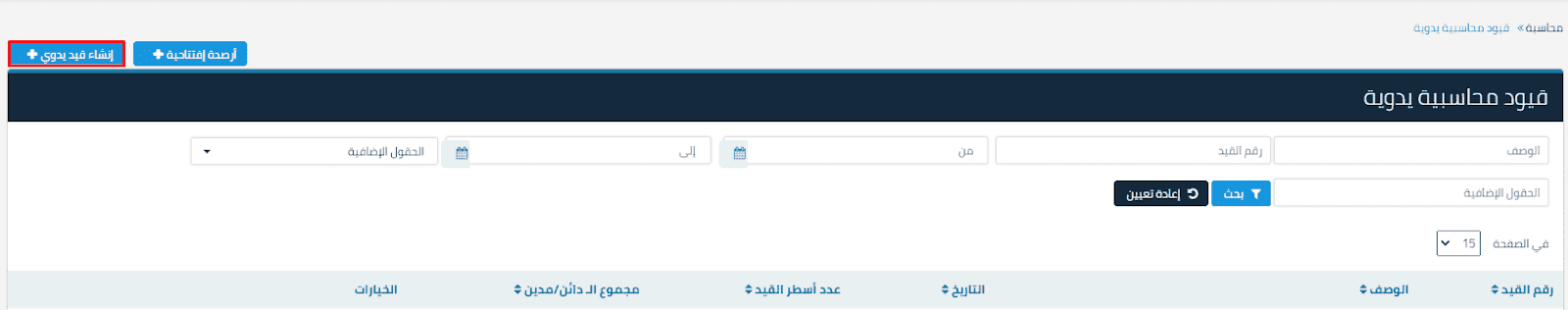

- Go to the Accounting section in the side menu, and from there, choose Manual Accounting Entries.

- You will be taken to a new interface that includes manual accounting entries, so click “Create a new manual entry.”

- Fill in the fields that appear in front of you on the page, which include the description and account information, as well as uploading the required attachments.

.png?width=1600&height=636&name=%D8%B1%D8%A3%D8%B3-%D8%A7%D9%84%D9%85%D8%A7%D9%84-3%20(1).png)

- After completing all the steps, you must click Save, and the account will be added.

How is capital used?

Capital is used in every organization by its objectives. The types of capital available in the company must be limited, the types it needs must be provided, and then thoughtful planning must begin to exploit it in the best possible way. New projects should not be launched without a feasibility study conducted for them. Every investment step taken by the company must be planned, in addition to recording all the company’s accounting transactions, to be able to analyze the capital and follow its growth or decline in order to identify ways that contribute to increasing it and maintaining it. In addition to avoiding the risk of it falling below the safe limit, it must therefore be used according to plans drawn up by experts to protect it from depreciation while adhering to the time plan and path that were drawn for the institution.

Conclusion

We see from what was mentioned that capital is an essential element in any institution, regardless of its field of work and size, and it is necessary to record it in accounting in order to be able to monitor its level of growth and maintain it in order to avoid the risk of its depreciation. So go now to try the free plan from Qoyod so that you can register accounts for capital in your company and make appropriate decisions based on the analysis of the data that you record. The Qoyod accounting system is the best in the Kingdom of Saudi Arabia because it does not require registering a credit package to benefit from the free trial. It does not require downloading, and the reliable level of data encryption gives you unparalleled protection.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don't miss out, join us today!

.png?width=206&height=208&name=Mask%20group%20(1).png)