In our modern era, technology has become an indispensable tool in facilitating aspects of our daily lives, including managing financial and practical affairs. Among these innovations, the PDF format of the salary payment form for domestic workers stands out as an effective and useful means that ensures transparency and organization in our financial dealings. But how can this model contribute to enhancing trust and achieving justice between employers and workers? What are the benefits of incorporating it into our homes? In this article, we delve into the key features of the monthly salary payment form for domestic workers in PDF format, demonstrating its potential to transform salary management, simplify the process for everyone, and reduce time and effort. So follow along.

What is a salary payment form for domestic workers in PDF format?

The official document records the salaries paid to domestic workers. This ensures the process’s transparency and integrity from a legal standpoint. It is worth noting that this document is an important part of the procedures that enhance domestic workers’ rights and provide them with the necessary protection.

It is worth noting that using a salary payment form for domestic workers is not just a routine procedure but rather part of the commitment to providing a fair and transparent work environment for domestic workers, as it contributes to protecting their rights and ensuring that they receive their entitlements on time. However, it provides employers with a legal reference that they can rely on in the event of any future salary disputes.

Contents of a Monthly Salary Payment Form for Domestic Workers PDF Ministry of Labor

A salary payment form for domestic workers in PDF format is an important document documenting the process of paying monthly salaries to domestic workers, and it plays an essential role in protecting the rights of both the worker and the employer. This model includes several basic elements, which vary slightly depending on who uses them, but often contain the following points:

Domestic worker information

- Name: Includes the full name of the domestic worker.

- Identity number: This includes the national ID number or passport, which facilitates the verification of identity.

- Job: Shows the job title of the domestic worker, such as nanny, maid, cook, etc.

Employer information

- Name: The full name of the employer.

- Identity number: The employer’s national ID number.

- Address: the full address of the employer, which helps document the place of residence and work.

Salary details

- Salary Disbursement Date: The specific date on which salaries were paid.

- Amount Due: The amount of money paid to the domestic worker for her services.

Signatures

- Domestic worker’s signature: The worker’s signature is proof of receipt of the salary, which confirms her acceptance of the amount paid.

- Employer: The employer’s signature serves as proof of salary payment, officially documenting the process.

Notice

The contents of the form may vary based on the requirements of each entity using it, such as intermediary companies for hiring domestic workers or the local laws of each country, but the above-mentioned elements are basic and common in most forms.

What is the purpose of preparing a salary payment form for domestic workers?

Preparing a salary payment form for domestic workers in this form is an important step in documenting salary payment processes and confirming their receipt in an official and transparent manner. This form serves both the worker and the employer, achieving several main goals summarized as follows:

Documenting the labor relationship

A salary payment form for domestic workers contributes to providing an official record of salary payment operations. Consultation of this record when needed facilitates the follow-up of the labor relationship between the worker and the employer. It also provides legal proof of financial transactions, which reduces the chances of future disputes or misunderstandings.

Protecting the rights of domestic workers

The form is a means to ensure that domestic workers receive their wages in full and on time, and thus this contributes to protecting their financial rights and ensuring that there is no tampering or delay in the payment of salaries, which enhances the feeling of security and stability among workers.

Compliance with laws and legislation

Using a salary payment form for domestic workers on a regular basis helps comply with local labor laws and legislation. It is worth noting that this compliance reduces legal problems and potential disputes and enhances the employer’s commitment to legal standards, which reflects a positive image of commitment and responsibility.

Enhancing transparency and trust

The form enhances transparency in the labor relationship by clearly and specifically documenting every payment process. Therefore, this contributes to building trust between the two parties and enhances mutual understanding and respect, leading to a more positive and stable working relationship.

Steps to prepare a salary payment form for domestic workers

In preparing a salary payment form for domestic workers, systematic and organized steps are usually followed to ensure accuracy and comprehensiveness, so here is a detailed explanation of these steps:

Determine basic information.

The beginning is to collect basic information for both parties involved, which is as follows:

- Domestic worker information includes the worker’s name, national ID or residency number, and work location to verify the identity of the recipient and document the process accurately.

- Employer: It includes the employer’s name, ID number, and address. This data confirms official documentation and helps with accountability when needed.

Determine payroll dates.

Determining the time periods for salaries is an important part of the model, as it must contain:

- Salary disbursement date: The day on which the salary will be paid must be clearly stated.

- Covered salary period: It is important to determine the time period covered by salaries, whether monthly, semi-monthly, or according to agreement.

Determine the amounts due.

Here, the amounts of money that must be paid are determined as follows:

- Total Amount: The full number of salaries due for each period must be stated, including any additional benefits or deductions.

- Amount details: It is useful to clarify salary details, such as the basic wage and overtime hours, in addition to deductions, if any.

Add space for the signature.

Signatures play a crucial role in confirming the receipt of salaries, as there must be:

- The domestic worker’s signature represents confirmation of receipt of the aforementioned amount.

- Employer: represents confirmation that the said amount has been paid and documents liability.

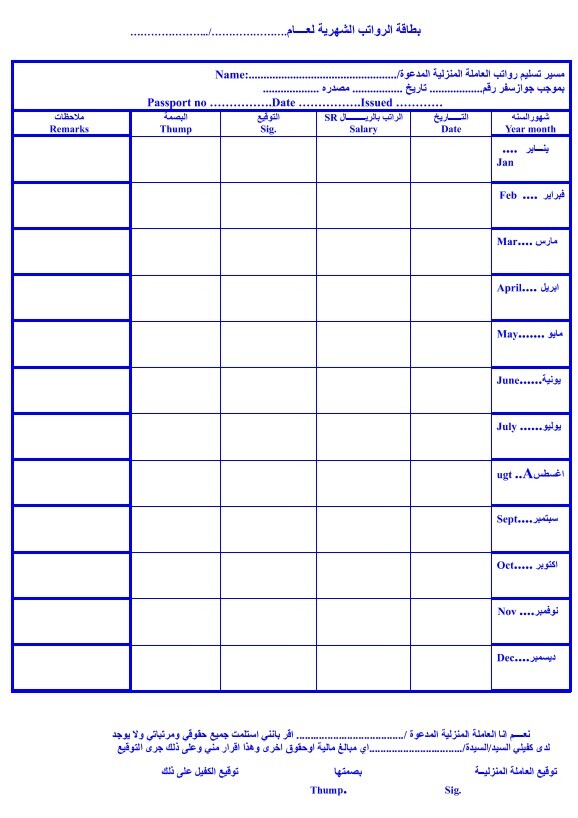

Domestic worker salary form

We can learn about the model of domestic workers’ salaries, as shown below:

a monthly salary payment form for the year… Name of domestic worker/………………..

According to the passport number…

Date…………………………Source…………………………..

Months of the year date ………………. Salary ……………..

Fingerprint, Signature,

comments ……………………

January

February

March

April

May

June

July

August

September

October

November

December

I declare that I am the worker.

I obtained all my financial rights from Mr.

On that basis, I signed

Worker’s signature…………………………..

Fingerprint ……………………………

Sponsor’s signature……………………..

Format the form and convert it to a PDF file.

After collecting all the information,

Form format: Information is arranged in an organized and clear manner to ensure ease of reading and understanding.

Converting the form to PDF: The final form is converted to PDF format to ensure stability of the format and no modification, which makes it easier to print and use.

Model distribution

In this final step, the form is printed and distributed to the concerned parties, as there must be a copy for the domestic worker and a copy for the employer. It is worth noting that the form is repeated every time salaries are paid, which facilitates periodic documentation.

Notice

It is worth noting that some steps may differ based on the requirements of each employer or the legal authority under which he works, as some details can be added or modified according to special needs.

How do I document the domestic worker’s salary electronically?

Documenting the domestic worker’s salary is an important step to guarantee the rights of both parties: the worker and the employer. To ensure that the contract is properly documented, the following steps can be followed using the Musaned platform:

- Login to the Musaned platform: Start by logging in to your account on the Musaned platform from here using your personal data.

- Accessing the Contracts page: Go to the Contracts page in the site interface. You will find all the options related to managing domestic worker contracts.

- Choose documentation in the New Orders section: Within the Contracts page, find the “Documentation” option in the New Orders section to start documenting the contract.

- Complete the steps to request contract documentation: You will need to enter the necessary information for the contract, such as the worker’s details, conditions, and the agreed-upon salary.

- Make sure to fill out all required fields accurately to ensure the process goes smoothly.

- Sending the request: After ensuring that the information entered is correct, send the authentication request. The request will be processed, and the documentation link will be sent to the worker via text message.

- The worker’s interaction with the authentication message: The worker will receive a text message containing the authentication link.

- The worker must enter the link, the residence number, and then the verification code sent to her.

- Approval of the contract: To activate the contract, the worker must read the contract details and agree to them within 5 days of receiving the text message.

- Issuing the notarized contract: After the worker approves the contract, the notarized contract will be issued, and its status will change to “valid.”

- You can then download a copy of the notarized contract and keep it for future reference.

Is it mandatory for domestic workers to use the monthly salary receipt form?

No, but using a salary payment form for domestic workers is an important practice, even if it is not legally mandatory in all cases, as these forms provide a reliable means of documenting the salary payment process and officially recording financial transactions.

Salary payment form for domestic workers

- If you want to download a salary payment form for domestic workers in Word format, click here.

- If you want to download a salary payment form for domestic workers in PDF format, click here.

The importance of using the Qoyod program in calculating domestic workers’ salaries

Using the Qoyod system to calculate domestic workers’ salaries is of great importance and contributes to improving the efficiency and effectiveness of human resources management, as the program provides all of the following:

Improve efficiency

Using the Qoyod program to calculate domestic workers’ salaries reduces the time and effort required to enter data and calculate salaries manually. This automation frees up time to focus on other, more important, and more complex tasks.

Reduce errors

The system significantly reduces the possibility of human errors that occur during the salary calculation process, thus enhancing the accuracy of financial data and contributing to providing reliable results.

Possibility of analysis

The program provides tools to create detailed reports and analyze the cost and distribution of salaries. These analyses allow management to make better strategic decisions based on accurate and up-to-date data.

Compliance with legislation

Qoyod also helps ensure full compliance with local and international legislation and laws related to payroll, taxes, and social insurance, thus protecting the company from legal problems and potential fines.

Save time and money.

Thanks to advanced and automatic technologies, the system contributes to saving time and costs associated with the process of manually calculating domestic workers’ salaries, thus saving resources that can be used to improve other processes within the company.

Boost confidence

By providing high accuracy in calculating salaries and complying with laws, the system enhances employees’ confidence in the company, which can reflect positively on employee morale and increase their loyalty.

Conclusion

It can be said that the salary payment form for domestic workers PDF is not just a financial document but rather a vital tool that contributes to strengthening trust between the worker and the employer and ensuring the rights and duties of each party separately. It is worth noting that by applying this model correctly and accurately, we are taking a step towards a more transparent and fair work environment where the rights of domestic workers are respected and mutual respect prevails. Therefore, both employers and employees must adopt this model as part of their daily work culture to build together a society that works on the foundations of justice and mutual respect.

Do not forget to use the Qoyod program when using the salary payment form for domestic workers to get the greatest possible benefit. It is worth noting that this program also provides to all its customers with various electronic invoice systems, the point-of-sale system, etc., which makes it the best accounting program in the Kingdom of Saudi Arabia and around it.

After you learn what the salary payment form for domestic workers is and how to download it, try Qoyod now for free for 14 days to ensure success. It is an integrated accounting program.

Join our inspiring community! Subscribe to our pages on LinkedIn and Twitter to be the first to receive the latest articles and updates. An opportunity to learn and develop in the world of accounting and finance. Don’t miss out; join today!

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!