Bank reconciliation is an accounting process through which differences and variances can be explained between the financial values appearing in the bank statement and the values listed in the organization’s books, especially the “general ledger.” It is used to discover the reasons why values differ between records, detect any debts that the company has not paid, watch for fraud that the company may be exposed to, and determine the dates when the organization will be able to pay the costs incurred and receive the funds recently deposited in its account. From this standpoint, we provide you with examples of bank reconciliation procedures, and we also add bank reconciliation statement templates that you can use to conduct bank reconciliation.

What is a bank reconciliation or a bank reconciliation statement?

The bank reconciliation process means comparing the balances and financial transactions that take place on the accounts of institutions abroad, using the data and values that were recorded in the “general ledger” to determine the reasons that led to the recorded values of the accounts being different from the amounts present in them.

The bank reconciliation statement is used to analyze the balances and reveal the reasons that led to the difference in the balances in the account statement of the resident recorded in the establishment’s books to determine the items on which the cash was spent, which caused the difference in values between the books and statements.

The bank account balance in the account statement is often different from the company’s books due to transactions that have not yet taken place, that have not been recorded, or the like, so it is assumed that the balance listed in the organization’s books is realistic and correct. While differences appear for reasons other than that, it requires adjusting accounts and examining spending channels to arrive at the correct amount and add it as cash or documents proving its spending.

Examples of bank reconciliations

When a discrepancy appears between the account records, the accounting department specialists must examine the books and the account statement and review the recent transactions that took place on the account to explain the reason for the difference between the values in the account and the ledger, in a method known as simplification or bank reconciliation to the books. An example of this is as follows:

A bank reconciliation statement for Al-Makki Company

Company name: Al-Makki.

The company’s account balance in the account statement dated (12 Safar 1445) is 3,214,605 riyals.

The company’s balance in the general ledger is (12 Safar 1445) = 2,985,312 riyals.

| Reviewing the company’s current account reveals the following:

· An amount of 100,000 Saudi riyals was deposited on the same day as the account statement. · There were monthly bank administrative expenses deducted on the previous day, which was a holiday, amounting to 10.5 riyals. · Collection of special bonds issued from the company’s account; their value is 605.5 riyals. · 3 checks were issued, the details of which are as follows: Check No. 3636373, worth 85 thousand riyals. Check No. 3663645, worth 27,677 riyals. Check No. 3668737, worth 16 thousand riyals.

|

| statement simplifying and reconciling the bank statement balance to the books on 12 Safar 1445 | |

| Total Balance “Based on Account Statement” | 3,214,605 riyals. |

| Deposits that have not been recorded | 100,000 riyals. |

| Checks that were not presented to the bank | Check No. 3636373, worth 85 thousand riyals.

Check No. 3663645, worth 27,677 riyals. Check No. 3668737, worth 16 thousand riyals. |

| The correct balance on 12 Safar 1445 | 3,214,605 riyals. |

| The balance recorded in the company’s books on 12 Safar 1445 | 2,985,312 riyals. |

| Bank expenses that are not recorded in the institution’s books | 10.5 riyals. |

| Other expenses | 605.5 riyals. |

After completing the preparation of the bank balance reconciliation statement and the books for actual monitoring, we move on to the reconciliation entries, which are as follows:

| Date: 12 Safar 1445

700/cash in the bank. 700 / revenues and expenses.

100/bank expenses. 100/cash in the bank. |

The importance of bank reconciliation

There are some reasons that explain the importance of bank reconciliation and better explain the benefits of settlement in the bank, and these reasons are:

Determine the level of cash flow.

Financial transactions in any organization are essential work based on which its future steps can be determined. When the account statement is reconciled with the values recorded in the organization’s books, the company can better understand its financial transactions and determine what it needs to pay in real-time. The company is also able to calculate its profits and the best sources it obtains from them.

Achieving trust

The difference in values between books and account statements may cause incorrect decisions to be made. This puts the company facing many problems over time, such as paying an amount that is not easy for the company to afford at present or missing the opportunity to purchase an asset that has great advantages and a low price at this time.

Fraud detection

The apparent differences in the financial values between the accounts and the books make the specialists carry out the review, as we mentioned, and here unjustified financial transactions appear that may mean the occurrence of fraud. The matter is similar to spending an amount of 350 riyals on repairs made in the company, and a bond was issued for this amount, which was then recorded in the book with a value of 390 riyals.

Show debts

Some invoices may fall from the attention of the company’s management, but the difference between the accounts shows any invoices that have not been paid or dues that have not yet been paid, and this is what makes the bank reconciliation show any money that has not been paid to those entitled to it in order to expedite its payment or develop a plan that helps in this.

Bank reconciliation conditions

It is important to know three basic terms in any bank reconciliation process that you conduct so that you can understand the differences between financial values and be able to perform the bank reconciliation smoothly and easily. These terms are:

Pending amount

It is the balance that has already been received by the company but has not been processed in the central system yet. Although its delivery has been completed, the number in the bank account is the same and has not been changed after the amount was disbursed.

NSF inspected

This refers to a financial transaction that takes place despite the lack of sufficient balance in the account. Here, no change in the balance appears on the account, and the person will not be able to complete the transaction due to the insufficient amount.

Deposit in transit

This means depositing money in the bank at the end of a business day, which means that it does not appear on the system before the next business day. It also means other cases, such as sending money via mail in a process that has not yet been registered, and this is what causes an unreal amount to appear in the company’s balance. It is different from the balance mentioned in her account statement.

Steps to implement bank reconciliation

To be able to review your company’s account and carry out the bank reconciliation, you must do the following steps:

- Compare the balance mentioned in the account statement with the balance recorded in the company’s accounting books and determine whether there is a difference between them or not.

- Check the financial transactions mentioned in the account statement that were carried out from or deposited into your account, especially the interest and fees charged to your bank account.

- Go back to your company’s ledger and check the cash transactions that took place in it. Do not neglect any detail so that you can uncover any transaction that was not recorded or was recorded before it was implemented.

- Adjust your account balance, and you will know that the next few days will bring you an increase or decrease in your account according to the transactions made from it.

A bank reconciliation statement form

Bank reconciliation statement

Name of the bank …………. for the month ………

Account number……… Date…………..

| Statement | the amount | Notes |

| Bank account balance from accounting records | 0.00 | |

| Total deposits | 0.00 | |

| Total withdrawals | 0.00 | |

| Bank expenses | 0.00 | |

| Uncashed checks | 0.00 | |

| Deposits appear in accounting records. | 0.00 | |

| Deposits appear on the bank statement. | 0.00 | |

| Withdrawals appear on the bank statement. | 0.00 |

There are different forms. A bank reconciliation statement, and below are the two most prominent bank reconciliation forms in Dox and PDF format so that you can modify them according to your company’s accounts, or print them and work on them as is:

- Download Form 1 in Dox format from here.

- Download Form 1 in PDF format from here.

- Download Form 2 in Dox format from here.

- Download Form 2 in PDF format from here.

How to perform bank reconciliations with Qoyod

You can use Qoyod’s bank reconciliation feature and easily set up a bank reconciliation statement to audit your financial transactions in simple steps:

- Go to the Qoyod website from here and log in.

- Click on “Accounting” from the side menu.

- You will find a drop-down list under the Accounting option, at the end of which is the Accounting Quality option. Choose it.

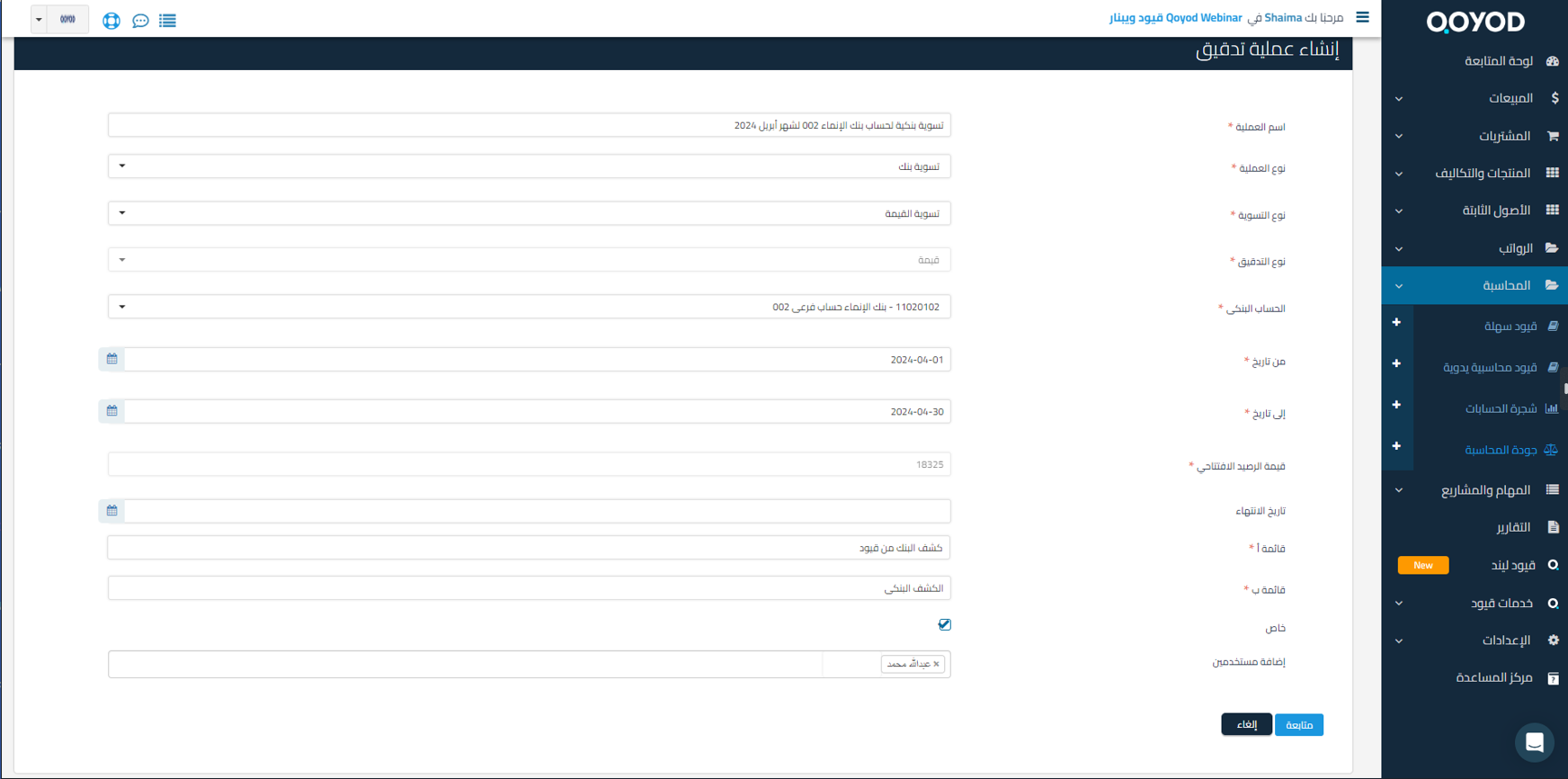

- A new interface will appear in front of you with the “Audits” option, so choose Create an Audit.

- Start by typing the name of the transaction you want to add, and you must choose the audit type “bank reconciliation.”.

- Select the company account to be settled, and allocate the period you want to bank settle it.

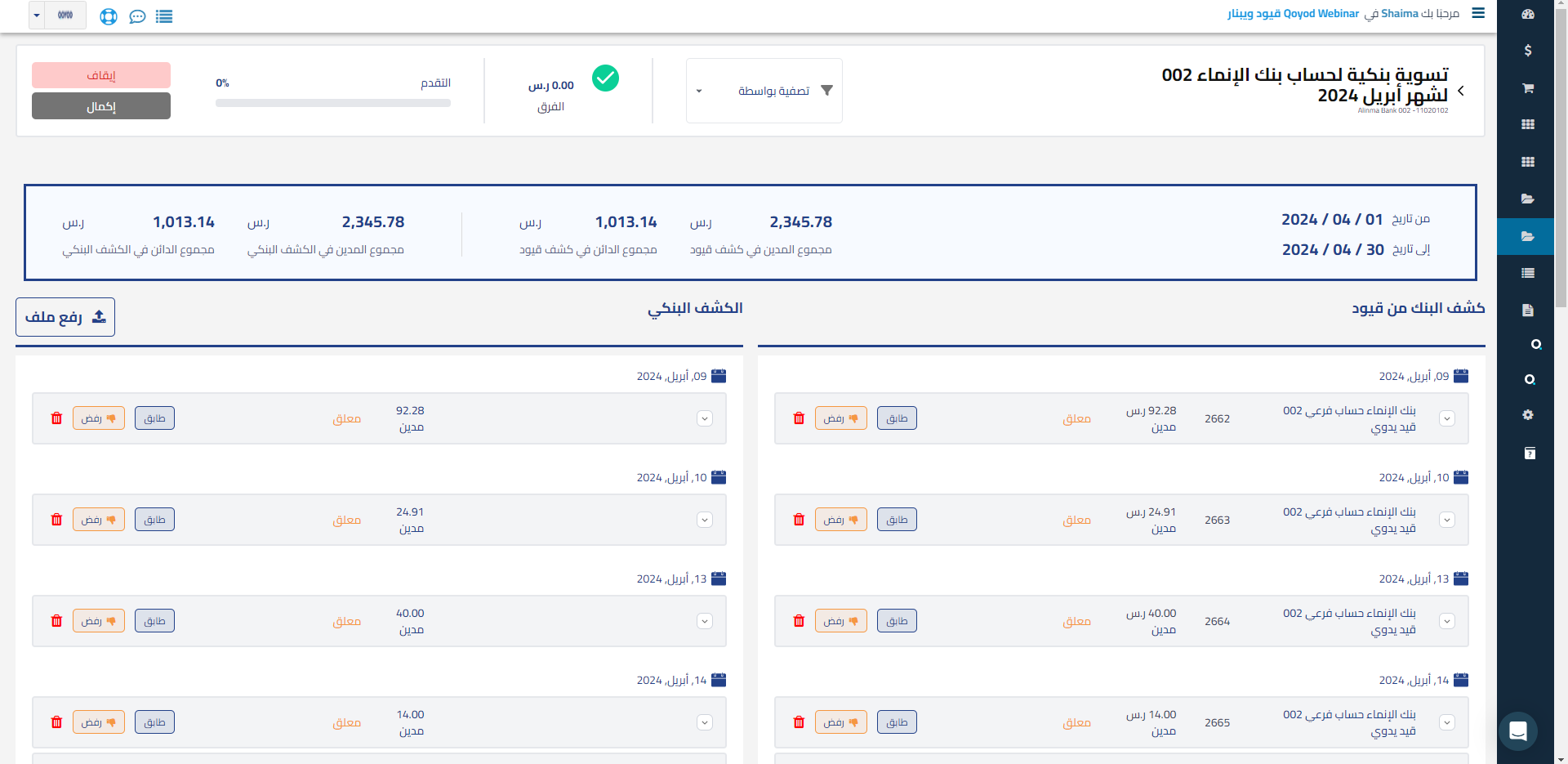

- An interface will appear in front of you, showing you the value of your opening balance. Here, you must verify that the declared value matches the account statement received from the bank.

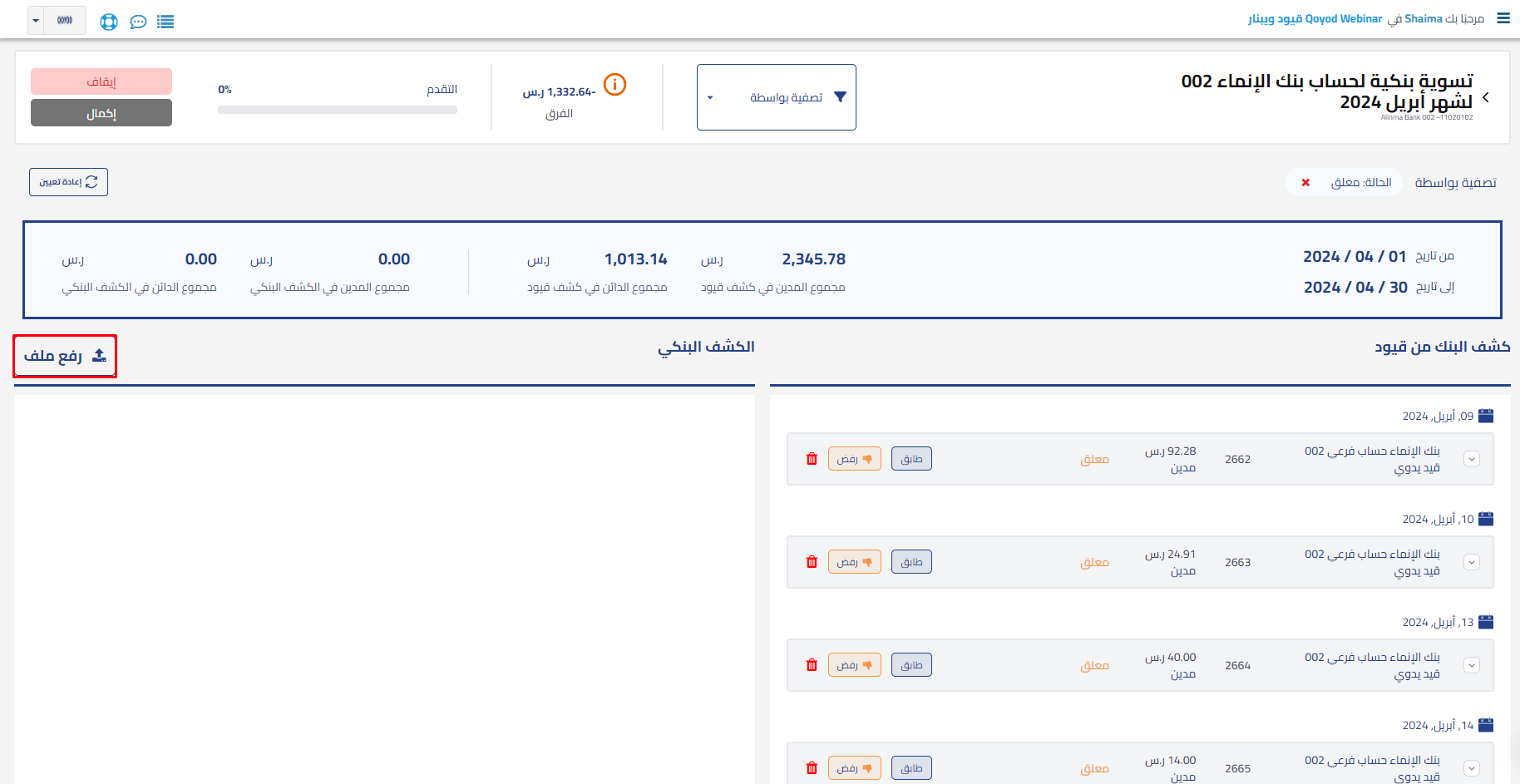

- To be able to match the value, you must click “Upload File” to add the bank statement.

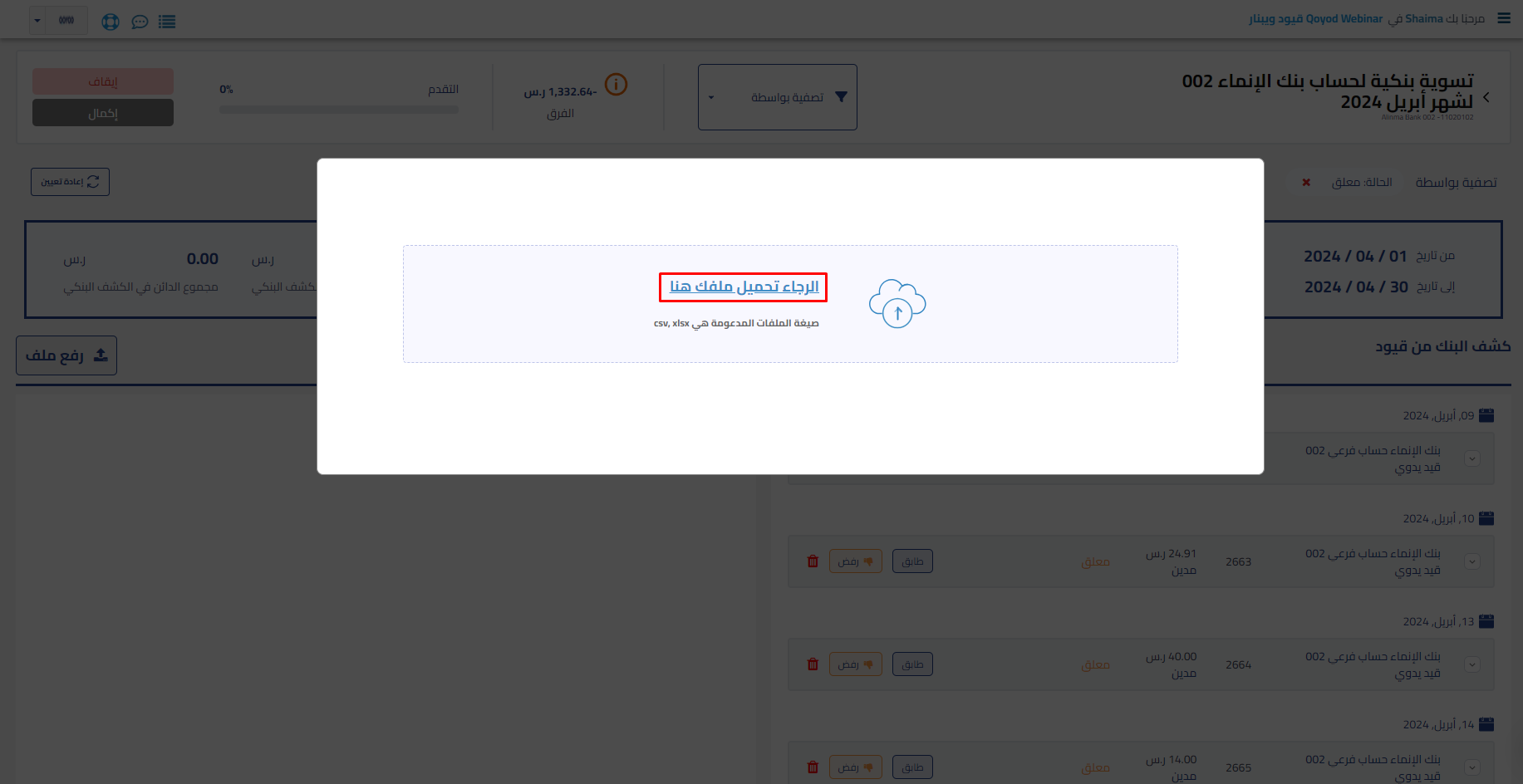

- Choose the file you want to upload by clicking “Upload your file here.”.

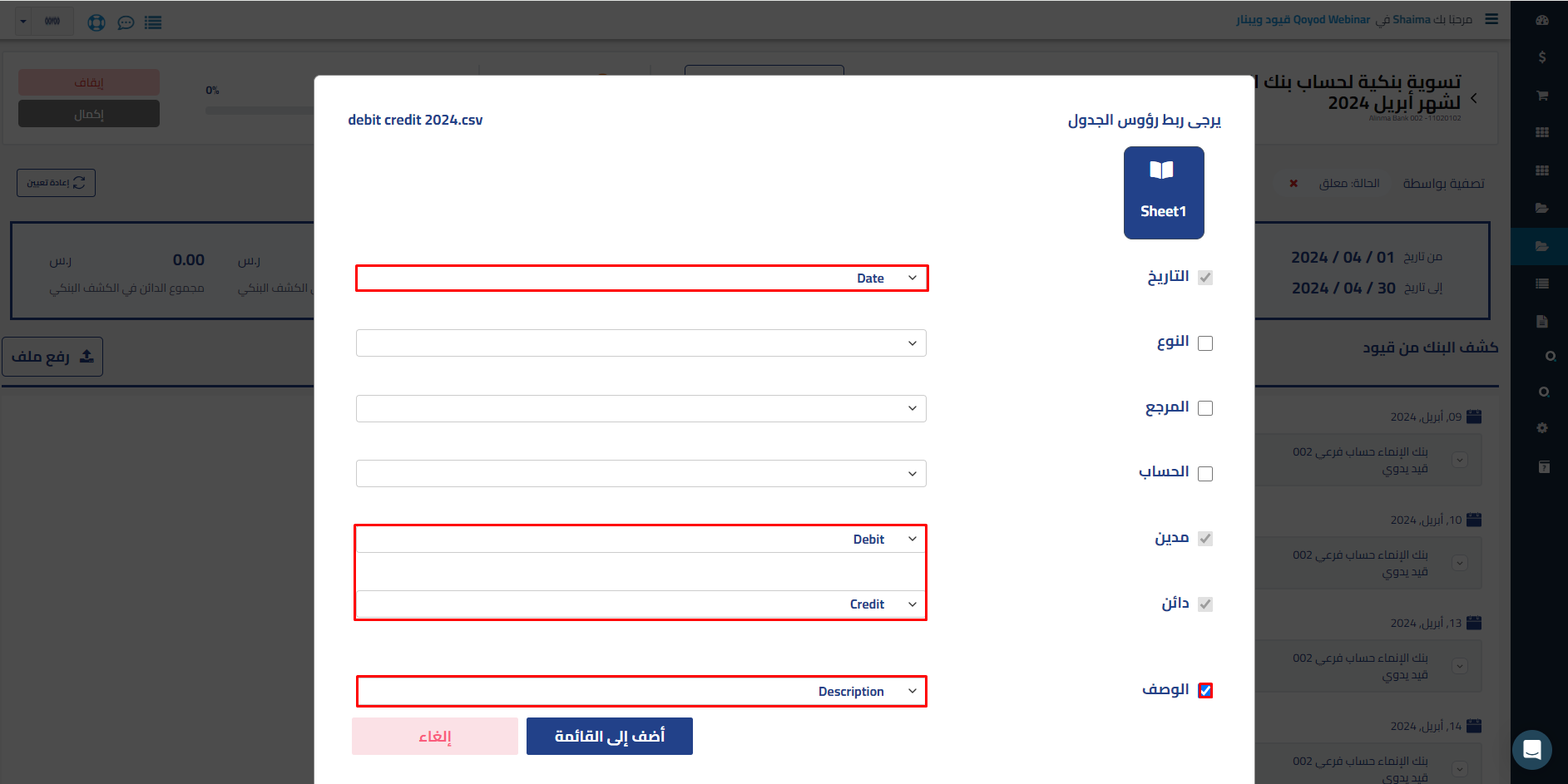

- You must link the headers of the table by specifying the date on which reconciliation is required and specifying the amounts that were deducted from the account or that were added to it.

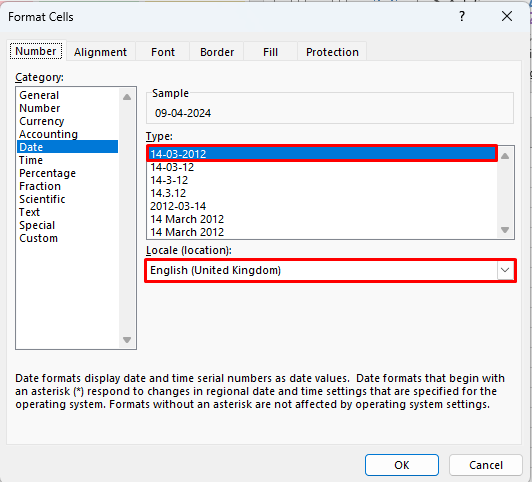

- It is important to note that the date needs to be set in full to match the system, so choose the “Date” format, set the location to “United Kingdom,” and then choose its format as 12-5-2024.

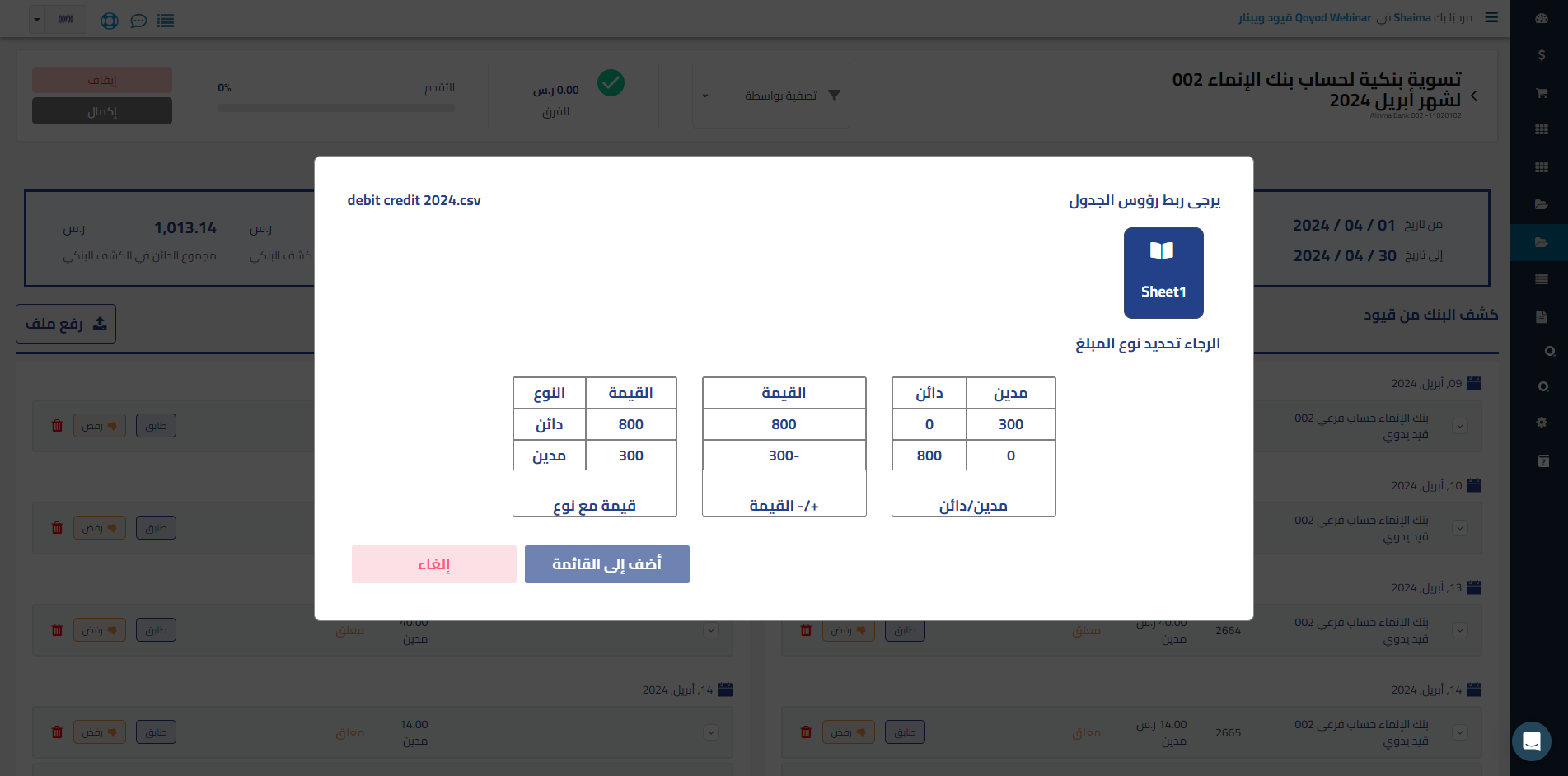

- You also need to adjust the classifications of the funds that you want to analyze between credit and debit, through the bank statement format, to facilitate matching the data and ensure its accuracy. Here you will choose between the formats as follows:

- A credit and a debit if the account uses this formula to classify funds.

- (+/-) if the statement expresses debit accounts as positive and credit amounts as negative.

- Value or type if debit is referred to as value, and type as credit.

- Thus, the statement of the account you have chosen is uploaded, and data analysis begins to discover and address any differences in values, after which the bank reconciliation process is completed successfully.

- Include the designated date for completing the reconciliation process, which is a non-mandatory step. After that, review the lists, and if you want to change their titles, you can do so.

Conclusion

The bank reconciliation process is necessary to reveal the transactions of financial institutions, which gives them complete confidence and transparency and paves the way for them to make appropriate financial decisions. In order to make a bank reconciliation statement at the hands of experts, you must use the Qoyod accounting system, which allows you to try it for free for 14 days without the need to register your credit card data, while enjoying all the features of the system and without the need to install the program on your computer. So try it now and do not hesitate, we will be waiting for your opinion about the system after using it.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!