The deduction from the salary for all its reasons is a topic of interest to establishments and employees alike, as companies are interested in establishing a human resources department with sufficient experience and knowledge of the country’s work system so that the company can comply with it in the method of deducting absences, delays, and other deductions from the salary, and employees are interested in this in order to have sufficient knowledge of their rights.

Whether you are an employee who wants to know the salary deduction law and its percentage to ensure your rights, or a company you want to know to ensure that the deduction is calculated in the right way and preserve the rights of the company and employees alike, you should follow this article with us, where we address the salary deduction law in the Saudi Labor Law for the year 2024 and the method of deducting absences and delays with easy-to-understand examples, and we also show you the advantages of the Qoyod system with regard to salary management and deduction.

Deduction from salary in the Saudi Labor Law 2024

In order to know the method of deduction of absences and delays, you must first know what the Saudi Labor Law stipulates regarding salary deduction, as the Saudi Labor Law has specified the cases in which the employer is allowed to deduct part of the employee’s salary and the permissible deduction rate in order to preserve the rights of both the employer and the employee. The law stipulates the following:

First: deduction cases

Saudi Arabia’s Labor Law stipulates that no amount may be deducted from a worker’s wages in exchange for private rights without his written consent, except in certain cases, including deduction of social insurance contributions, recovery of loans from the employee, and deduction of fines incurred by the employee for violations he commits, which include absence or delay without a legitimate excuse, and other cases.

Second: deduction rate

The Saudi Labor Law has set the discount rate allowed to preserve the rights of employees, as it stipulates that it is not permissible in all cases for the percentage of the deducted amount to exceed half of the employee’s due wage, unless it is proven to the Labor Court that the deduction can be increased on that percentage or it is proven that the employee needs more than half of his wage. In the latter case, the employee is given no more than three-quarters of the salary, whatever the case.

How to deduct absences and delays from salary

After you know the laws of the Saudi labor system regarding cases of deduction from the salary and its permissible percentage, you can now learn how to deduct absences and delays from the salary in particular. The method of discount and its percentage are determined according to the company’s policy and system, according to what is agreed upon between the employer and the employee in the employment contract that binds them together, and in accordance with the Saudi Labor Law as well. Absence or delay without a legitimate reason is a breach of one of the terms of the contract (which is the specified working hours and days) that deserves a penalty or fine.

While the method of deducting absences and delays is due to the company’s policy and what it deems appropriate, in order to protect employees from exploitation and loss of their rights, the Saudi Labor Law stipulates limitations for this method and the deductions, fines, or penalties it imposes as follows:

- The value of the deduction for one absence or delay violation shall not exceed the employee’s five-day wage.

- No more than one penalty shall be imposed on one violation.

- Not to deduct from his wage in fulfillment of the fines due from him more than five days’ wage per month.

- The period of his detention without pay shall not exceed five days in one month.

An example of the absence deduction method

If the employee is absent from work without previous permission and without a legitimate excuse, his salary shall be deducted according to the company’s method of deduction of absence and delays, and an example of the method of deduction of absence can be provided as follows:

Company X adopts the system of deducting the wage of the day in which the employee is absent in full in the event of his absence without a legitimate reason, such as if the employee A’s salary is 3000 Saudi riyals per month and he is absent for four days during the month, his salary is divided by the thirtieth days of the month, then deducting the value of the wage of 4 days from him as follows:

3000 riyals ÷ 30 days = 100 riyals per day.

100 riyals × 4 days of absence = 400 riyals

3000 riyals (basic salary) minus 400 riyals (absence deduction) = 2600 riyals (salary due for this month).

In the event that employee A is absent from work for 6 days or more, the value of the wage of only 5 days during the current month will be deducted, and then the rest of the absence will be deducted in the coming months.

The status of the deduction in absence and its percentage can be explained in the following table:

| Absence without a legitimate excuse or prior permission | Deduction Percentage | ||||

| First time | second time | Third Time | Fourth Time | Notes | |

| One day | Two days | Three days | Four days | The employee is deprived of a one-time bonus or promotion. | |

| Two to six consecutive days | Two days | Three days | Four days | The employee is deprived of a one-time bonus or promotion. | In addition, the wage for the days of absence is deducted. |

| 7 days to 10 consecutive days | Four days | Five days | The employee is deprived of a one-time bonus or promotion. | The employee is dismissed and given an end-of-service gratuity if the period of absence does not exceed 30 days. | In addition, the wage for the days of absence is deducted. |

| 7 days to 10 consecutive days | Five days | Dismissal from service | In addition, the wage for the days of absence is deducted. | ||

| More than 15 days consecutive | Warning the employee in writing after 10 consecutive days of absence, and if it extends to 15 consecutive days, the employer may terminate the contract without notifying the employee and without remuneration or compensation. | ||||

| More than 30 days of non-continuous | Warning the employee in writing after 20 days of absence, and if it extends to 30 days, the employer may dismiss the employee. | ||||

An example of the delay deduction method

If the employee is late for his specified and agreed dates without prior permission or a legitimate excuse, his salary shall be deducted according to the company’s method of deduction of absences and delays, and an example of the method of deduction of delay can be provided as follows:

Company X adopts the system of deducting the hourly wage that the employee is late for without a legitimate reason. If the employee’s salary A is 24,000 Saudi riyals per month and he is late for work for two consecutive days, his salary is divided by the thirtieth days of the month, then the daily salary is divided by the number of working hours, and the value of the 4 hour wage is deducted from it as follows:

24000 riyals ÷ 30 days = 800 riyals per day

800 riyals (daily salary) ÷ 8 working hours = 100 riyals per hour.

100 SAR × 4 hours of delay = 400 SAR

SAR 24,000 (basic salary) minus SAR 400 (delay deduction) = SAR 23,600 (salary due for this month).

The cases of deduction when delayed with the discount percentage can be illustrated in the following table:

| Delay without a legitimate excuse or prior permission | Deduction Percentage | ||||

| First time | second time | Third Time | Fourth Time | Notes | |

| 15 minutes without disruption | Written warning | 5% | 10% | 20% | |

| 15 minutes of downtime | Written warning | 15% | 25% | 50% | 15% |

| 15 to 30 minutes without disruption | 10% | 15% | 25% | 50% | |

| 15 to 30 minutes of work downtime | 25% | 50% | 75% | Day | |

| 30 to 60 minutes without disruption | 25% | 50% | 75% | Day | |

| 30 to 60 minutes with downtime | 30% | 50% | day | Two days | In addition, the delay period fee is deducted. |

| More than 60 minutes | Written warning | day | Two days | Three days | In addition, the delay period fee is deducted. |

An example of how to deduct violations of labor regulations

If the employee violates the work organization regulations, his salary shall be deducted, and the case of the violation and the percentage of the deduction can be clarified in the following table:

| Type of violation | Deduction Percentage | |||

| First time | second time | Third Time | Fourth Time | |

| The presence of the employee outside the workplace during working hours | 10% | 25% | 50% | day |

| Receiving non-work-related guests in the workplace without permission | Written warning | 10% | 15% | 25% |

| Personal use of work property without permission | Written warning | 10% | 25% | 50% |

| Employee interference in work affairs that does not concern him | 50% | day | Two days | Three days |

| Entering or exiting gates not designated for the employee | Written warning | 10% | 15% | 25% |

| Neglecting work tools or failing to report their need for maintenance | 50% | day | Two days | Three days |

| Destroying company publications and posters | Two days | Three days | Five days | The employee is dismissed and is entitled to the bonus. |

| Employee negligence in using his custody | Two days | Three days | Five days | The employee is dismissed and is entitled to the bonus. |

| Eating at a time or place other than the designated time and place | Written warning | 10% | 15% | 25% |

| Sleep at work. | Written warning | 10% | 25% | 50% |

| Sleep at work if work calls for the employee to be awake. | 50% | day | Two days | Three days |

| Manipulation of attendance and departure records | day | Two days | Deprivation of a bonus or promotion is only one-time. | The employee is dismissed and is entitled to the bonus. |

| Non-implementation of work instructions | 25% | 50% | day | Two days |

| Inciting colleagues to violate work instructions | Two days | Three days | Five days | The employee is dismissed and is entitled to the bonus. |

| Smoking in a non-smoking area | Two days | Three days | Five days | The employee is dismissed and is entitled to the bonus. |

How does Qoyod help you deduct absences and delays from your salary?

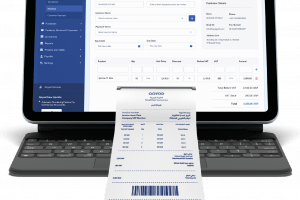

One of the most important services provided to you by Qoyod may be the service of preparing and calculating salaries and wages, which includes deduction from the salary in case of absence or delay, as well as advances, bonuses, and others. In order to benefit from these services, you must first determine the method of deducting absences and delays in your company, then activate the payroll feature by following these steps:

- Subscribe to Qoyod easily.

- Select the payroll feature from the main menu, and select Enable features.

- Then you go to the work schedule selection page, where you specify working hours in days and hours. It should be noted that you must add all days of the week to the schedule, even if some of these days are official holidays, so that the salary is divided by 30 days a month and not by 21 days, so the deduction is correct when you do it.

- Fill in the employee information on the settings configuration page that appears, where you specify the salary details of increases, deductions, allowances, and social insurance.

- Fill in the necessary information on the Salary Components page.

- Add the social insurance details on the next page, and the percentage is based on the social insurance system in the Kingdom of Saudi Arabia.

- Then choose the payroll delivery time from the payment cycles as per your company’s policy, where you can pay daily, weekly, or monthly.

- All payroll pages will be available, including deductions.

- Go to the Discounts page and choose New Deduction.

- Go to a page where you can choose the employee whose salary you want to deduct, the amount of the deduction, the type of deduction, and the date, write a brief description of this deduction, and then save the deduction.

The deductions that you add appear on the pay slips from the payroll list and are calculated from the employee’s salary automatically so that they are deducted from the amount due that will be paid to the employee. When you add a new payroll, you can specify the hours of absence or lost hours for each employee from the Review working hours page, so that the correct deduction value is calculated when paying salaries.

You can benefit from Qoyod services in managing salaries and determining the method of deducting absences and delays in your company in the Qoyod system, in addition to many other professional accounting services completely free of charge for a period of 14 days when subscribing to the Qoyod system. You do not need a credit card to subscribe, and you can upgrade the subscription (with all the information you entered and all the services you did remaining the same) or cancel it at any time you want.

Conclusion

It must show you how important it is to know how to deduct absences and delays from the salary according to the Saudi Labor Law in order to ensure full compliance with the Labor Law and to preserve the rights and entitlements of employees. Therefore, it is preferable to use an electronic system that calculates the discount automatically and accurately when paying salaries in order to avoid any possible calculation errors and to keep all the records of the deductions so that you can return them to them when needed.

The Qoyod accounting system provides you with a comprehensive set of services related to the salaries and wages of employees in your facility, so that it is easy for you to deduct absences and delays, as you can determine the deductions with their reasons and determine the hours of absence and delay so that Qoyod automatically deducts them from the salary. In addition to all that, it provides you with all the accounting services you need to manage your facility professionally, such as inventory management services, linkage from POS systems, accurate reporting, and other services that enable you to manage all aspects of your business in one integrated program. Feel free to activate the Qoyod accounting system now.

Join our inspiring community! Subscribe to our LinkedIn page and Twitter to be the first to know about the latest articles and updates. An opportunity for learning and development in the world of accounting and finance. Don’t miss out, join us today!