When you need to buy products or goods and pay the price in advance for any reason, the bill of exchange payment paper becomes your secure document, which enables the seller to guarantee his rights and ensure that you pay the required amount on a specific date. However, this bill of exchange has special conditions to become a legally and officially accepted document. It is also integrated with the presence of several basic elements. What are these elements, what are the conditions for preparing the bill of exchange, and how can it be recorded in accounting based on a system of records? This is what we will explain in detail in our article.

What is a bill of exchange payment paper?

It is one of the commercial papers that is used between the seller and the buyer and is used when cash is not available at the time of purchase. It aims to ensure that the buyer fulfills his obligation to pay the amount recorded therein on the agreed-upon date or when the required condition is met.

A bill of exchange is known among accounting documents as a withdrawal document, and it includes a direct order to pay (for the buyer) and a promise to receive (for the seller) on a date specified in it. Payment can be made to the seller himself or to a third party identified in the bill of exchange, and this is what is known as an endorsement or transfer of rights.

In the event that a bill of exchange is endorsed between several beneficiaries, it turns into a credit document and an instrument for disbursing funds, and its amount is due from the debtor to his creditor at the time or place as it is and on the terms agreed upon without delay, even with the difference in the beneficiary to whom it will be paid.

Parties to the bill of exchange payment paper

There are several parties in which the bill of exchange payment paper is created by their presence together, and it gives them all the benefit either from the service or good that is purchased with the bill of exchange or by paying its price to the beneficiary. These parties are:

drawer

It is the party that prepares the bill of exchange and agrees with the creditor and debtor on the specified amount of the good or service that must be paid for, as well as agreeing to specific terms for payment, whether a specific date or a specific place.

drawee

He is the person who is responsible for paying a sum of money in exchange for a service or good he obtained, and he is committed to paying the amount stipulated in the promissory note under the conditions approved by the holder of the promissory note in agreement with him.

Endorser

He is the seller or creditor owed money, known as the holder of the bill of exchange, and he has the right to have the debtor pay him his money according to the agreed-upon terms.

Endorsee

He is not a permanent party to the bill of exchange, but he is a person whose name is signed in it so that the debtor pays him instead of the original seller. The bill of exchange is endorsed in the presence of its parties and with the signature of the endorser or the owner of the original right.

The main elements and data in the bill of exchange

There are several information and elements that must be included in the bill of exchange, and it cannot become an accounting and legal payment instrument in the Kingdom of Saudi Arabia unless it is completed. These data include the following:

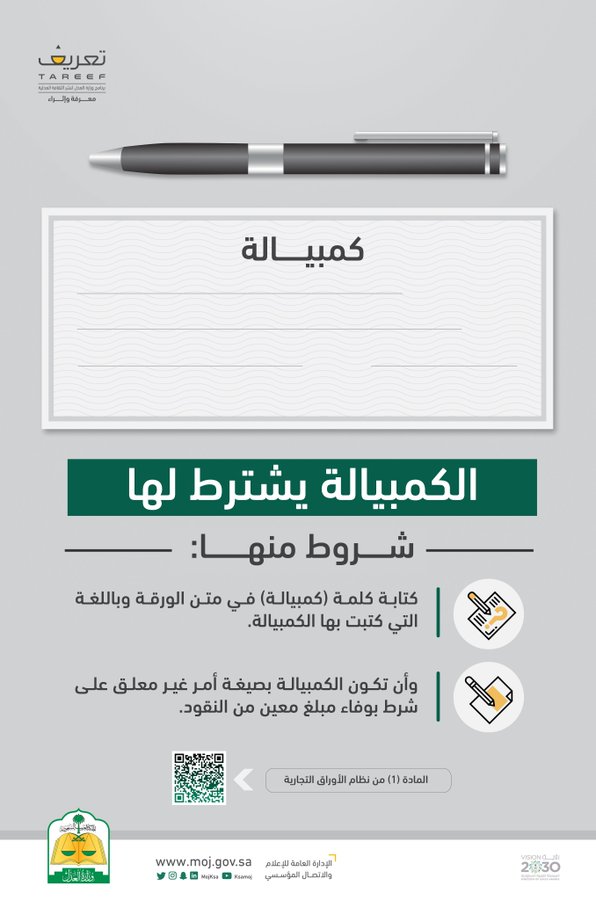

- The word “bill of exchange” is mentioned in the opening and beginning of the document to determine the type of document and its official wording.

- A payment order without restrictions specifies the amount to be paid in numbers and in installments.

- The name of the debtor, or one who is due to pay at least four quarters, is mentioned.

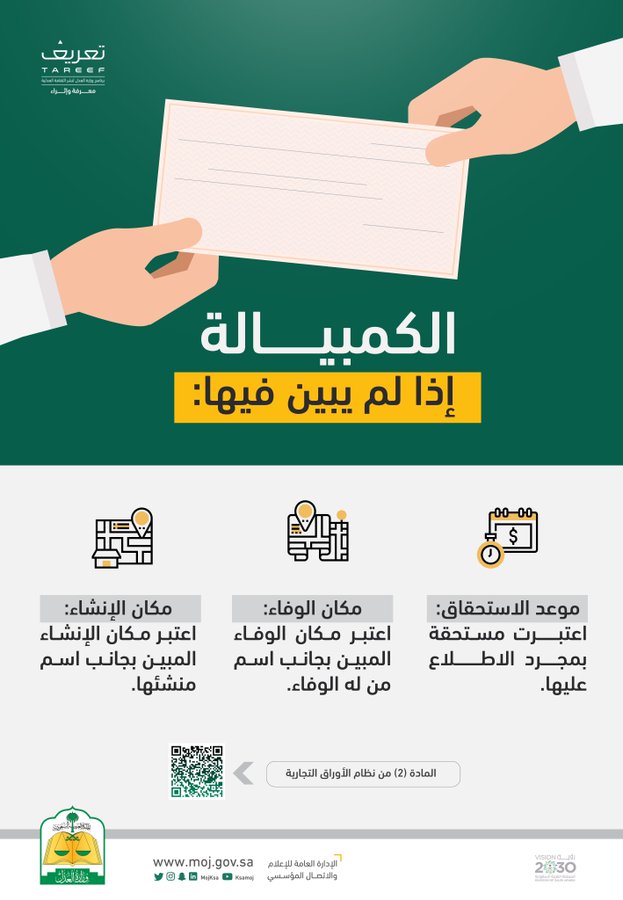

- Specifying the agreed-upon date for paying the money, or the condition of payment if it is a specific place, or something similar.

- Mention the name of the creditor or the person to whom the money will be delivered, written in four quadrants.

- Determine the date on which the bill of exchange was created and the place where it was created.

- The signature of the parties to the bill of exchange, especially the person who prepared it, whether the seller himself or the drawer, is responsible for ensuring the debtor’s commitment to payment.

Types of bills of exchange

In the Kingdom of Saudi Arabia, there are two types of promissory notes:

The bill of exchange is endorseable.

This type of promissory note can be transferred to a beneficiary other than the original recipient of the money, and here it is known as “the endorsee.” It can also be transferred between several endorsers, with the debtor paying the money to the last of them, and its condition is to include the phrase “payment to the order of…” and specify the endorsee in this phrase. .

A bill of exchange that cannot be endorsed

It is another type in which the phrase “payment to an order” is not recorded, but rather it is written “not to an order…” or any other phrase that gives the meaning that the value of the promissory note is paid to the owner of the original right and it is not accepted to be paid to another beneficiary.

Conditions for writing a bill of exchange

When the three parties, “the creditor, the debtor, and the drawer,” meet to prepare a bill of exchange, they must be aware of the conditions that must be adhered to for the bill of exchange to be considered an official document and to become correct in terms of legal wording. Among these conditions are the following:

- A bill of exchange cannot be issued to a Saudi person under the age of 18. If the debtor is non-Saudi and is considered qualified by his country’s system, then he is subject to the Saudi system in determining eligibility or not.

- A bill of exchange containing more than one amount, whether for the same commodity or for different commodities, cannot be taken into account.

- If a minor signs the bill of exchange and tries to revoke it under the pretext of being incompetent, this will not be taken into account, despite his right to use his legal argument when filing the lawsuit.

- The bill can be drawn by the same beneficiary, which means that there does not have to be a different drawer than the seller, and it can also be drawn to the account of a different person, which means that there is a drawer and there is also a beneficiary.

- Any person who signs a bill of exchange is responsible for his signature and for the responsibilities he assumes under that signature, even if he forged the signature, was disqualified, or otherwise.

- When the terms of payment are determined, a place different from the debtor’s home country can be chosen, and it is not necessary to choose places with a specific scope.

- Another person can be authorized to sign the bill of exchange and agree on it in the name of the drawer, and it is then required to sign the bill of exchange in his name and clarify his capacity.

- Whoever signs a bill of exchange in the name of another person without his permission becomes responsible for what the bill stipulates, and nothing is owed to the person in whose name the bill was signed. When the signatory fulfills his obligation towards the bill of exchange, he benefits from the results of that, without this being related to the person whose name was signed.

- If the amount is not written in both the numerical and notation methods and there is a discrepancy in the decided amount mentioned several times in the bill of exchange, the lower amount will be taken into consideration. If it is written in both methods, the basis is the amount written in the notation method “in letters.”

- When a condition is placed on paying the amount with additional interest, this condition will not be taken into account, and it is legally void.

- The drawer guarantees that the debtor will pay the money, and he can request to be exempted from guaranteeing acceptance of the bill of exchange on the part of the debtor, but he will not be able to get rid of the responsibility of guaranteeing payment.

Is it possible to trade a bill of exchange and transfer it to another beneficiary?

Yes, it can be traded, not for one person but for several people, but this is only if the phrase “payment to an order” is mentioned in the bill of exchange. However, if “not to order” is written, it is not permissible to trade it, and when it becomes available for circulation and is transferred to another beneficiary, it thus becomes “endorsed.” This means that the debtor will pay the money to a beneficiary other than the one with whom it was agreed, with the payment date and terms remaining the same.

Endorsing bills of exchange does not depend only on individuals, but endorsement can be done by companies as well, as your company can purchase goods at a certain value and pay on another date that is specified in the bill of exchange payment paper that is concluded between your company and the selling company with the guarantee of a third party, who is the drawer. Then the entry will be as follows:

| Statement | Credit | Debt |

| From/purchases or goods

To/receivable notes (Purchasing goods based on endorsed receivable papers) |

xxx | xxx |

Conditions for endorsing a bill of exchange

We learned previously that there is a type of promissory note that cannot be endorsed. This means that endorsing the bill of exchange or transferring it to one or more beneficiaries different from the original beneficiary is linked to the fulfillment of certain conditions, including:

- The person who holds the bill of exchange is the holder of the original right to the money to be paid, but this must be proven through the endorsements that it passed without a missing link in it, even if the sequence of endorsements contains a blank endorsement.

- The bill of exchange can be endorsed in blank, and when this is done, the bearer can register its information and complete its elements. He can also re-endorse it to another beneficiary.

- A bill of exchange endorsed in blank is subject to re-endorsement without completing the information in it.

- The drawee has the right to endorse the bill of exchange, even if he does not accept it.

- No restrictions or conditions are imposed on the endorsement of a bill of exchange. If the condition is imposed, it is not legally binding.

- Endorsement data can be recorded either within the bill of exchange data, on its back, or on another piece of paper linked to the bill of exchange.

- The name of the assignee does not need to be written on the bill of exchange.

How to record a bill of exchange in accounting books

For the seller, the bill of exchange is an asset account. It is a document due on a specific and agreed-upon date, and it must be recorded in the books of the financial institution to prove the sale of the product for which the bill of exchange was issued. Therefore, it is recorded in one of the following two ways:

The first method

It is through which the sale process is recorded on the account, and it takes place in two steps, the first of which is proving the sale as follows:

| Statement | Credit | Debt |

| From/debt

To/Sales |

xxx | xxx |

The second step is to confirm receipt of the receivable paper from the debtor, the buyer, while paying the amount decided on it, and it is recorded as follows:

| Statement | Credit | Debt |

| From/receivable paper

To: Debtors Payment of the account by bill of exchange. |

xxx | xxx |

The second method

The bill of exchange is used directly to prove the completion of the sale in the company’s books and records, and here the bill of exchange is recorded in accounting as follows:

| Statement | Credit | Debt |

| From/receivable paper

To/Sales. Payment of the account by bill of exchange |

xxx | xxx |

Recording the sending of the bill of exchange to the bank in an accounting manner

When the time comes to pay the bill of exchange, it is sent to the bank to prove its collection and recording. At that time, an intermediary account is opened, and it is one of the accounts for the funds that will be transferred to pay the value of the bill of exchange. In this case, the account transaction is recorded as follows:

| Statement | Credit | Debt |

| from

the bank Collection expenses To/receivable notes for collection |

xxx | xxx |

Recording an accounting endorsement of the bill of exchange

When the entity obtains a sale deal for which payment is made in advance according to a bill of exchange, it is recorded in the company’s books as follows:

| Statement | Credit | Debt |

| From/purchases or goods

To/receivable notes |

xxx | xxx |

Bill of exchange payment form

Bill of exchange

Place of issue: Riyadh Date of issue: 14 AH

Amount (…………….) The amount written “in installments” is:

I, the undersigned, hereby pledge:……… Saudi nationality, national ID number: That I pay under this bill of exchange to (the beneficiary): ……………. The amount shown above and its amount: (……………… Saudi riyals) on the date: 14 AH, which is the due date, The holder of this paper has the right to return it to the debtor or the guarantor without incurring expenses or protesting.

Name:………………. ID number:……………………………………..

the signature:

Name of debtor: Name of guarantor:

ID number: ………………………… ID number:

Signature: …………………………… Signature: ………………………

This type of commercial paper has several forms that you can download and modify or print and write manually according to the stages that the bill of exchange goes through. In the following, you will find all the accounting models related to the bill of exchange:

- To download the Dox bill of exchange form, click here.

- To obtain it in PDF format, click here.

When does the bill expire?

There are several bills of exchange that are issued in Saudi commercial operations, but they are invalid under Saudi law and are not considered acceptable official documents in the event of judicial disputes. Among the cases in which the bill of exchange payment paper is invalid are the following:

- If it has a different topic and is different from the general financial or legal system in the Kingdom,

- If it is proven that there is any reason for invalidation, such as forcing a party to assume a responsibility that he does not want, fraud, etc.

- When it is proven that one of the parties is incompetent, has been sentenced to confinement, or is not allowed to practice business,

How to record a bill of exchange in the Qoyod system

You can easily record bills of exchange issued by or from your company on the Qoyod accounting system, as the system has many features that enable you to follow the payment date and conditions, record the movement of the bill of exchange, transfer it to the bank for payment, or even endorse it to other beneficiaries.

When you encounter any problem in paying the bill of exchange, you can resort to its accounting record on the Qoyod system within the specified time to prove it and prove the date that was agreed upon to pay the value of the bill, while referring to the drawer who is responsible for paying the bill of exchange.

The bill of exchange payment is kept away from tampering and forgery in Qoyod’s secure cloud system, which gives you comprehensive security even though you can access your account from different devices.

Conclusion

The bill of exchange payment paper is one of the most important commercial papers that you can use to credit customers. It serves as security for deferred payment in many cases in which there is a lack of cash availability. To be able to record it, subscribe to the Qoyod accounting system for free for 14 days. Learn how to save a bill of exchange without any difficulties and without the need to download the system to your devices.

Join our inspiring community! Subscribe to our pages on LinkedIn and Twitter to be the first to receive the latest articles and updates. An opportunity to learn and develop in the world of accounting and finance. Don’t miss out; join today!

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!