With the expansion of the economy and the development of infrastructure around the world, contracting has become a crucial game in developing megaprojects and achieving urban progress. However, this vital sector is not without challenges. There may be entries in contract accounting. It is worth noting that contract accounting is a unique and complex field in general. It deals with multiple aspects, including costs, revenues, asset management, taxes, and financial reports, as well as the multiplicity of projects that contractors deal with and the diversity of their activities. One of the biggest challenges facing companies in accounting is dealing with project-related costs. When there are many projects ongoing at the same time, it becomes difficult to track and analyze the costs related to each project effectively.

Contracting accounting entries

Contracting accounting entry expenses are divided into two main categories:

Direct expenses.

Other indirect.

The project bears the direct expenses associated with it, while the indirect expenses are distributed among the rest of the projects. It must be noted that when we deal with contracting contracts, we find that they extend over long periods of up to two years or more. It is worth noting that contracting accounting entries appear as follows:

Accounting entry for the purchase of the booklet of conditions

When the contracting company is not assigned the project directly, the continuous follow-up of tenders published by project owners in official newspapers and the appropriate media becomes the alternative way to take charge of a project. It is worth noting that a booklet of conditions must be purchased to determine the project that corresponds to the capabilities and qualifications of the contractor, including financial and human resources and profit goals. Here the contracting accounting entries appear as follows:

| Statement | Debt | Credit |

| From: General Expenditures

(Booklet)

|

XXXXX | |

| To/CCash | XXXXX |

Note

The terms and conditions booklet is part of the cost units in the field of contracting accounting entries, as each unit associated with this contract is included in its own account. Therefore, the value of the condition sheet is calculated within these units.

One of two situations may occur in this context:

Either the company obtains the contract or it wins the tender, in which case the value of the terms and conditions document will be credited to the contract account.

If another contractor obtains the contract, the terms and conditions document will be part of the calculation of losses and profits, as they are considered costs that were not benefited from and cannot be recovered.

Letters of Guarantee Entry

It is one of the entries in contracting accounting, and in order to be able to have the opportunity to win a contracting contract, it is required to pay the initial insurance amount as an indication of the company’s seriousness in implementing the project, as the insurance amount is documented in a letter of guarantee, whether it is cash or a check, and it is worth noting that the bank is the party that is responsible for issuing the guarantee and indicates the contracting company as a beneficiary party.

In the event of non-compliance with the terms of the contract, the project owner shall retain the value of the initial letter of guarantee, and in the event of compliance with the terms of the contract, the contracting company has the right to recover the amount but bears the bank expenses on the project costs.

An example of a letter of guarantee entry

In 2022, a real estate developer issued a tender for an infrastructure project for a residential complex with a total value of 1,250,000 US dollars, and the value of the initial insurance was set at 1% of the total value of the project.

Contracting Company X submitted a request for a letter of guarantee from the bank covering part of this amount by 20%, and it is worth noting that the bank charges a commission of 5% every 3 months, and the cost of issuing the letter of guarantee was 25 US dollars.

In the event that the contractor wins the bid and does not comply with the terms of the contract, an amount of USD 1.850 will be paid, and the value of the final letter of guarantee will be 5% of the expected value of the project, and the bank costs will remain fixed for both the initial and final letter of guarantee.

- Primary insurance value = 1,250,000 * 1% = 12,500 US dollars.

- Commission value = 12,500 * 5 / 1000 = 62.5 USD.

- Partial coverage value = 20% * 12,500 = 2,500 USD.

Advance payments

The advance payments relate to the amounts of money provided by the project owner to the contracting company, which is one of the contracting accounting entries, and we must clarify that these payments aim to facilitate the implementation of the project and are considered financial assistance from the owner to the contractor. It is worth noting that the value of the advance payments must be deducted from the extracts later, and the entry is as follows:

| Statement | Debt | Credit |

| From / Bank | XXXXX | |

| To/CCustomers (Down Payments)

|

XXXXX |

the expenses of inspection and assay procedure entries

The expenses of inspection and assay are things that must be taken into account when talking about contracting accounting entries, as the inspection is carried out by engineers and specialists who visit the project site and take all necessary procedures and activities to explore the site and determine the required works to achieve the specifications desired by the customer in the contract, and it is worth noting that the inspection expenses are divided into two types:

Direct expenses

These are those that are charged to the account of the contract in the event that the contract is successfully obtained, and in the event that the company does not win the contract, they are awarded to another contractor. Direct expenses can be included as part of the profit and loss account, similar to the entry of the conditions booklet.

Indirect expenses

As for indirect expenses, they are distributed to all contracts at the end of the period, as the entries for inspection expenses can be submitted, and the assay can be made as follows:

In the event of winning the tender

| Statement | Debt | Credit |

| From/CContract No. ××××× | XXXXX | |

| General Expenditure

|

XXXXX |

In the event of losing the tender

| Statement | Debt | Credit |

| From: Profit and Loss | XXXXX | |

| General Expenditure

|

XXXXX |

What is the most commonly used accounting software for accounting entries for construction companies?

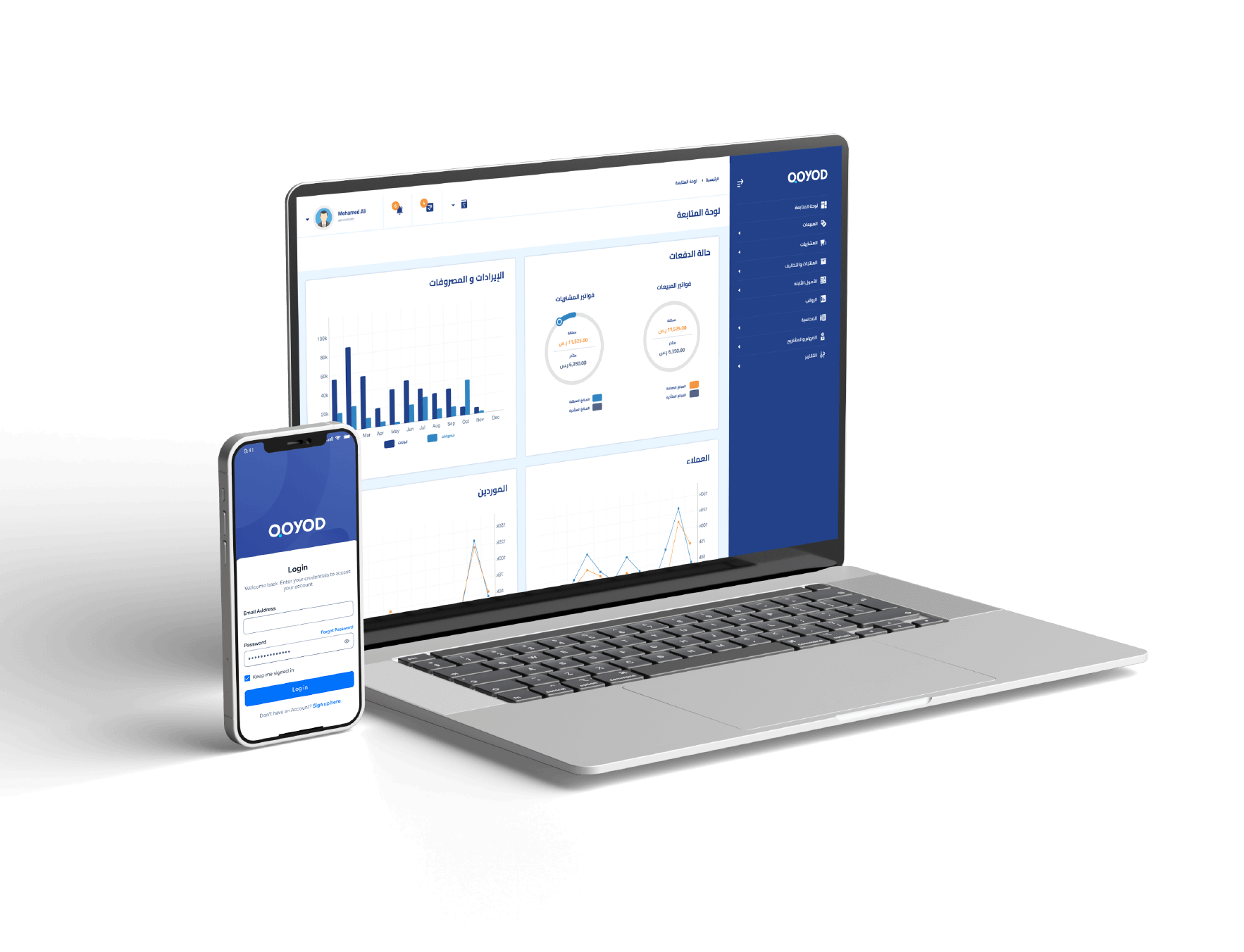

If you are looking for the best accounting program for contracting companies, it is Qoyod, as it is a powerful tool for managing contracting accounting in companies. The program provides a variety of solutions and features that meet the needs of companies in the fields of accounting and business management, the most important of which are the following:

Accounting guide

The program includes a comprehensive accounting guide that facilitates the process of recording and organizing accounting entries, as companies can easily define, classify, and track their financial accounts through this guide.

Category guide

The program provides the ability to manage different types of contracting companies, as companies can easily define, classify, and track items. This helps in inventory management and tracking the costs of materials and equipment used in projects.

Cost Centers Guide

The program provides a guide to cost centers, which is an important tool in business accounting as it allows companies to assign specific costs to different centers within the company. It is worth noting that this information can be used to analyze expenses and estimate project costs.

Financial transaction management

The program includes a module for managing financial transactions, such as invoices, payments, and receipts, so companies can easily record these transactions and track them for accounting and financial reporting purposes. Which helps to get rid of the restrictions of contract accounting day after day.

Analytical tools and review

The program includes analytical tools that help analyze financial data and provide useful insights to companies, as these tools can be used to analyze financial performance and identify strong and weak points in contracting operations.

Financial reports

The program provides detailed financial reports tailored to enterprise requirements, as companies can create reports on profits, losses, balances, cash flows, etc., and other important financial indicators.

Conclusion

We must remember that contract accounting entries are not the absolute end to the creativity and progress of this important sector. Despite the challenges that contractors face in the field of accounting, there are opportunities for innovation and continuous improvement, and instead of waiting to change entries, contractors can take advantage of the technology and digital solutions currently available. Advanced accounting tools can help streamline operations and improve accuracy and effectiveness. Furthermore, we should encourage contractors to follow accounting practices. Transparency, financial responsibility, and remembering that by ensuring that all financial operations and transactions are documented and explained, contractors can build a strong reputation and gain the trust of clients and partners.

Let’s move beyond these entries and focus on the opportunities and solutions available. To enhance the contracting sector and achieve progress and sustainable growth, this can only be achieved through the use of the Qoyod program, and it is worth noting that it provides all its customers with electronic invoice systems as well as points of sale systems, stores, customers, etc., which makes it the best accounting software you can come across.

Now try Qoyod for free for 14 days.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!