In the world of accounting, the ledger is one of the basic tools that form an important pillar in organizing and documenting accounting operations. It is like a book that contains in its hidden pages the keys to understanding and analyzing the numbers and financial data that tell the story of the work and financial performance of any organization or company. By browsing its pages, accountants and financial managers can understand income and expense flows, track assets and liabilities, and also analyze financial results comprehensively. It is also like an accurate map that guides the company towards financial success and sustainability, as it records and documents every financial movement accurately and transparently. What distinguishes it is its ability to organize financial information in a hierarchical and logical manner, as data is collected in specific accounts according to the type of financial transaction.

What is a ledger?

If you are wondering, what is the definition of a ledger? It is a main accounting tool used by the accountant to record and compile financial information related to various accounts during the fiscal year, and it is considered an essential part of the facility’s accounting system as it helps in tracking the movement of funds and analyzing financial activity, expenses, and revenues.

In the daily work of an accountant, every financial transaction is recorded in the book using daily entries. These entries include information such as the date, debit account, and credit account, in addition to the amount of money referred to. Through these entries, the accountant can track financial transfers and know the current balance for each account at any given time.

What are the types of ledgers?

Accounting ledgers are important tools in the process of recording and tracking the financial and accounting operations of companies and institutions, and they are one of the basic elements in the financial accounting system, as they help in recording and organizing financial information and provide a comprehensive overview of the facility’s financial activities.

The types of ledgers in accounting vary according to the different accounting purposes and needs of companies, which can be summarized as follows:

General ledger

It is an important accounting tool used to summarize and document all financial transactions at the facility. It collects and compiles the details of these transactions from daily and auxiliary books and then includes them in the main accounts.

This book is opened at the beginning of the fiscal year and closed at the end after preparing the financial statements and final accounts. It is worth noting that it contains many accounts, such as assets and liabilities accounts, property rights, and also all income and expenses.

Auxiliary records

It is an essential part of the general ledger, as it records and documents all the accounts in the general ledger in the most detailed detail. It is an important tool for managing accounts and tracking financial information and transactions related to each account.

What is the difference between a general ledger and auxiliary records?

Auxiliary records and the general ledger are two essential parts of the accounting cycle, dealing with recording financial transactions. However, there are major differences between them in purpose and organization, which are as follows:

| The differences | Auxiliary records | General ledger |

| the goal | It aims to track and aggregate the details of sub-transactions recorded in the journal. | The main purpose of this type of ledger is to summarize the transactions transferred from the auxiliary records and summarize them in the main accounts. |

| Accounting balance | The accounting values in the Auxiliary Records account must balance the values reflected or transferred to the general ledger. | The accounts and their ending balances in the general ledger must balance the financial statements in the trial balance. |

| Organizing transactions | It consists of a group of transactions that are included under one account or group of accounts, and each transaction contains detailed information. | It contains several main accounts. The transactions within these accounts are organized separately and concisely, and each transaction contains brief information. |

| Similar groups and financial transactions account | The transactions in their groups are similar in terms of common characteristics. | It is used to balance the final total for each account after collecting the transactions related to it. |

What is the general ledger format?

This notebook is designed in an organized and coordinated manner to facilitate the analysis and tracking of the various accounts and the changes occurring in them. Each section is allocated to a specific account, such as cash, sales, purchases, wages, etc. It is worth noting that it consists of several main elements that include:

- Account Title: It appears at the top of each account section or page and indicates the name of the account to which recorded transactions relate.

- Account number: It is used to assign a unique number to each account in the general ledger. This facilitates the process of identifying and tracking the account easily.

- Entry date: The date of each transaction is recorded in the general ledger, and thus this helps in determining the sequence of transactions and their chronological order.

- Description of the entry: It explains the nature of the transaction or the details related to it, such as a description of the process or the accounting transaction that took place.

- Reference: refers to the journal entry number or any other document associated with the transaction, which helps in tracking documents associated with the accounts.

- Debit and credit amounts: The amounts added or deducted from the account are recorded, so the debit amounts are in one column and the credit amounts are in another column.

- Balance: The new balance is calculated after each entry and is classified as a debit or credit balance based on the amount recorded in the account.

When is the ledger prepared?

The ledger is at a late stage in the accounting process, after the completion of recording and tracking financial transactions in the journal. It aims to summarize and compile the financial information recorded in the journal and organize it appropriately.

One of the main steps in preparing this journal is extracting the final balances of the main accounts associated with the sub-transactions that were recorded in the journal. This is done by collecting the amounts recorded in certain accounts—income accounts, expenses, capital accounts, etc. And also calculating the final balances for each account.

How is the ledger set up?

Preparing the ledger is an important procedure in the accounting process to document and organize the financial transactions of the company or institution. This procedure is carried out after recording the accounting transactions in the journal and aims to provide a comprehensive overview of the company’s accounts and prepare them for posting to the trial balance. Below are the main steps for preparing the general ledger:

Open a page for each account.

A separate page opens for each account in the ledger, and each account includes information, such as:

- account name.

- Date of its creation.

- Daily transaction details.

- Timing of the occurrence.

- The total ending balance of the account.

Coordination of accounts

Accounts in the general ledger use a T-like format, showing debit transactions on the right side of the page and credit transactions on the left side, then arranging the transactions according to their dates for easy review and analysis.

Double entry

Transactions are recorded in the general ledger using double entry. On the debit side, the debit amount of the transaction is recorded, and the statement column identifies the credit side of the transaction. Likewise, the credit amount is recorded on the credit side, and the debit party is identified in the statement column.

Update balances

The account balances in the general ledger are updated periodically to ensure their balance. It is worth noting that this procedure is known as “account reconciliation,” as the balances are updated based on the debit amounts and credit amounts recorded in the accounts. If there is an imbalance in the balances, the necessary adjustments are made to correct accounting errors.

Closing accounts

After updating the balances and ensuring their balance, the accounts are closed in the general ledger. This is done by collecting the final amounts for each account and recording them as a final balance, and these amounts are posted to the trial balance.

Ledger examples

If the daily entry is as follows:

These entries are required to be posted in the ledger.

| Date | statement | Credit | debt |

| 2022\3\1 | from the bank | 1000000 | |

| To/capital | 1000000 | ||

| 2022\3\4 | from furniture and fixtures | 400000 | |

| To/bank | 400000 |

The solution

| Bank | |||||

| credit | debt | ||||

| date | statement | amount | date | statement | amount |

| 2022/4/3 | from furniture and fixtures | 400000 | 2022/4/1 | To/bank | 1000000 |

| 4/30 | Balance | 600000 | |||

| 1000000 | 1000000 | ||||

| 5/1 | Balance at the beginning of the period | 600000 | |||

Another example

If the sales account balance is 4,000 Saudi riyals and the transaction of selling a product to a customer is posted for 400 riyals, then the final balance becomes 4,400 Saudi riyals.

Ledger template

If you are looking for a ledger template, just click here.

How does Qoyod accounting software help in making a ledger?

Qoyod Accounting Program provides many features and benefits that help you manage the ledger effectively and smoothly, as it works on:

Relying on the entered data

The Qoyod program allows you to use data entered manually or automatically. You can enter entries manually based on your accounting transactions, and the program also generates automatic entries based on the transactions recorded in your system panel.

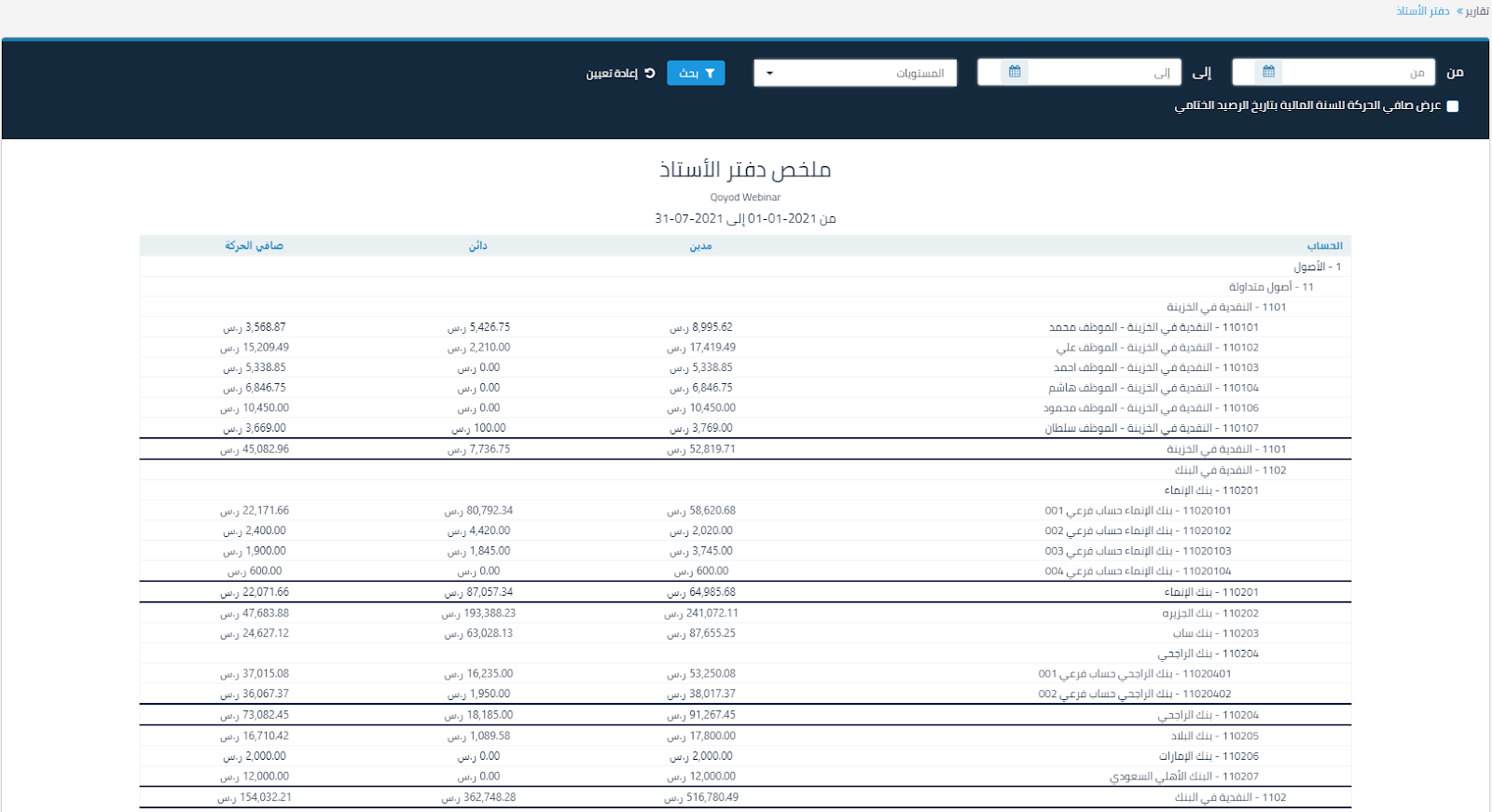

Real-time ledger report

The real-time ledger report is one of the most prominent features provided by the Qoyod program. You can extract a report that contains the total assets, liabilities, and all other accounting items arranged based on the debit and credit accounts. Thus, this allows you to obtain a comprehensive and immediate picture of the financial condition of the company or institution.

Control the display of accounts.

You can adjust the search settings in Qoyod accounting software to specify which accounts you would like to see in the ledger. This provides you with great flexibility when browsing specific accounts and focusing on relevant information.

Go to detailed entries.

The program makes it easy for you to navigate to the details of specific entries. You can simply click on the desired entry to view its details. Thus, this provides you with ease in examining and analyzing entries and understanding their impact on accounting accounts.

Custom report formats

The program allows you to download the ledger report in the format that you specify and prefer. You can choose the format that suits your needs, whether it is PDF, Excel, or any other format that the company or institution prefers.

Conclusion

The beauty and importance of the ledger in the world of accounting are evident to us, as it is the basic tool that helps us document and organize financial and accounting operations in companies and institutions. Through our review of all the different types of ledgers, we realized the diversity of their uses and their ability to meet the needs of different companies. It is worth noting that it is a tool that contributes to improving accounting transparency and accuracy and enhances the ability to make sound financial decisions, but its role does not stop there, as it also represents an important reference for financial auditing and review, thanks to which accountants and auditors can discover errors and identify discrepancies in financial records.

So, every accountant and CFO should pay close attention to ledgers and choose the right type that suits the company’s needs. They are not just simple recording tools but rather strategic tools that contribute to the success and sustainability of financial businesses.

Let us appreciate the tremendous power of ledgers in analyzing and documenting financial matters, consider it one of the most important basics of modern accounting, and do not forget to use an effective accounting program in this regard, such as Qoyod. It is worth noting that the program also provides all its clients with electronic invoice systems, as well as a point-of-sale system, stores, customers, etc., which makes it the best accounting program that enhances efficiency in financial business management.

Dear reader, after knowing what a ledger is and its types, we advise you to try Qoyod now for free for 14 days to maximize the benefit of managing your financial business.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!