When you need to gain experience in everything related to accounting for professional advancement and to gain the ability to create and prepare accounting books, forms, and financial statements in a sound legal format, your first step is learning. This is done by developing your accounting skills in the Distinguished Accountants Program, as this type of work enables you to protect the rights of workers. It is also used to prove the organization’s commitment to pay its dues, provide the required inventory, and bear the expenses that contribute to the normal operation of the business. These accounting records also contribute to planning the future of enterprises and making the best decisions for them, which was necessary to learn in the accounting program. In our article today, we talk about the steps for registering in the Distinguished Accountants Program and explain to you the conditions that must be met to be accepted into it. We also give you a complete picture of what you can benefit from when you obtain the certificate that proves that you have learned accounting in this program.

Definition of the distinguished accountants’ program

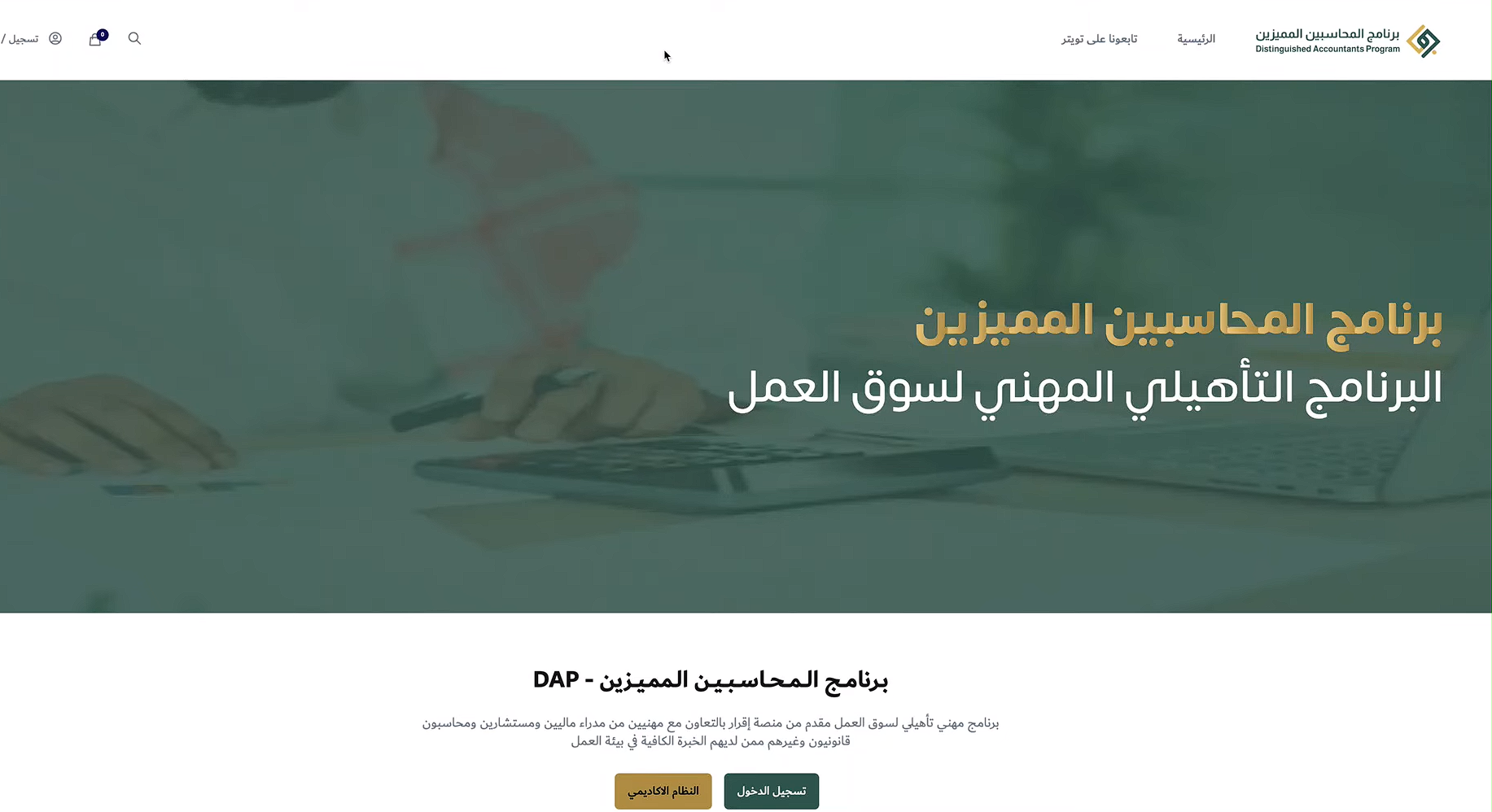

The Distinguished Accountants Program (DAP) is a type of training program offered by the Egrar platform to qualify business school graduates for the labor market without imposing additional costs that burden them, to feed the market with experienced and skilled accountants who can advance commercial institutions and lead them to success and achieve goals.

The program was established in 2020 by a group of accounting experts, legal practitioners, and administrators who contribute their expertise and efforts to training a new generation of accountants in accounting, preparing books, financial statements, and others, to link institutions of different business sizes with entities that provide reliable and supported services.

How to register for the Distinguished Accountants Program

To be able to start learning the higher levels of accounting, you need to register in the program and learn how to create official records, audit, inventory, and analyze data. You can easily register on the Iqrar platform to benefit from the Distinguished Accountants Program by following the following steps:

- Go to the official website of the Egrar platform from here.

- Choose the type of account you want to register, as you are provided with either a customer or service provider account, and click Confirm after choosing.

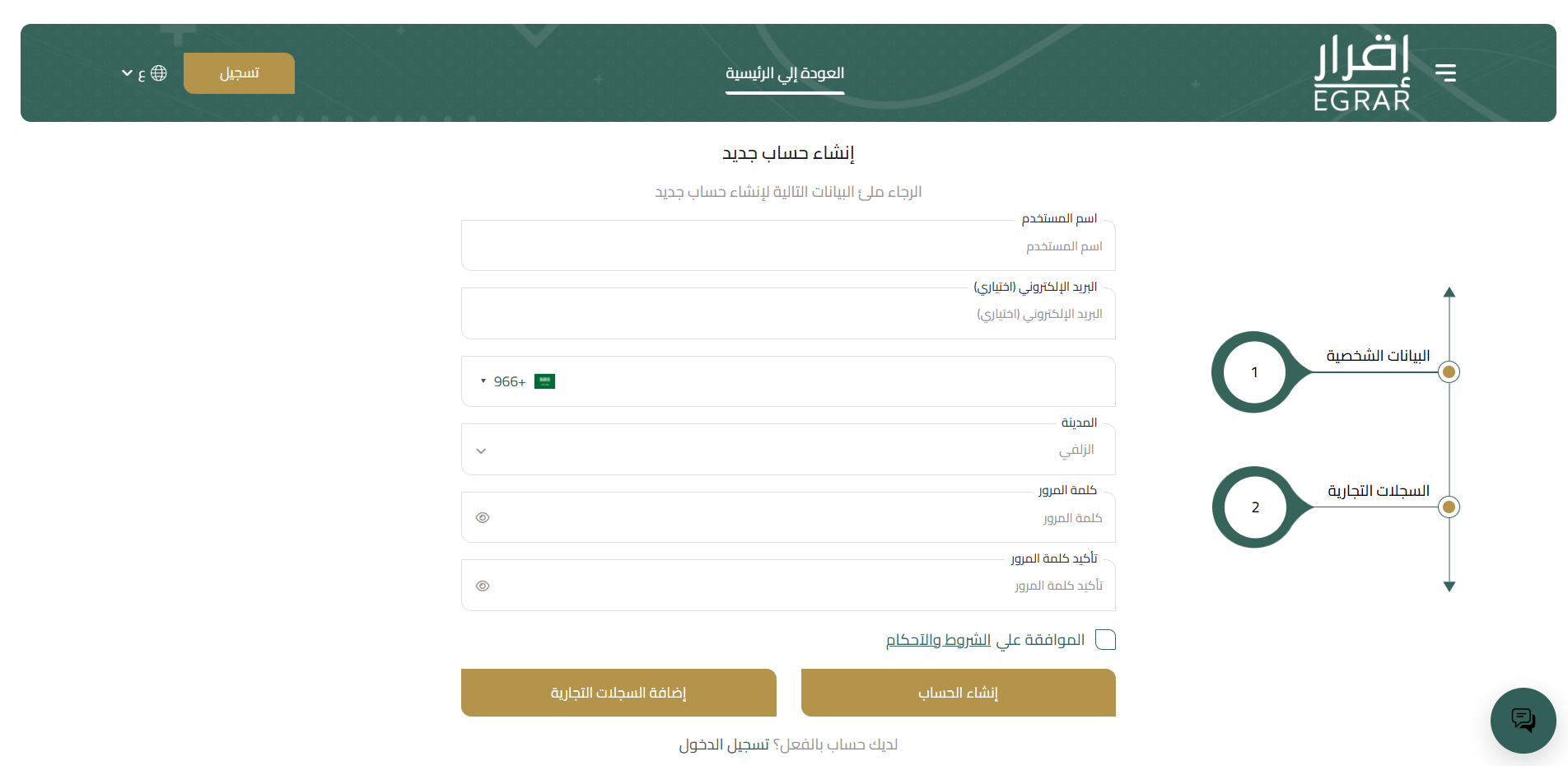

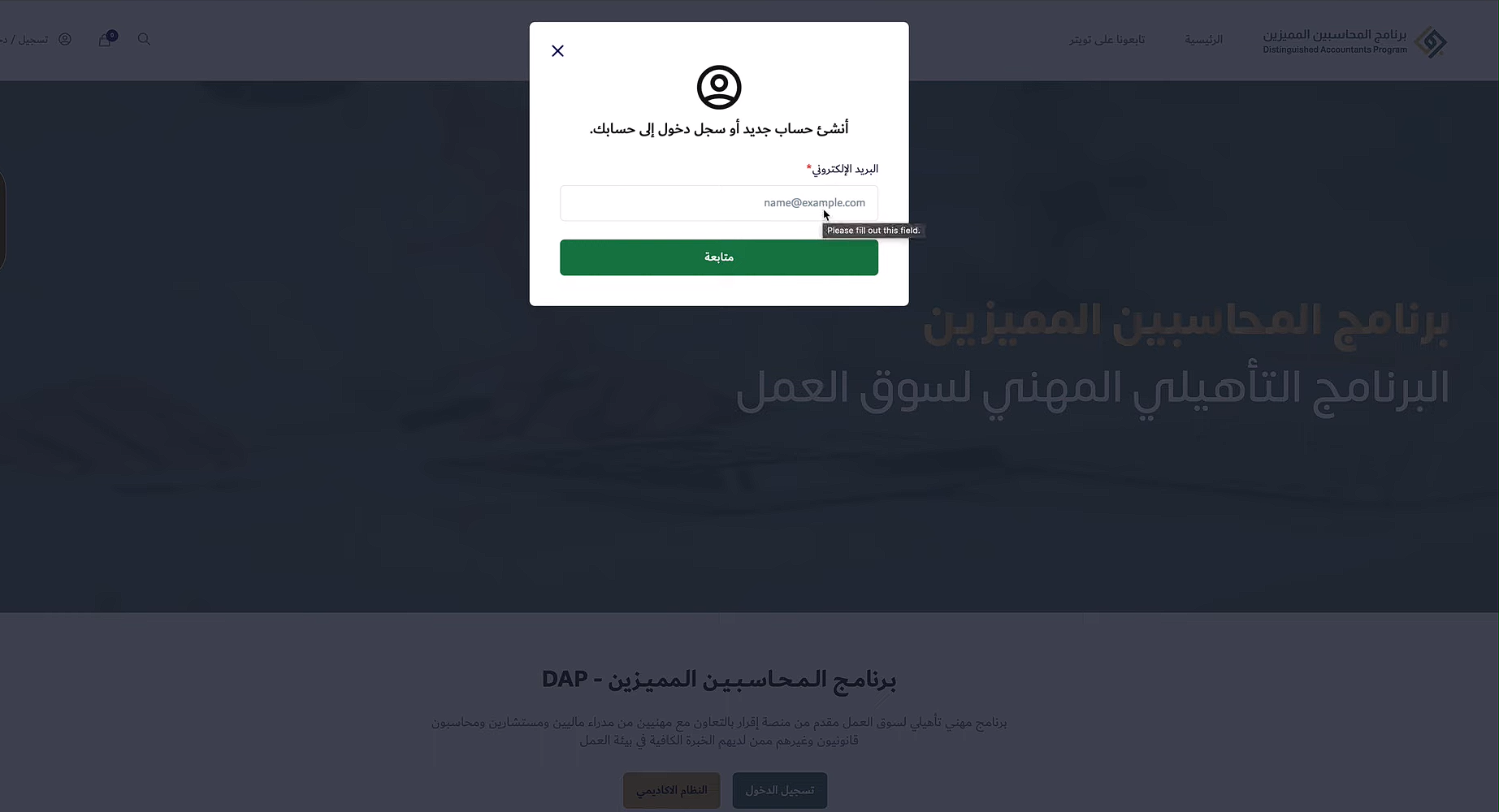

- If you choose a customer account, start by registering all the required data, which is shown in the image below.

- After filling out the information, click Create Account to be able to obtain a customer account.

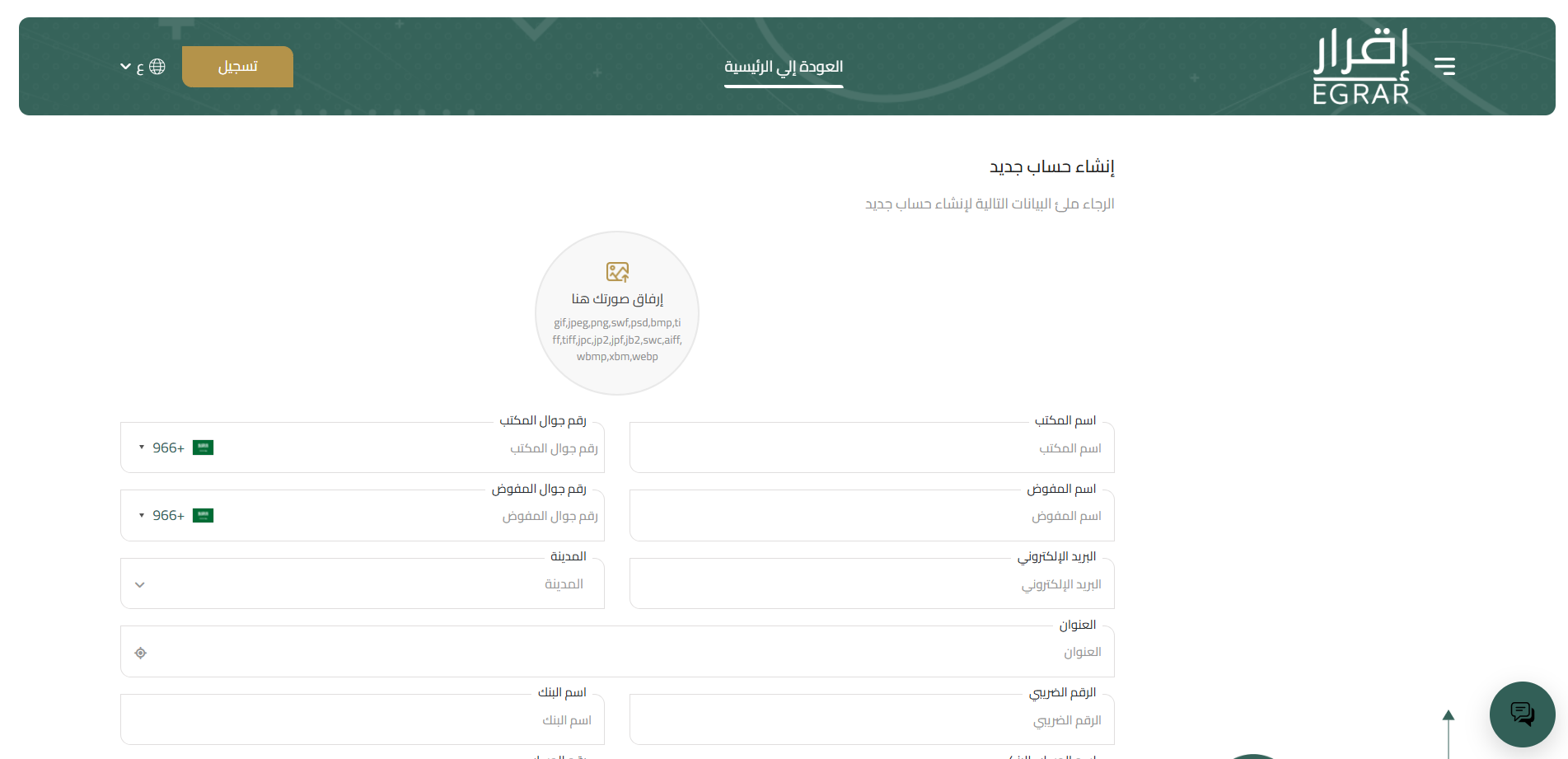

- If you choose a service provider account, you will need more detailed data that includes your office information, tax number, commissioner data, etc.

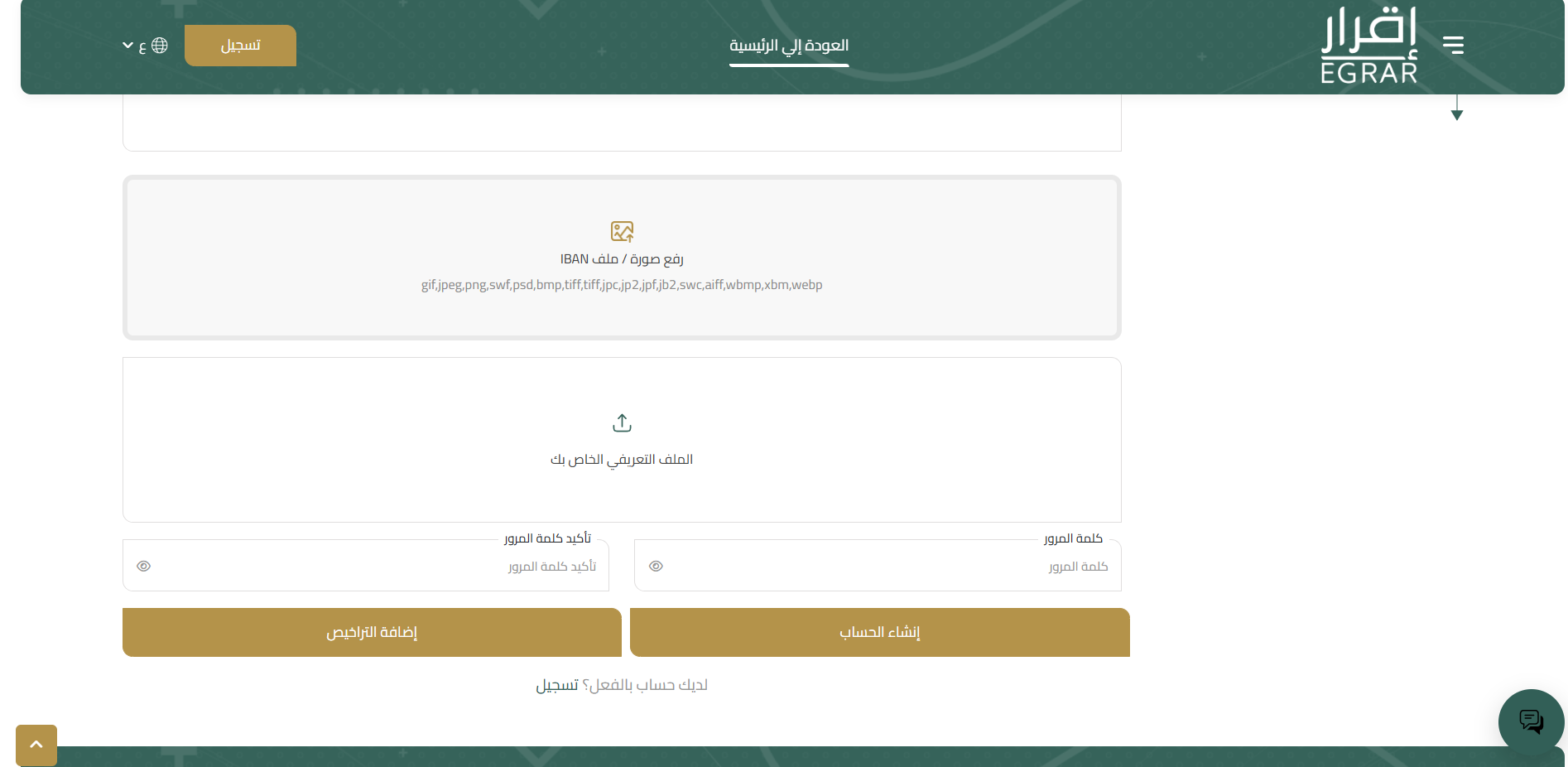

- After completing your complete information, upload a clear image of your account’s IBAN, then click Create Account.

- Thus, you have successfully completed registration on the platform, and after that, you can request admission to the Distinguished Accountants Program and begin studying by moving to the professional qualification program for the labor market.

- Register your email to create a new account, and you will be delivered a verification code on the phone you register, so enter it in the designated box.

- Thus, you can join the courses and subjects you want and begin studying them easily.

How is training done in the Distinguished Accountants Program?

The program follows a training mechanism dedicated to educating those wishing to join the labor market as accountants, tax consultants, etc. This mechanism revolves around four rules that you must adhere to in order to be able to obtain the certificate that qualifies you for the labor market, and these topics are:

Study courses

You can join the training from anywhere because it is an online accounting program that only requires a computer and an Internet connection. After registering, you will know the timing of the virtual classes, so you can attend them on their scheduled dates.

Regular attendance

The classes in which the courses are explained are obligatory for attendance at a rate of no less than 80%, but it is preferable to exceed them, and this is one of the conditions for training in the program.

Grade point average

When you pass any practical tests or assessments during your studies, you must achieve at least 70% to be considered eligible to continue in the program.

The percentage required to pass the program

At the end of one training course, you must pass the final exams with a grade of 70% or higher. You cannot obtain the certificate if you are unable to do so, and you will not be able to obtain it if you do not adhere to the prescribed attendance percentage.

The skills you acquire in the Distinguished Accountants Program

Of course, you want to join the program to develop your accounting skills for the purpose of professional or career development. Here, we identify for you a few skills that you will be able to acquire and master through the Distinguished Accountants Program. It takes you from the skill level of beginners and intermediates to the level of skilled accountants, and among the most important skills you will acquire during it are the following:

Accounting skills

It includes learning how to prepare books, include data in them, analyze them, and make them conform to generally accepted accounting principles. As you advance in levels, you learn the skill of completing tax treatments and the ability to create tax records and financial and tax accounting reports by the controls stipulated in Saudi Arabia.

communication skills

It is considered one of the most important skills because it helps communication between the accounting department and the organization’s management. It also contributes to determining the optimal time to establish relationships between the organization and other institutions and create partnerships that contribute to business success. These skills are essential because they are among the most important skills of a competent administrative accountant.

Self-learning skill

Acquiring this type of skill helps you develop your accounting abilities and apply what you learn theoretically. It also contributes to facilitating the creation of adequate CVs that are accepted in CV screening programs, along with keeping up with everything new in your field of work and obtaining accredited certificates that contribute to raising your career status.

Data analysis skills

When you acquire the skill of analyzing data, you are able to understand it, know its meanings, and make decisions based on it. In addition, you gain professionalism in managing accounting books of all kinds thanks to a better understanding of the data.

Practical application skills

In the Distinguished Accountants Program, you are able to apply everything you learn practically, whether when using the Excel spreadsheet program, preparing accounting records, calculating taxes, or otherwise. This application gives you the ability to overcome a major obstacle to learning accounting.

Career development

By following the advanced program courses, you will obtain accredited certificates for acquiring these skills. These are official certificates that can be relied upon to become qualified for the labor market or obtain a promotion in the institution in which you work.

Courses prescribed in the accountants’ program

There are two main courses in the Distinguished Accountants Program, and within these two courses, there are some subjects that the accountant must learn and pass to be able to pass the program and obtain the accredited certificate. The details of these courses are summarized as follows:

Basic course

It is suitable for all levels of accountants, from recent graduates to those seeking promotion and professional development. This course contains 50 materials distributed by experts into 4 bags, and its duration is 98 hours of study that you must attend on the Zoom meeting application. It includes the following:

- Practical application of calculating taxes, preparing tax records, and general details about the types of taxes imposed on different institutions.

- Learn the Excel program and how to use it for accounting work and recording and extracting data from its files.

- Develop self-learning skills and improve your ability for practical application and communication.

- The practical application of registering taxes, especially value-added tax, and knowing its percentage and controls.

- Preparing accounting records and financial statements and learning about their types, how to prepare them, and their importance to the organization.

- Learn about accounting basics in English.

- Learn cost accounting for commercial, service, and other institutions.

- Using accounting systems and auxiliary programs in accounting work while applying all the examples learned in practice.

Advanced course

This course is advanced from the previous one and includes 57 courses with a total of 98 hours of study, distributed over 46 virtual sessions. You can learn it regardless of your level of accounting work, and at the end of it, you will obtain an accredited certificate, which you can use to work in the job you dream of, and in which you will learn the following:

- Advanced levels of reading financial records, analyzing their data, and preparing more complex financial records.

- Dealing with value-added tax for institutions, as well as applying methods for calculating it and calculating zakat and other tax payments.

- Learn the complex accounting equations used in Excel.

- This is in addition to the more in-depth levels of subjects studied in the previous course, such as cost accounting, the use of accounting systems, and others.

Conditions for admission to the Distinguished Accountants Program

You do not have to fulfill many requirements to join the Distinguished Accountants Program, as you are only required to be a Saudi with a bachelor’s degree in one of the disciplines related to administrative sciences, whether it is the accounting, business administration, or finance department. You can apply to the program if you have a diploma in accounting.

The cost of the distinguished accountant program

No fees are charged for studying in the program, but you must pay 150 Saudi riyals to be able to take the exams and obtain the certificate at the end of the program, and there are no other fees charged for the training.

What do you learn in the Distinguished Accountants Program?

Although the program offers two courses, one basic and the other advanced, the courses for each course exceed 45 and cover all areas of accounting that you need in the labor market. Among the most important things you learn through the Distinguished Accountants Program are the following:

- Application and calculation of zakat and all types of taxes.

- Creating accounting models, especially financial statements, and accounting books in general.

- Skills in dealing with Excel spreadsheets and equations, and ways to apply them in a professional accounting manner.

- Everything related to the preparation of books, financial statements, and accounting reports.

- The basics of financial accounting and cost accounting.

- Constructive communication skills with institutional departments.

How does the Qoyod accounting system integrate with the Distinguished Accountants Program?

Integration does not appear in the form of a link between the two systems, but in the accounting program, you will learn everything related to the use of accounting systems, most notably the Qoyod system, which is considered the best in the Kingdom despite its recent appearance on the scene. With your subscription to the Qoyod accounting system, you will be able to apply everything you have learned in the Distinguished Accountants Program smoothly, in addition to using the explanatory content of the system, which helps you take full advantage of it and understand any steps you need to implement in it. Therefore, after obtaining the training program certificate, you must immediately take the initiative to subscribe to the Qoyod accounting system and begin applying it to consolidate what you have learned and transform it into experience and professionalism in accounting transactions.

Conclusion

You can rely on the Distinguished Accountants Program to learn about many accounting matters, not just preparing financial statements, records, and accounting books. The accounting work you learn benefits you personally in developing your knowledge and skills and contributes to your promotion and career progression, in addition to contributing to preventing fraud and preserving rights in institutions in general. So do not hesitate to subscribe to the Qoyod accounting system after the free trial and enjoy many accounting transactions that help you qualify for the labor market as quickly as possible.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!