| (Excerpt) :

Discover the easiest and most automated way to handle VAT Calculation, Income Tax, and Zakat using the best accounting software in Saudi Arabia to ensure full compliance with the Zakat and Tax Authority. |

Tax Calculation is undoubtedly one of the most significant challenges facing the business sector in the Kingdom of Saudi Arabia, especially for small and medium-sized enterprises (SMEs). Amidst changing accounting systems and the strict requirements of the Zakat, Tax, and Customs Authority (ZATCA), tax compliance can feel complex and time-consuming. This is true whether you manage a small shop in Jeddah, a startup in Riyadh, or a factory in the Eastern Province (Dammam and Khobar).

The good news is that complexity is not inevitable! In this comprehensive article, we will unveil the easiest way to simplify the process of Tax Calculation for all types (VAT, Income, Withholding Tax). We provide practical examples and local context from the Saudi market. We will help you transform this challenge into a seamless, automated operation that guarantees full compliance with ZATCA’s e-invoicing system and helps your business thrive.

Why Accurate Tax Calculation is Crucial for Saudi Businesses?

Accuracy in Tax Calculation is a fundamental pillar for the success and continuity of any commercial or industrial establishment operating in the Kingdom. It is not just about legal compliance; it reflects a company’s professionalism and its ability to manage cash flow effectively. For the thousands of SMEs that form the backbone of the Saudi economy, neglecting this aspect can lead to severe consequences.

Corporate Obligations Towards the Zakat and Tax Authority (ZATCA)

Upon commencing commercial activity, the establishment becomes directly responsible to ZATCA. These obligations include VAT registration if revenues exceed the threshold, timely submission of tax declarations (monthly or quarterly), and accurate payment of dues. Adhering to these deadlines and accurately applying regulations, such as the mandatory e-invoicing system in Saudi Arabia (Fatoorah), puts the company in a safe legal position and prevents a spiral of audits and corrections.

Legal Consequences of Errors in Tax Calculation

An error in Tax Calculation is not merely a simple accounting mistake; it is a legal violation that may result in substantial financial penalties and, in extreme cases, the closure of the establishment. Penalties can include fines for late payment, failure to submit declarations on time, and providing incorrect or incomplete information. These fines directly impact the liquidity of companies in Riyadh, Jeddah, and Dammam, threatening their financial stability.

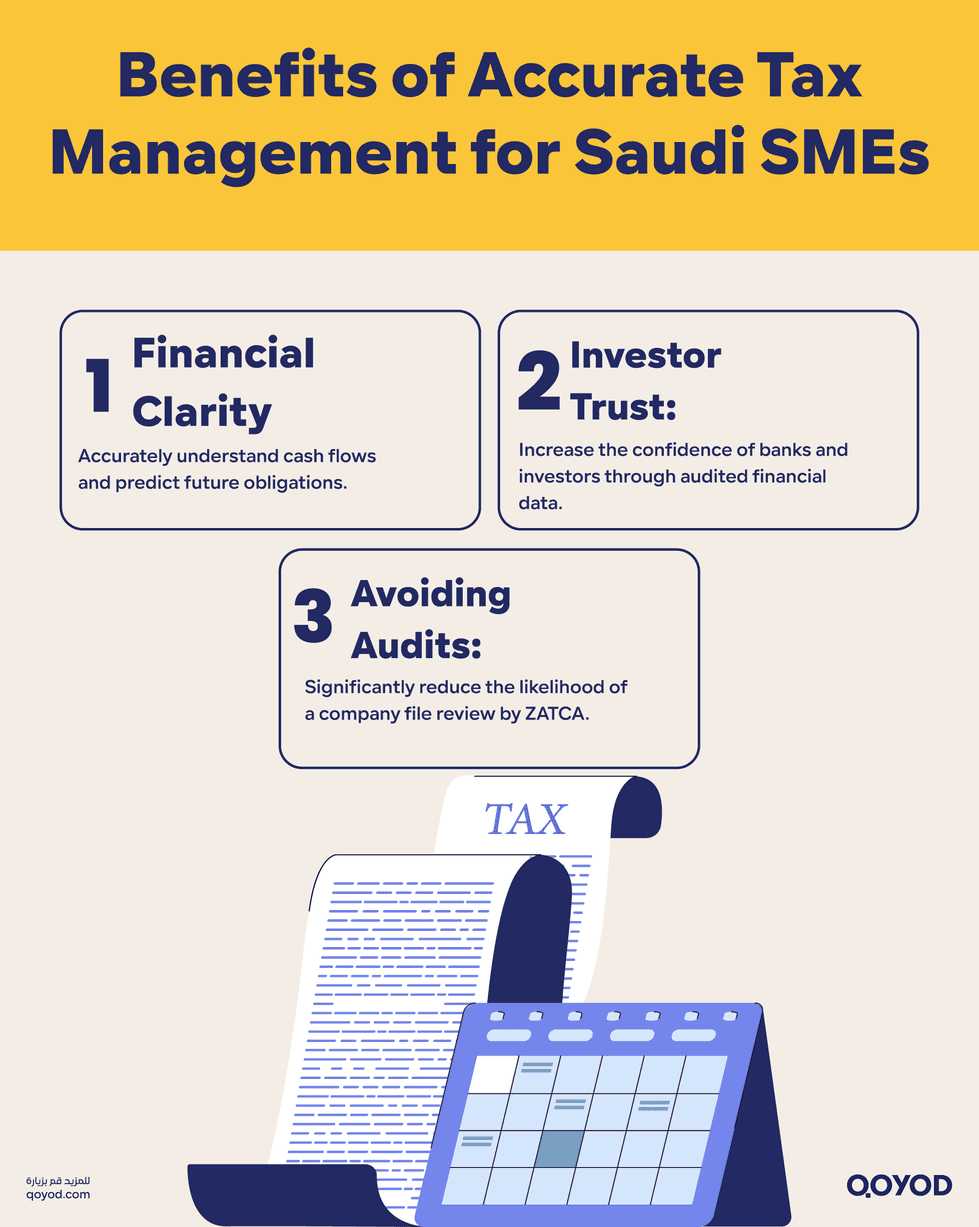

Benefits of Accurate Tax Management for Saudi SMEs

Managing taxes accurately is an investment, not a cost. When Tax Calculation is performed correctly using the best accounting software in Saudi Arabia, the company enjoys the following advantages:

- Financial Clarity: Accurately understanding cash flows and predicting future obligations.

- Investor Trust: Audited financial data that conforms to local regulations increases the confidence of banks and investors.

- Avoiding Audits: Reducing the likelihood of a company file review by ZATCA, thereby saving time and effort.

What is Tax Accounting? A Simple Explanation with Practical Saudi Examples

Types of Taxes in Saudi Arabia and How to Calculate Them

To understand the easiest way for Tax Calculation, one must first identify the main types relevant to commercial activities in the Kingdom: Value Added Tax (VAT) and Income Tax.

1- Value Added Tax (VAT)

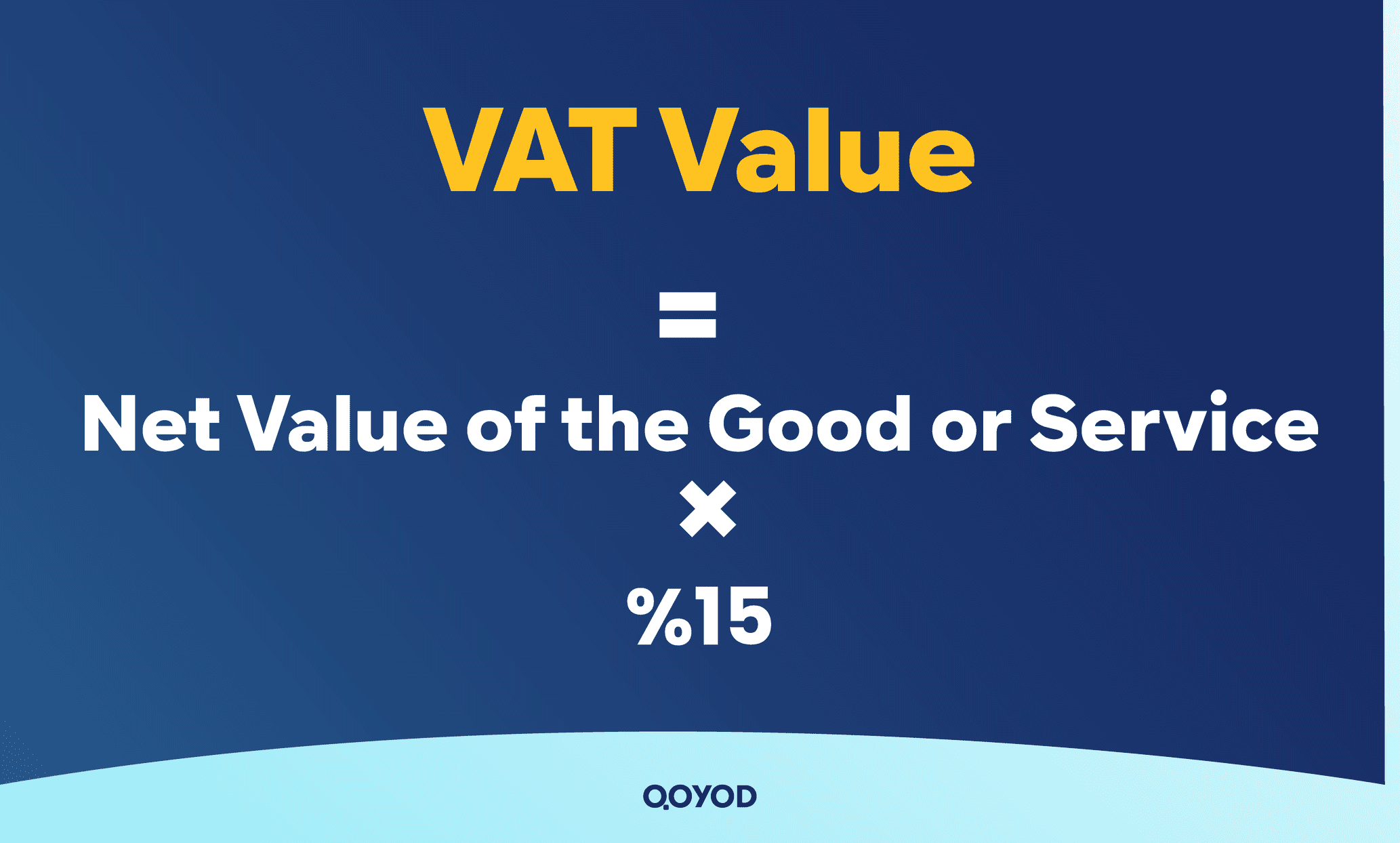

VAT is an indirect tax levied on most goods and services bought and sold. The current rate applied in the Kingdom is 15%. Tax Calculation is theoretically simple and performed as follows:

- The Basic Formula:

VAT Value = Net Value of the Good or Service × 15% - Local Example for a Small Shop in Jeddah:

If an electronics store in Al-Hamra district, Jeddah, sells a device at a net value of 1,000 Saudi Riyals (SAR), the Tax Calculation is:

VAT = 1,000 × 15% = 150 SAR

The total invoice amount will be 1,150 SAR. When submitting the tax declaration, the shop subtracts the ‘Input Tax’ (paid when purchasing the device) from the ‘Output Tax’ (collected from the sale) to determine the net amount payable to ZATCA.

2- Corporate Income Tax

Income tax in Saudi Arabia applies to the shares owned by foreigners in resident companies and non-resident establishments operating in the Kingdom. Fully Saudi-owned companies are subject to Zakat regulations, except for certain foreign investments. Tax Calculation here requires precision in identifying permissible expenses and amounts subject to tax under local regulations. The income tax rate is 20% on annual net profits.

Read More: [Types of taxes in Saudi Arabia]

3- Withholding Tax (WHT) and Other Fees

WHT applies to payments made by resident companies (such as contracting firms in Khobar or service providers in Riyadh) to non-resident entities (international) for specific services. The payer (the Saudi company) is obliged to deduct a certain percentage from the paid amount (ranging from 5% to 20% depending on the service type) and remit it directly to ZATCA. This type of Tax Calculation is complex and requires a precise understanding of international agreements to avoid errors.

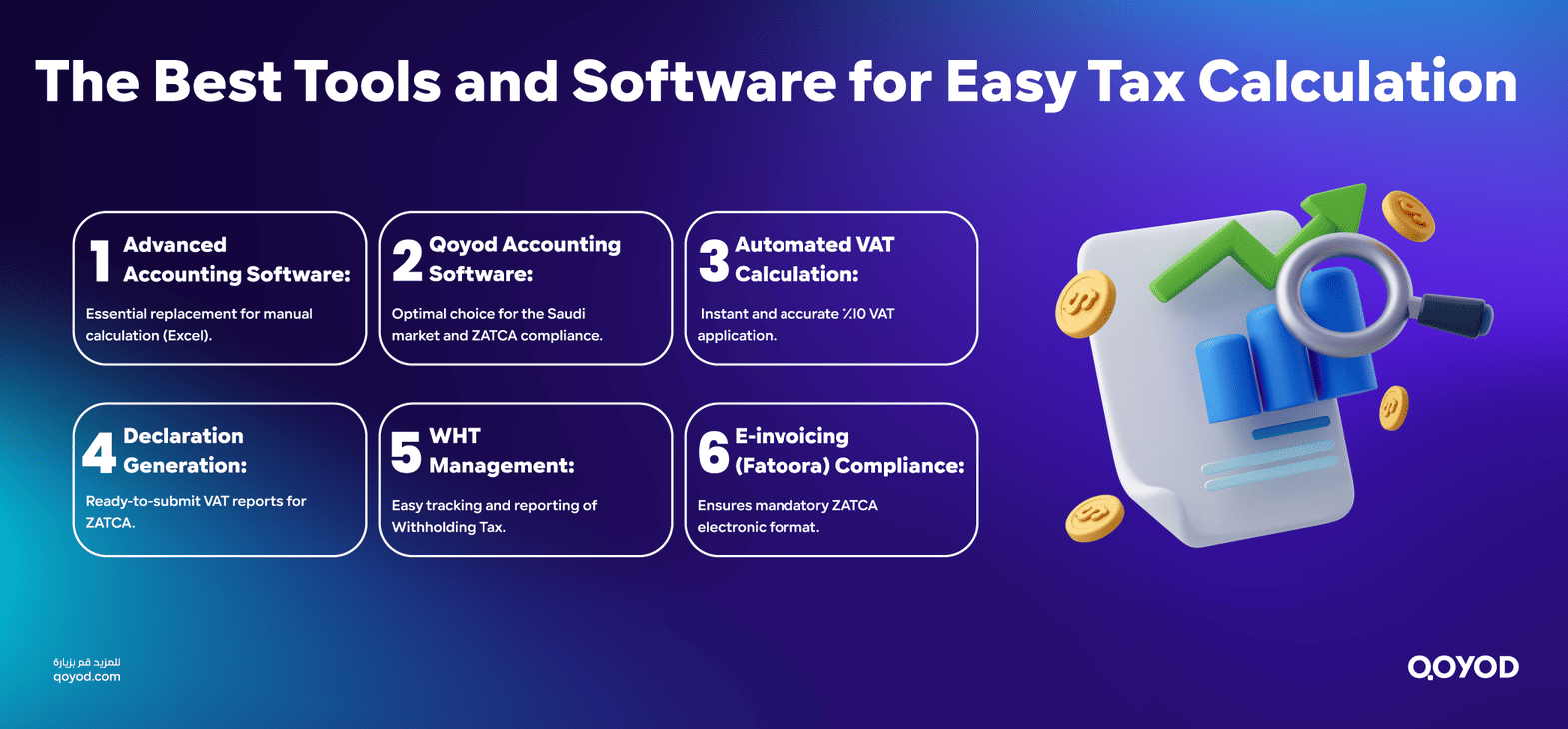

The Best Tools and Software for Easy Tax Calculation

Qoyod Accounting Software and Automated Tax Calculation

Qoyod Accounting Software is one of the best accounting software in Saudi Arabia, specifically designed to meet local market requirements. Qoyod provides the feature of automated and instantaneous Tax Calculation upon issuing invoices. Qoyod performs the following:

- VAT Calculation: Automatically applies the 15% rate and classifies it as input or output tax.

- Declaration Generation: Prepares the VAT tax declaration reports ready for submission to ZATCA.

- WHT Management: Facilitates the tracking and monitoring of payments subject to Withholding Tax and generates their reports.

Accounting Solutions for Riyadh, Jeddah, and Dammam Businesses

Companies in major cities (Riyadh as a financial hub, Jeddah as a commercial gateway, and Dammam as an industrial center) require robust accounting solutions that ensure compliance with local regulations. Programs like Qoyod offer Accounting solutions for Riyadh businesses, Jeddah, and Dammam through user-friendly Arabic interfaces and continuous updates to guarantee compatibility with any amendments issued by ZATCA. This ensures that the Tax Calculation process is fast and compliant across all company branches.

Linking E-Invoicing and Tax Calculation

The e-invoicing system in Saudi Arabia (Fatoorah) is a major turning point. When your accounting software is certified by ZATCA (like Qoyod), it ensures that all your invoices include the correct Tax Calculation according to the applicable rate and are prepared in the required electronic format. This direct link reduces human errors to zero and makes VAT declaration submission a one-click process.

Practical Tips to Simplify Tax Calculation for Saudi SMEs

To make the Tax Calculation process smooth and efficient, the following tips should be integrated into your daily workflow:

- Use Approved Electronic Invoices and Statements: Ensure every transaction (purchase or sale) is documented with an electronic invoice compliant with the “Fatoorah” system. This guarantees easy tracking of input and output tax.

- Update Data According to Zakat Authority Systems: Stay continuously informed about the decisions and circulars of ZATCA. Good accounting software handles this update automatically.

- Regularly Review Accounts to Avoid Errors: Do not wait until the end of the tax period. Review your tax reports monthly or quarterly to compare the calculated tax in the records with the company’s cash reserve.

- Retain Records for a Sufficient Period: Saudi law requires companies to retain accounting records and invoices for a minimum of 6 years. Learn more about ZATCA regulations.

Frequently Asked Questions (FAQ) about Tax Calculation in the Kingdom

How do I calculate VAT for a small shop in Jeddah?

Multiply the net product price by 15% (the current rate). If the price is 500 SAR, the tax is 75 SAR. Qoyod automatically calculates this upon issuing the invoice.

What is the difference between Income Tax and Zakat in Saudi Arabia?

Zakat applies to the shares of Saudi citizens and GCC nationals in companies. Income Tax applies to the shares of foreign investors and non-resident establishments, at a rate of 20%.

Can accounting software like Qoyod cover all types of Tax Calculation?

Yes, Qoyod provides automated tools for calculating VAT and preparing its declarations, monitoring Withholding Tax payments, and generating the necessary reports for Income Tax declarations.

Is ZATCA-certified accounting software essential for implementing the e-invoicing system?

Yes, it is absolutely essential. It is not enough for the software to just handle Tax Calculation. It must be certified and compliant with Phase 2 requirements of the Fatoora e-invoicing system in Saudi Arabia.

Conclusion

We have seen that Tax Calculation: The Easiest Way to Calculate All Types of Taxes no longer relies on manual complexity but on adopting smart digital solutions. Accurate Tax Calculation is the key to legal compliance, penalty avoidance, and ensuring sustainable growth for your business in the Kingdom of Saudi Arabia. To transform the tax calculation process from a chronic burden into a competitive advantage, you must utilize an accounting platform specifically designed to handle dynamic local regulations and the requirements of ZATCA. Stop wasting time and money on error-prone manual calculations. Try Qoyod Accounting Software now to make your business operations easier and more accurate with solutions designed for Saudi companies.