An electronic tax invoice is defined as an electronic invoice issued by every taxpayer subject to value added tax (VAT) residing in the Kingdom of Saudi Arabia through electronic means.

It has many benefits, including protecting consumers by putting an end to hidden economic transactions.

It helps attract many investment opportunities, prevents trade cover-ups, and reduces its size.

The electronic bill has greatly improved the consumer experience since its inception compared to the traditional bill.

It has facilitated access to finance and banking facilities for small and medium-sized enterprises.

The definitions of an electronic invoice and a simplified invoice, the form and requirements of an electronic invoice, as well as their importance to shopkeepers, will be defined below.

What is an electronic tax invoice?

It’s an invoice issued electronically by the Zakat, Tax, and Customs Authority instead of on traditional paper to facilitate financial transactions.

This invoice contains all the details of the procurement process and represents a commercial document to establish or request payment for the procurement process.

What is a simplified invoice?

It is an invoice issued from an establishment to an individual, especially when the value of the exchanged services or goods is not more than SAR 1,000.

It is the responsibility of the final consumer, and it is applied to payments or supplies in which the time of the transaction between the enterprise and the supplier is fixed to preserve the rights of the parties.

Tax invoice format

The Zakat, Tax, and Customs Authority has converted the traditional invoice into an electronic tax invoice.

It must contain the identification number of the customer and the supplier to whom the goods are given.

As well as the address and name of the supplier written on the invoice, it is worth noting that it is divided into two parts, namely:

Required fields: These fields should appear on the electronic invoice and the traditional printed ones.

Unrequired fields: These fields exist in electronic form in the technical system, but they do not have to appear on tax invoices submitted to the customer.

Electronic tax invoice requirements

Business owners and merchants must register for the electronic tax invoice at the Tax Authority.

In order not to exclude the center of major financiers files belonging to the company and other problems that you can avoid when registering.

In order to register for the electronic invoice, you need some basic requirements, the most important of which are the following:

1.Legal requirements

If you want to register for the electronic invoice, you need to contact the Tax Authority and send a request by email to einvoice@eta.gov.eg with the following documents:

- A copy of the tax card.

- a copy of the ID card

- A copy of the authorization letter from the company to the representative of the financier

- A copy of the VAT registration certificate.

The tax authority will send you a letter with all the details of when the electronic file was created by your email.

Then, submit the originals of the documents you attached upon completion of the registration process to the competent mission.

If you find this difficult for you, connect with the best accounting software to do the job for you, as you will find us wherever the brilliance and excellence at work are.

2.Technical requirements

The Tax Authority helped everyone understand how to apply electronic invoices by explaining the necessary tools, which are as follows:

- API application programming interface

- SDK software development tools

- Enterprise Resource Planning (ERP) systems

The importance of the electronic invoice for store owners and shops

There have been many investment and economic benefits for store owners and shops since they used the electronic bill, as follows:

- Tax equality and fair competition between traders

- Increase the trader’s sales ratio when the consumer trusts him, and make sure he’s reliable.

- Help the shop grow.

- Prevention of tax evasion.

- Reducing commercial cover-up

- The accuracy and speed of business operations.

- Raising the technological level of stores and companies

- Reduce accounting errors.

- Disposal of paper transactions and the consequent accumulation of records

- Fight the hidden economy.

- Store owners are catching up with the digital transformation.

- Reducing zakat and tax evasion, and manipulating bills.

- Making it easier for the store owner to follow up on the process of collecting taxes

- Support for tax liability.

- Set up relationships between the consumer and the owner of the store.

- Facilitate tax procedures.

- Promote digitalization.

How do I issue an electronic tax invoice?

In order for an electronic tax invoice to be issued, you need to register via e-mail in the electronic system of the Tax Authority and then register a digital account to access the system.

Additional commissioners are registered, and not only does the bill come to an end at this point, but it requires more additional steps that consume too much of your valuable time.

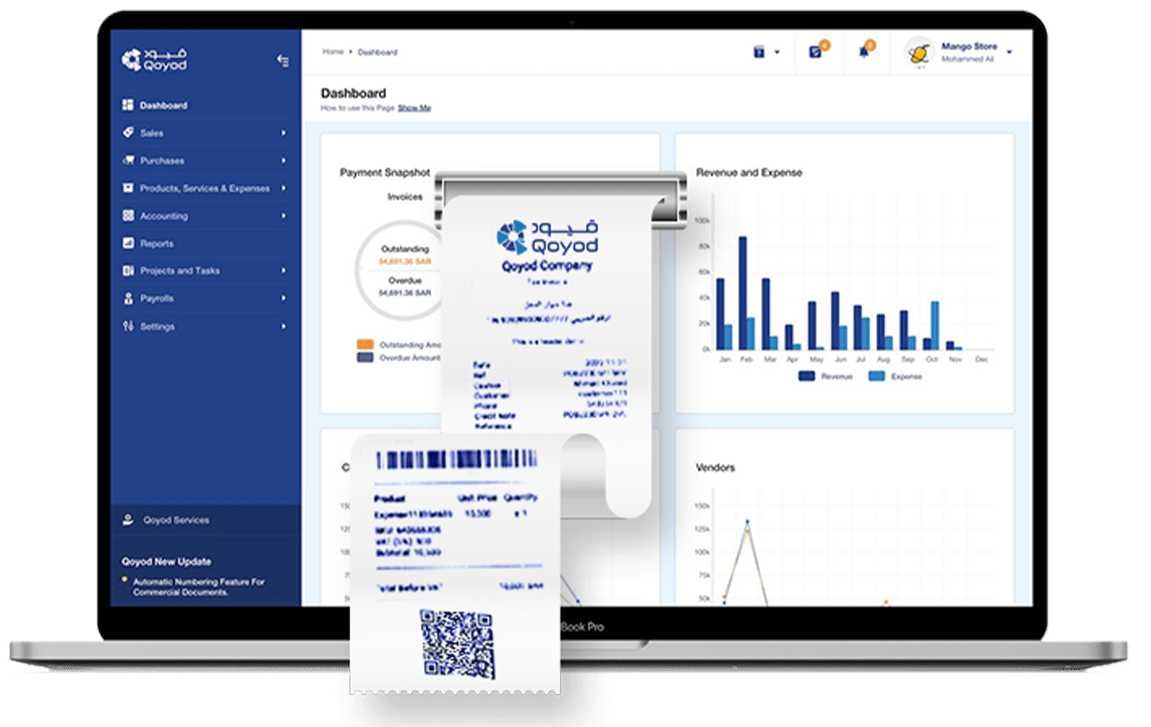

So in order to take the trouble out of all that, I leave this task to Qoyod, the best accounting software, and it will issue the tax invoice for you in a few minutes.

All this can be done with the click of a button; just contact Qoyod customer service and follow the instructions they give you.

Conclusion

The Zakat, Tax, and Customs Authority in Saudi Arabia has converted the digital invoice to an electronic one, and this would facilitate many financial transactions.

The electronic tax invoice system was implemented in two stages, and store owners benefited a lot from it, as this system helped stores grow and equalized taxes between merchants.

In conclusion, we would like to explain the importance of Qoyod in the field of accounting.

Qoyod is an integrated cloud accounting software, offering you many tools that meet your accounting needs with the click of a button.

Which saves you effort and time, such as issuing your electronic invoice as well as managing the POS system at a unified price that suits your budget and capabilities.

What are you waiting for now? We invite you to try Qoyod now for free for 14 days, and don’t forget to know the difference between an electronic invoice and a traditional printed one to save your valuable time.