Indeed, the term “joint stock company” may be confusing for individuals lacking sufficient experience in corporate accounting. However, with the guidance of accounting system experts, you will gain a clear understanding of joint stock companies, their various types, and the factors that contribute to their strength and influence in the global economy. They will also elucidate the distinction between joint stock companies and limited liability companies.

What is a joint-stock company?

A joint-stock company is one of the largest financial companies in the Saudi system. It is a for-profit institution that operates in the commercial field. The institution converts its capital into shares of equal value and trades them in the market. Anyone who purchases shares in it becomes an owner for the value of those shares and also receives the dividends from these shares. This type of institution enjoys strength because of the huge capital on which it is based. It is also simple for its shareholders to trade their shares and sell them to others, even if they are legal persons. Despite this, they do not bear any responsibility for its debts, except within the limits of their shares.

Characteristics of a joint stock company

This type of company, powerful enough to control the economies of countries and contribute to maintaining the organization of trade, has many characteristics that distinguish it from other institutions. These characteristics include the following:

A company with an independent entity

This company is not founded on personal considerations, as it is an independent entity and a legal person with the right to file lawsuits in its name, conclude contracts and agreements in person, and have its own separate capital over the shareholders’ funds and properties.

Shareholders’ liability is limited.

No shareholder is responsible for the company’s debts and financial obligations beyond his share. This feature provides financial security to shareholders, as well as independence for the company.

Ease of stock trading

Any shareholder can sell his shares and stake in the company at any time and without restrictions, but once any person owns even one share in the company, he becomes the owner of the value of this share.

The company’s name stems from its goals.

In order to inform its creditors that the partners in this company have limited liability, the joint-stock company must add the type of activity it operates after its name.

The capital is huge.

Joint stock companies are among the largest financial companies due to their large capital, which is very beneficial for the company as it provides a sense of security to those dealing with them through guarantees based on their capital.

The joint-stock company is a partnership of one kind.

In the Saudi system, the minimum number of shareholders is 5, they do not need to be traders, there are no restrictions on adding new shareholders or selling their shares, and a shareholder’s bankruptcy, death, or withdrawal does not necessarily indicate the company’s bankruptcy or impact it.

The system in the company is tyrannical.

This means that the company has a certain system that is not subject to shareholder decisions, especially regarding subscriptions and stock conditions. Rather, they work according to its articles of association, and they can only determine the activity in which the company operates, its type, and nothing more than that.

Joint stock company terminology

When joining the owners of a joint stock company, you must familiarize yourself with a few key accounting terms, such as:

- Capital: It is the financial value that shareholders paid in exchange for purchasing shares in the company, or, in other words, the total amount of money that shareholders paid to the company.

- Ownership rights: These are the rights guaranteed to every shareholder in the company and the benefits he can benefit from related to his contribution to the company.

- Liabilities: A description that identifies all of the company’s obligations and responsibilities.

- Share: These are small units into which the capital is divided, and each unit is offered for sale in the trading market.

- Assets: A term that describes all the resources and capabilities a company possesses.

- Revenues: The total profits and funds that the company receives in exchange for carrying out its activities and marketing its products.

- Costs: These are the expenses incurred by the company in order to be able to carry out the activities in which it operates properly.

- Net profits: It is the net income that the company receives in exchange for providing a service or good to the customer.

- Net losses: what the company lost in expenses and was unable to compensate for after achieving sales.

How to establish a joint stock company

Some people believe that it is difficult to establish a joint-stock company due to the lengthy incorporation procedures, but with the help of experts, its establishment becomes easier and more clear. What a joint-stock company needs to establish can be summarized as follows:

- Developing a comprehensive plan for the company that includes the founders, activity, headquarters, feasibility study, and learning about the regulatory laws for joint-stock companies in Saudi Arabia.

- The contract is written by the founders of the company, and everyone who signs the contract is considered a founder, just as everyone who provides something to establish the company, whether in cash or in kind, is considered a founder. It is necessary for the contract to include the company’s data, such as the name, location, and purpose, with its financial data written as well.

- Opening an account in the name of the company in a government bank and depositing capital in it.

- Submit the application to the Ministry of Commerce, attaching the names of at least five shareholders and specifying the name and type of the company in the application to obtain its licenses.

- While waiting for the application to be accepted by the Ministry of Commerce, the company’s shares must be offered for subscription according to their type. If they are for public subscription, they are offered in one of the banks licensed in Saudi Arabia, and if they are private, they are offered to shareholders who are allowed to subscribe.

- Obtaining the approval of the Ministry grants the company its personality and independence, and at the same time, its capital will have been formed from the process of offering its own shares.

- Appointing the company’s board of directors from the people mentioned in the contract, and others can be added in some positions if they have not been added in the contract.

- Publicizing the company through an official announcement that includes the subscription acknowledgment, the minutes of the meeting of the founding assembly, and the company’s bylaws.

- Register the company in the commercial registry, mentioning its details, the number of its shares, and its license number.

Conditions for establishing joint-stock companies

In Saudi Arabia, partners cannot meet to establish a joint stock company unless the following requirements are satisfied:

- The capital is not less than half a million Saudi riyals.

- Choose a name that declares the purpose of the company.

- The company’s contract must be consistent with the provisions of the Saudi Companies Law.

- When the company is established, 25% of the total capital is provided in cash.

- Determine the company’s place of residence and ensure that it conforms to the conditions stipulated in the company’s system.

- Payment of the establishment fees for the joint stock company established in accordance with legislation.

Types of joint-stock companies

When you delve deeper into knowledge about joint stock companies, you will discover that they have three basic types, which are as follows:

Public joint stock company

It is the one whose shares are available for public subscription, whose shareholder count is open, and whose freedom to transfer ownership is unrestricted.

Private joint stock company

The company faces several limitations due to its limited shareholder base, ownership transfer restrictions, limited management capabilities, and the complexity of merging.

Simplified joint stock company

A type of new joint stock company that was developed from the Saudi corporate system, granting flexibility in capital and the conditions imposed on the transfer of ownership of shares.

What is the difference between a public joint-stock company and a private joint-stock company?

We mentioned that the joint-stock company has two types that are more widespread than the third type due to age, but what is the difference between these two types? This is what we explain to you in the table below.

| Comparison | Public joint stock company | Private joint stock company |

| Underwriting | Available to all investors, even if they are legal persons. | Limited to founders or specific investors and not generally available. |

| Number of partners or shareholders | Often a large number. | The number is not large, and partners may have personal relationships. |

| Issuing stocks and bonds | It can be released to the public. | Its rights to issue bonds and shares are restricted. |

| General Assemblies | The role of general assemblies is encouraged, and the ability of shareholders to make decisions regarding the company’s activities is improved. | General assemblies have no role in decision-making. |

| capital | huge. | Relatively low. |

| Formation of the Board of Directors | It is done flexibly, subject to the needs of the company. | It consists of shareholder representatives and is not very flexible. |

| Trading on the stock exchange | Its shares can be offered on the stock exchange, which makes it attractive for investment. | They are often not listed on the stock exchange. |

| Resources | It can be obtained from the public and does not depend solely on capital. | It relies solely on its identified shareholders for funding and increased resources. |

Is there a difference between joint-stock companies and limited liability companies?

There are a few differences that distinguish a joint-stock company from a limited liability company, and these differences include the following:

| Comparison | Joint stock company | Limited Liability Company |

| Number of partners | There is no maximum limit, and no less than 5. | Limited can be established by one shareholder and cannot exceed 50 shareholders. |

| capital | It cannot be established with less than 500 thousand Saudi riyals as a minimum capital. | It can be established without a minimum of capital. |

| IPO | One of the basics of its establishment. | It may not conduct an IPO. |

| Owner and manager | They must be separated. | They are not separated. |

Advantages of a joint stock company

From what was mentioned above, we conclude that there are a number of advantages that the joint-stock company enjoys over other institutions and companies, including:

- It can raise huge capital that helps it achieve its goals and contributes to the abundance of its resources.

- It is attractive for investment thanks to the limited debt liability of shareholders.

- It is easy to sell shares and transfer ownership, and this enhances investment in the company.

- Provides an atmosphere conducive to increasing productivity and improving efficiency.

- A board is appointed to manage it, and it is not necessary for all shareholders to participate in this.

Disadvantages of joint stock companies

Some negatives have emerged in the joint stock company, and they are represented in several points that may affect its ability to make decisions, including:

The cost of establishing it is high and requires many procedures and documents.

- Decisions are made slowly, which may cause lost opportunities, and requiring the approval of the majority may make some correct decisions and fail to convince them, making them choose the wrong decisions.

- Limited liability towards the company makes managers and decision-makers completely indifferent to the consequences of their decisions and their impact on the company in the long term.

- If a conflict of interest occurs, there will be many problems in managing the company.

- When many shareholders join, it will be impossible to control the company and conduct its business as required.

- Managing a company is complex because of the costs and legislation imposed on it.

When are joint-stock companies liquidated?

Some circumstances require the joint stock company to terminate and dissolve. Then it will continue to retain its legal personality until the process is completely completed, and the company will be liquidated in the following circumstances:

- Accumulation of debts and inability to repay them.

- The company’s board of directors and shareholders agree to dissolve it.

- Issuing a judicial order against the company to do so.

When one of these circumstances occurs, liquidation is decided in one of two ways:

- Forced liquidation: Here the request for dissolution does not come from within the company but rather from creditors, the prosecution, or others, and the liquidator is not affiliated with the company’s management.

- Voluntary liquidation occurs when the desire to liquidate comes by agreement and consensus, and this method is often followed, and a liquidator affiliated with the administration is appointed to end the matter.

How is a joint-stock company liquidated?

The company is liquidated in the following steps:

- Appointing a liquidator is responsible for the entire process and also for selling assets and distributing their price to shareholders to return their rights.

- The liquidator begins working to follow up on the sale of assets and first begins by paying off the company’s debts that have defaulted and paying its financial obligations, then grants the shareholders their rights.

- The company’s accounts are closed, and official reports are written and delivered to its extraordinary general assembly.

The legal impact of liquidating a joint-stock company

When a joint stock company is liquidated, this produces the following legal effects:

- The company no longer exists as a legal entity, and there is no longer a legal entity bearing the name and capacity that the company had.

- All agreements concluded in the company’s name become void, with rights returned to their owners.

- Any assets in the company are used to pay off creditors, and the rest is then distributed according to shareholders’ equity.

How to add a new joint stock company in Qoyod

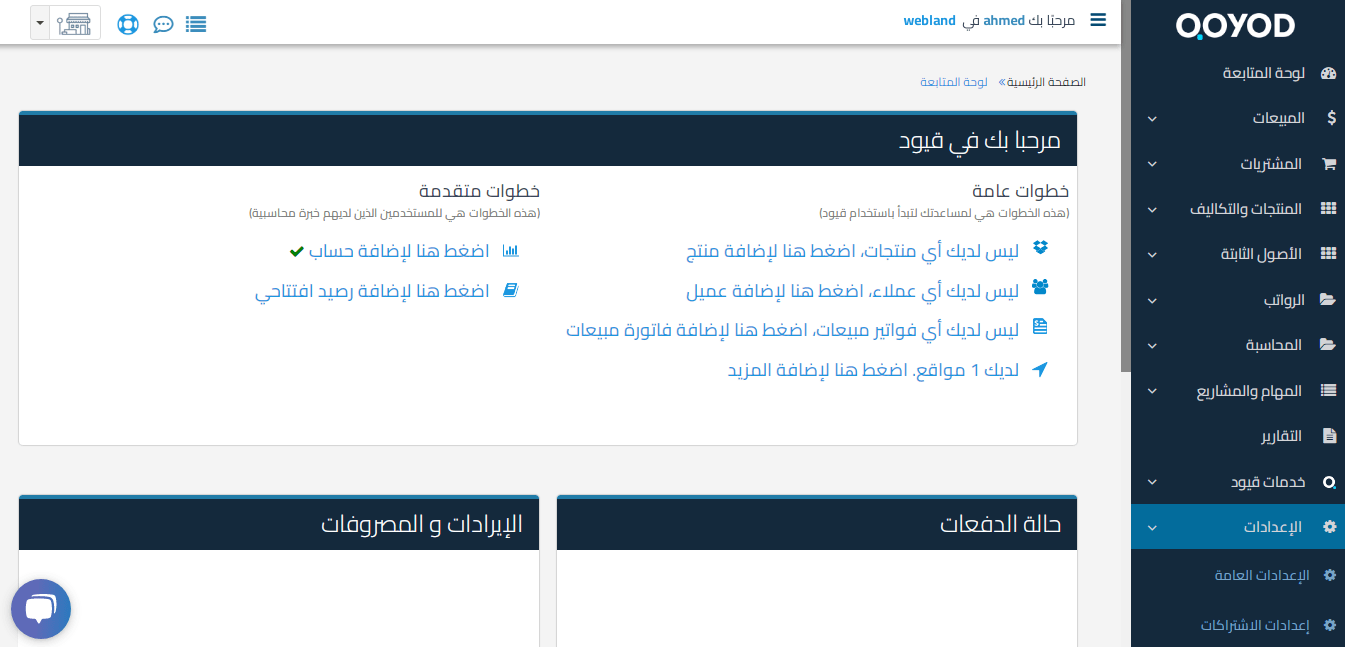

You can add your company to the Qoyod accounting system to take advantage of its advantages in keeping invoices, calculating all types of taxes, etc. To register your facility, follow the following steps:

- Go to the Qoyod program page from here.

- Log in and select Settings from the side menu.

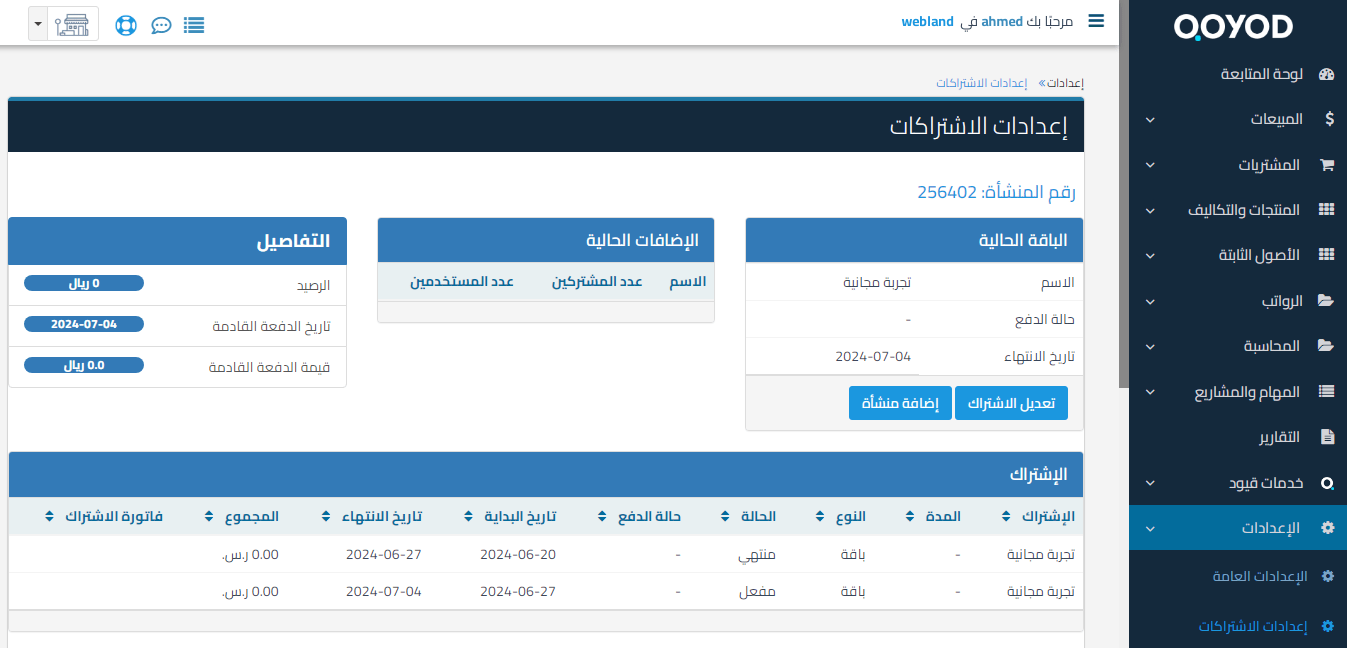

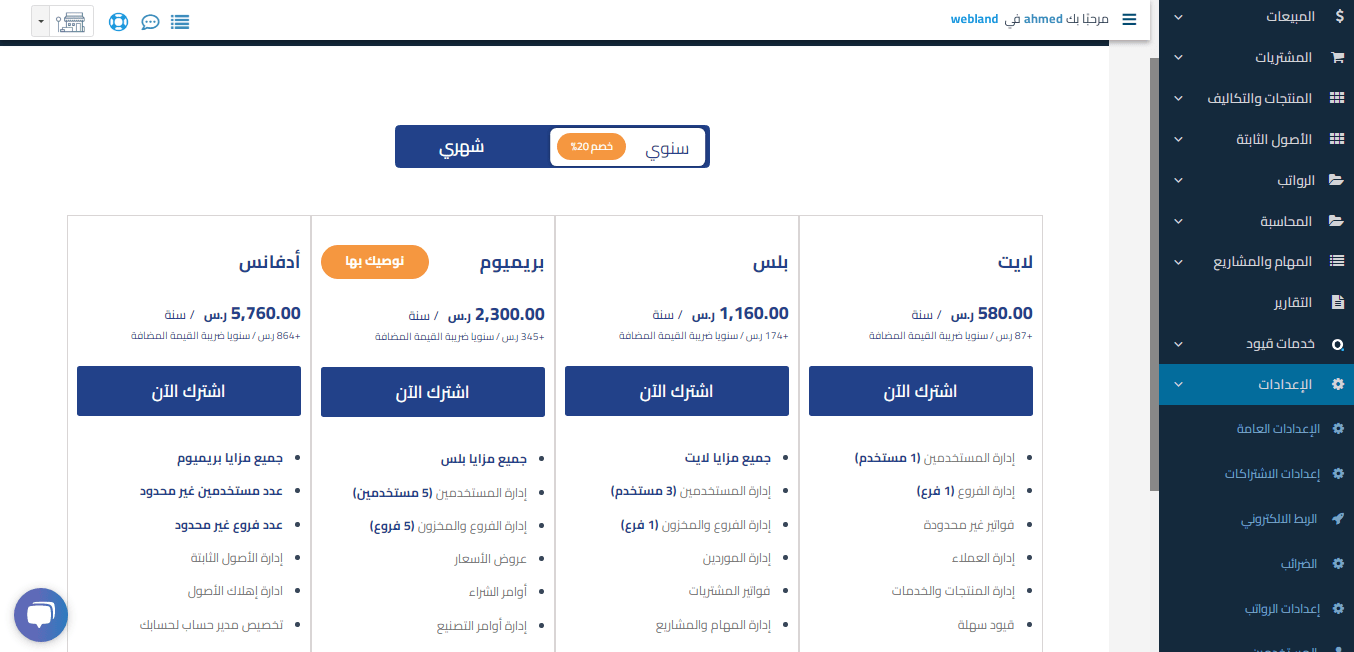

- Choose the subscription settings.

- Click on Add Facility from the interface that will appear to you.

- You will find the package details in front of you. Select the package that suits you and click “Subscribe Now.”

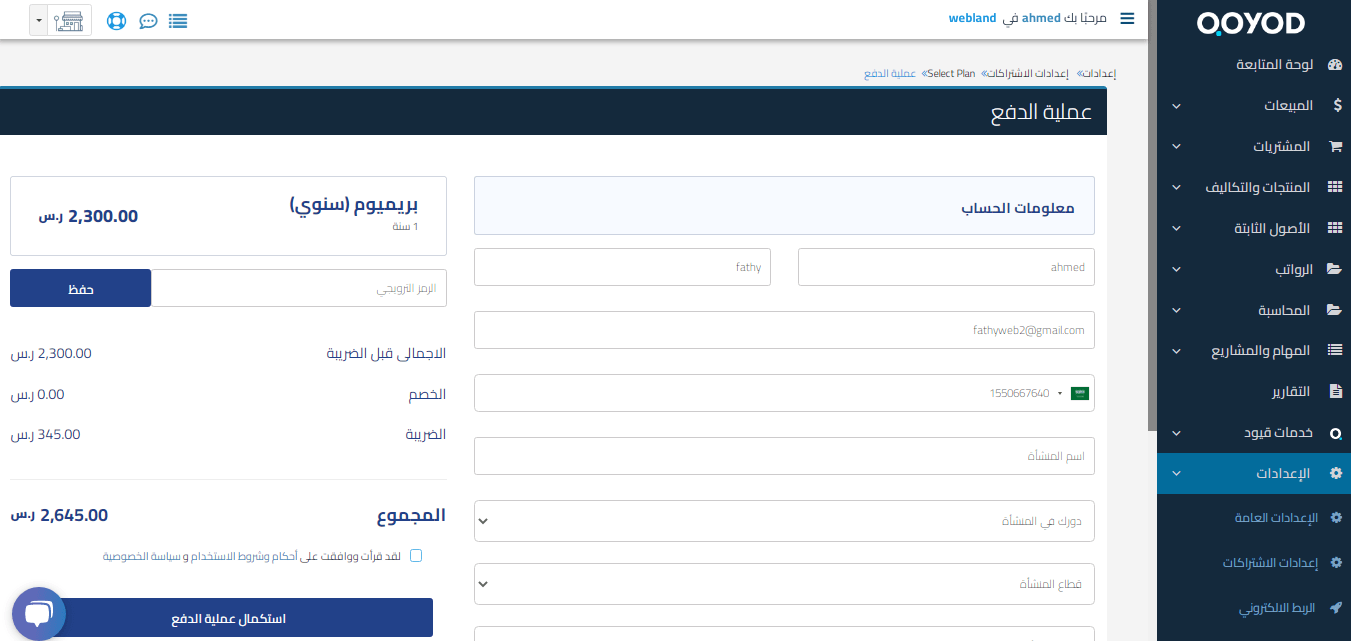

- After selecting, scroll down and specify the number of your company’s employees and the number of beneficiaries, and click Continue to display a page whose fields you need to fill with your company’s data.

- Select the payment method, and after completing the data entry, click Complete the payment process.

- The payment information will be confirmed, and after verification, click “Continue.”.

- Complete the procedures to confirm your subscription, and you will receive messages from the program to give you ways to contact support in addition to your subscription invoices.

Conclusion

The joint-stock company gives investors greater flexibility than other companies, which makes it an influential factor in the economies of different countries. It has many advantages, provides a comfortable atmosphere for work, and increases efficiency, but it requires experience to avoid its defects and negatives. So try the Qoyod accounting system for free to register the company’s contracts and invoices and calculate its taxes, so you can manage them as fully as possible, which helps you achieve profits and avoid losses.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!